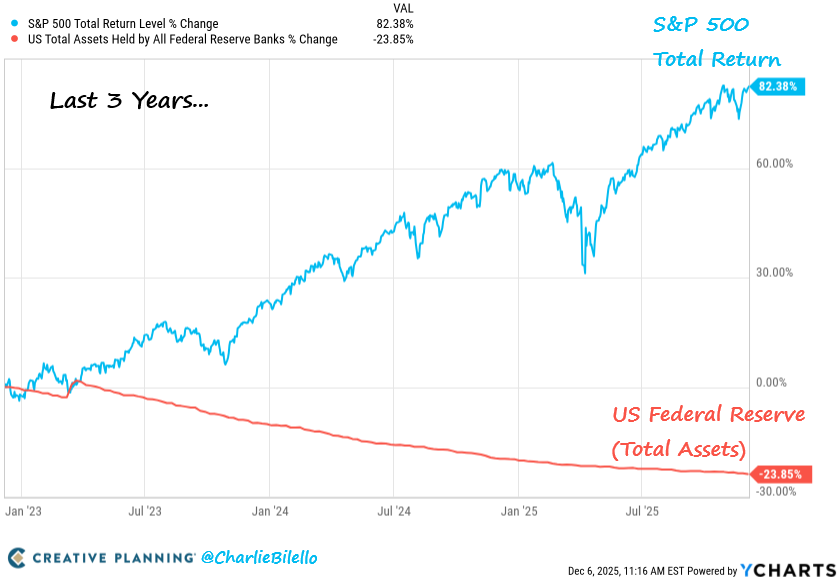

The S&P 500 has climbed 82% in three years even because the Federal Reserve (Fed) diminished its stability sheet by 27%.

