XRP trade reserves hit historic lows on Binance as institutional ETF inflows exceeded 900M. The provision shock will increase with accelerating withdrawals.

XRP is going through a provide disaster of its form. Binance reserves went right down to all-time lows. Concurrently, there was an institutional demand growth within the type of ETFs.

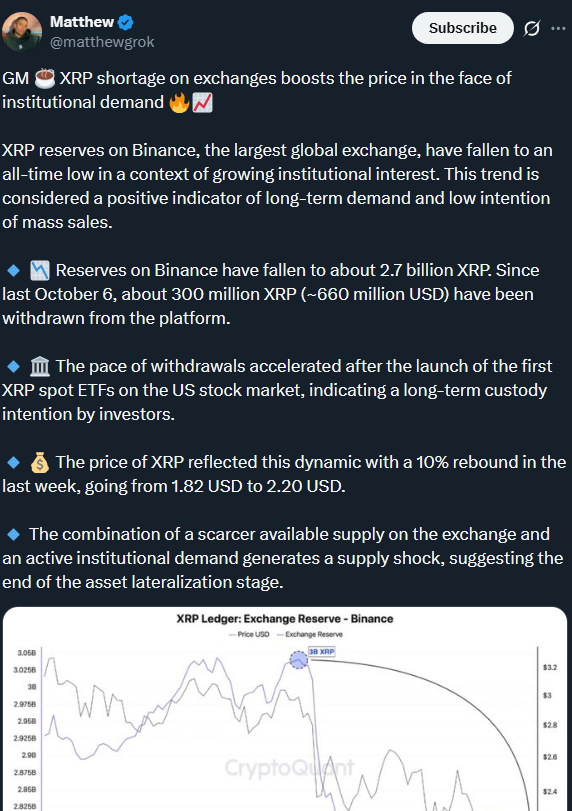

The most important trade on this planet skilled dramatic withdrawals. It’s estimated that because the sixth of October, 300 million XRP have disappeared from Binance. Platform reserves have reached 2.7 billion tokens. That is the bottom degree in historical past.

The mixture, as described by matthewgrok on X, is a classical provide shock situation. Little provide accessible is topic to aggressive institutional purchases. The exodus is motivated by long-term custody plans.

Supply: Matthewgrok on X,

The worth reacted immediately to the tightening. XRP surged from $1.82 to $2.20 final week. That could be a 10 p.c restoration amid market skepticism.

The ETF Catalyst No one Anticipated

After the introduction of spot ETFs in November, withdrawals elevated. The timing discloses the institutional accumulation patterns. Typical buyers transferred XRP to extremely regulated custody.

The ETF amassed hit maniacal ranges as LordOfAlts tweeted about it on X. The fifteen days generated purchases of 861 million. ETFs have taken virtually 1 / 4 of the overall provide.

So long as this continues, the chart won’t lengthy stay quiet, LordOfAlts warned. One thing sudden comes shortly.

The inflows are remarkably constant each day. On Wednesday, XRP ETFs obtained $50.27 million on their very own. In keeping with RipBullWinkle on X, complete property at the moment are close to $906 million.

You may additionally like: XRP Provide Shock: What Specialists Say Will Set off Value Surge

Provide Vanishes Behind The Scenes

Whales amass spot holdings. Firms accumulate XRP as treasury coffers develop. ETF scaling just isn’t but mirrored in costs.

RipBullWinkle wrote on X that there is no such thing as a proportional motion in worth. As an alternative, provide is thinned behind the scenes. Silently, the XRP provides shock hundreds.

Change reserves narrate a charming story. In keeping with Arab Chain knowledge, XRP-to-total-supply ratios have fallen to annual lows. Exchanges are changed by tokens in personal wallets.

Darkfrost is an on-chain analyst who sees the withdrawals as a bullish indicator. Buyers switch holdings into chilly holdings. The long-term conviction substitutes short-term hypothesis.

The development just isn’t restricted to Binance. The identical developments are recorded in different key exchanges. Liquidity on this planet strikes to institutional custodianship.

What Occurs When Provide Runs Dry

Previous experiences point out that will probably be an explosion. The decline in trade reserves is normally a precursor of massive rallies. A scarcity of provide will increase the strain to purchase exponentially.

CryptoQuant reporting exhibits institutional footprints in withdrawals. A majority of XRP doesn’t discover its manner again to rival exchanges. Tokens are held in chilly storage, which is linked to ETF custodians.

The current price is projected to have dramatic endings. The weekly withdrawals are 45-55 million XRP. By the top of the 12 months, Binance would possibly attain 2.65 billion.

That degree is necessary when it comes to worth dynamics. The final time Binance reached these ranges, institutional demand was low. Current circumstances will not be just like historic cycles.

Technical resistance is at $2.40-2.50 ranges. Breaking via might create institutional FOMO shopping for. The dearth of provide would enhance any momentum exponentially.