- LINK has fashioned a double-bottom at $11.56 and damaged above a significant falling wedge, with worth approaching the 50-day MA and Supertrend flip—signaling a possible transfer towards $20.

- Alternate balances dropped from 264M to 218M tokens as whales purchased over 2.18M LINK, with 28 consecutive days of enormous whale orders indicating regular accumulation.

- Grayscale’s LINK ETF continues to develop with nonstop inflows, now holding $70.6M in property; mixed with rising strategic reserves, this strengthens LINK’s long-term bullish construction.

Chainlink has been drifting across the $14 zone, looking for its footing after the broader crypto rally cooled off this week. Even with the market slowing down, LINK’s chart is beginning to flash a number of early indicators {that a} rebound is likely to be forming beneath the floor — nearly like the worth is quietly loading up power for the following transfer.

Technical Patterns Line Up for a Attainable LINK Breakout

On the day by day chart, LINK has already carved out a double-bottom round $11.56, with a neckline sitting close to $13.50. It’s the type of sample merchants like to see as a result of it usually marks a shift from weak point into early restoration. Not confirmed but, however positively one thing.

Much more attention-grabbing, the token spent weeks forming a large falling wedge, with two lengthy, downward-sloping trendlines squeezing tighter. LINK lastly broke out above the wedge’s higher boundary — a basic transfer that usually comes earlier than an upside extension.

Worth is now creeping towards the 50-day shifting common and is inching near flipping the Supertrend from pink to inexperienced. The final time LINK flipped the Supertrend inexperienced, it ripped upward shortly after. If patrons maintain management, the following main goal sits round $20, roughly a forty five% bounce from present ranges.

After all, a drop again underneath $11.56 would scrap the entire bullish setup — that degree is the road within the sand.

ETF Demand Surges as Grayscale’s LINK Belief Beneficial properties Steam

The Grayscale LINK ETF continues to shock the market. In keeping with SoSoValue, the fund has recorded inflows each single day since launch — not one thing many new ETFs can brag about.

The belief now holds over $48 million in property, bringing the full to about $70.6M, which equals 0.75% of LINK’s total market cap. For context, Bitcoin and Ethereum ETFs maintain round 5% of their complete market caps, that means the LINK ETF ecosystem nonetheless has tons of room to develop.

Whales Quietly Push LINK Provide Off Exchanges

One of many strongest indicators currently is what whales have been doing.

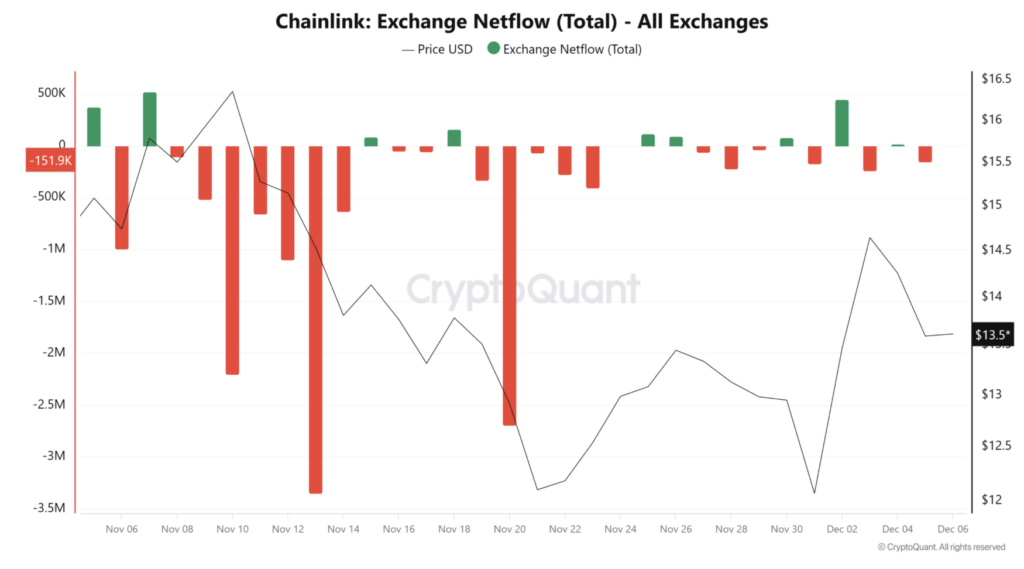

Alternate balances of LINK have dropped to 218 million tokens, down from a November peak of 264M — a reasonably sizable discount. This often factors to accumulation since tokens leaving exchanges can’t be bought as rapidly.

A large whale scooped up:

• 1.62M LINK ($22M) from Binance and Kraken

• and earlier 557,940 LINK ($8M) simply two days earlier than

This whale alone now holds 2.18M LINK.

Throughout the entire community, whale holdings jumped from 1.73M in November to 3.56M now. In the meantime, CryptoQuant exhibits 28 consecutive days of enormous whale orders — principally nonstop accumulation.

Alternate netflow additionally hit -151,000 tokens, that means extra LINK is being withdrawn than deposited. In crypto, unfavourable netflow = accumulation stress.

Strategic LINK Reserves Quietly Develop

Chainlink’s Strategic LINK Reserves — launched in August 2025 — have now grown to 1 million tokens, price round $14.7M. These reserves are funded by actual charges from Chainlink’s community companies and are used to purchase LINK on the open market, including much more demand.

Quick-Time period Strain Nonetheless Exists

LINK trades round $13.63, down round 4% on the day after getting rejected at $14.90 earlier this week. Retail merchants took earnings aggressively — Coinalyze knowledge exhibits three straight days of unfavourable Purchase Promote Delta, with sellers pushing 8.1M in quantity vs 7.32M in buys.

Stochastic RSI made a bearish cross and slid to 74, whereas the DMI’s optimistic index stays caught underneath the unfavourable index. So short-term indicators are combined, leaning barely bearish.

If retail promoting retains up, LINK might retest $12.70. But when whales maintain absorbing provide — and all indicators counsel they’re doing precisely that — LINK might break above $14 once more and intention for $15 → $16.70, then ultimately towards the $20 area if momentum actually picks up.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.