Bitcoin treasury companies have entered a Darwinian section as fairness premiums collapse, leverage turns dangerous, and survival depends upon liquidity.

Bitcoin treasury companies have moved right into a so-called “Darwinian section” after fairness premiums collapsed throughout the board.

This pattern has modified how these firms develop, borrow and survive. As soon as simple features disappeared, danger rose quick. As of writing, Bitcoin treasury companies now face a strict check of stability sheets and technique.

Bitcoin Treasury Corporations Enter Darwinian Part

Bitcoin treasury companies constructed their mannequin on a easy thought. Most of them began out with their inventory buying and selling above the worth of their Bitcoin holdings. That hole allowed them to difficulty new shares and purchase extra Bitcoin, and this labored nicely whereas costs climbed.

That cycle has now reversed. Bitcoin fell from close to $126,000 in October to lows close to $80,000. Liquidity dropped, danger urge for food weakened and on October 10, a significant deleveraging occasion worn out massive futures positions.

Market depth fell and issuance stopped working as a development instrument.

Galaxy Analysis described this era as a Darwinian section. Up to now, DAT survival now depends upon self-discipline and liquidity.

Bitcoin Treasury Corporations See Shares Flip to Reductions

Bitcoin treasury companies as soon as traded at sturdy premiums, which created a robust flywheel of development. Now, most of those shares commerce at reductions to the Bitcoin they maintain.

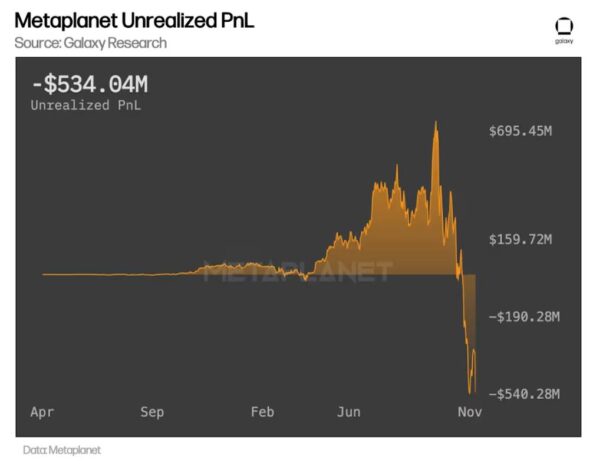

Firms like Metaplanet and Nakamoto present this clearly. Each firms purchased massive quantities of Bitcoin close to market highs. As of writing, their common entry worth sits above $107,000.

Now with Bitcoin nicely beneath that degree, unrealised losses maintain rising.

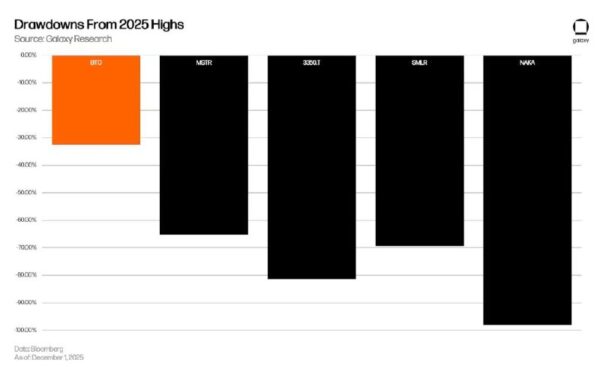

NAKA inventory dropped greater than 98% from its peak, and that degree of decline matches wipeouts seen in dangerous token markets.

This occasion hit more durable as a result of Bitcoin itself fell solely about 30%, whereas Bitcoin treasury companies declined way more.

Why the Bitcoin Treasury Corporations Mannequin Broke

Bitcoin treasury companies function like liquidity derivatives. The mannequin depends upon inventory buying and selling above internet asset worth, and when that premium holds, the corporate can difficulty shares and purchase extra Bitcoin with out hurting present homeowners.

As soon as inventory falls beneath asset worth, issuance turns into dangerous. Every new share reduces the Bitcoin per share and development turns into dilution.

Decrease Bitcoin worth triggered a decrease internet asset worth and fairness premiums compressed throughout the board. Issuance stopped serving to, and the loop flipped.

Galaxy Analysis warned about this sample months earlier than it occurred. And as of writing, the prediction has proved itself appropriate.

Associated Studying: Technique’s Bitcoin Buys Have Slowed Down Amid Bear Market Jitters

Drawdowns Reveal the Depth of the Downside

Drawdowns throughout main Bitcoin treasury companies presently present clear stress. Firms like Technique, Metaplanet, Semler Scientific and Nakamoto all suffered massive declines.

Metaplanet as soon as confirmed greater than $600 million in unrealized features, however that quantity has swung to round $530 million in unrealised losses.

In all, Bitcoin treasury companies now not symbolize pure upside trades. As an alternative, they now behave extra like complicated devices and every transfer depends upon how and when managers acted.

Traders at the moment are finding out stability sheets extra intently. Liquidity buffers entice consideration, whereas debt ranges increase warning.

This being mentioned, the Darwinian section is not going to finish rapidly. Smooth market circumstances may final months, and solely firms that deliberate forward will keep regular.