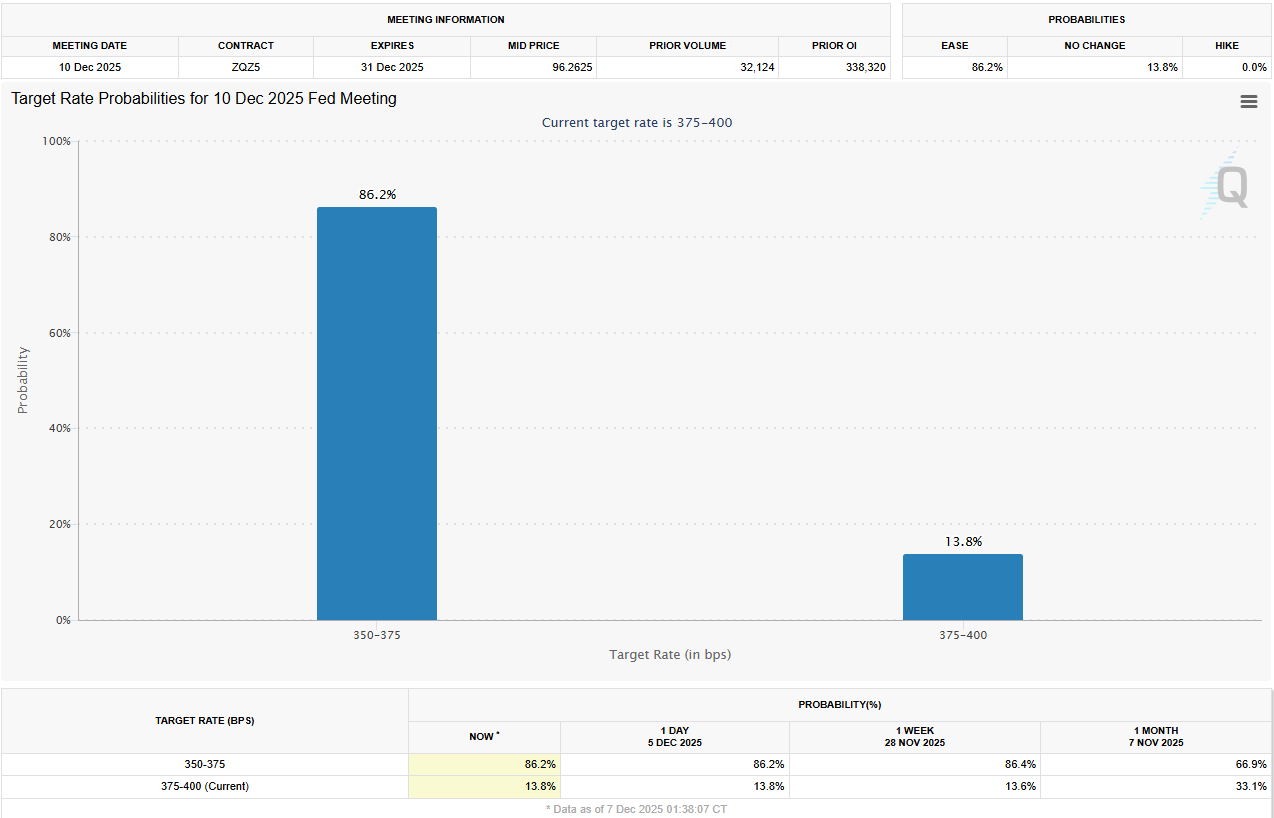

Markets anticipate a 86% likelihood of a 25 foundation level price reduce this week. Nonetheless, financial stress and discuss of Fed management adjustments may make coverage instructions much less clear.

Market Efficiency Surpasses Conventional Liquidity Theories

The fairness rally throughout a interval of quantitative tightening has challenged long-standing market beliefs.

Sponsored

Sponsored

Information shared by Charlie Bilello exhibits the S&P 500 up 82% whereas Fed property fell by almost 1 / 4.

This separation means that elements past central financial institution insurance policies now affect investor confidence. Analysts spotlight different liquidity sources fueling the rally:

- Fiscal deficits,

- Sturdy company buybacks,

- International capital inflows, and

- Regular financial institution reserves offset quantitative tightening.

EndGame Macro explains that markets react to expectations for future coverage, not solely the present stability sheet ranges.

Nonetheless, beneficial properties are concentrated in a handful of mega-cap expertise firms. In consequence, headline market efficiency disguises sector weaknesses tied to core financial fundamentals.

Psychological liquidity can also be important. Markets reply to anticipated coverage adjustments, not simply present situations. This forward-looking mindset permits equities to rise even when the Fed holds a tightening stance.

Sponsored

Sponsored

Financial Strains Obscured by Inventory Features

Sturdy inventory efficiency masks deeper financial stress. Company bankruptcies are nearing 15-year highs as borrowing prices rise. On the similar time, client delinquencies on bank cards, auto loans, and pupil debt are rising.

Industrial actual property are being impacted by declining property values and more durable refinancing phrases. These pressures aren’t mirrored in high fairness indices, since smaller firms and susceptible sectors are underrepresented. The hyperlink between index efficiency and wider financial well being is now a lot weaker.

This break up means that fairness markets primarily mirror massive companies’ energy. Firms with stable stability sheets and restricted client publicity are inclined to carry out properly, whereas others depending on credit score or discretionary spending face headwinds.

This financial divide complicates the Federal Reserve’s process. Whereas main inventory indexes recommend simple monetary situations, underlying knowledge reveals tightening pressures affecting many areas of the financial system.

Fed’s Fame Pressured as Price Minimize Nears

Many traders and analysts are actually questioning the Fed’s route and effectiveness. James Thorne described it as bloated and behind the curve, urging much less reliance on Fed commentary for market indicators.

Sponsored

Sponsored

Treasury Secretary Scott Bessent shared pointed criticism in a current dialogue.

“The Fed is popping right into a common primary revenue for PhD economists. I don’t know what they do. They’re by no means proper … If air visitors controllers did this, nobody would get in an airplane,” a person reported, citing Bessent.

These views present rising doubts in regards to the Fed’s potential to forecast financial turns and act shortly. Critics argue that policymakers are inclined to lag behind markets, fueling uncertainty.

Nonetheless, the market expects a 25-basis-point reduce this week on Wednesday.

Management Uncertainty and Dangers for Inflation

Altering management on the Federal Reserve provides volatility to coverage forecasts. Kevin Hassett leads because the probably alternative for Jerome Powell. Recognized for his dovish stance, Hassett might convey a looser coverage that might increase inflation expectations.

Sponsored

Sponsored

This prospect has moved bond markets. The ten-year Treasury yield has risen as traders weigh whether or not simpler financial coverage underneath new management will push inflation increased. Past near-term cuts, markets additionally worth in a broader tone of lodging.

Traders anticipate two further 25-basis-point price cuts in 2026, probably in March and June. If Hassett turns into Fed chair as early as February, Powell’s remaining time period may see him sidelined.

This transition makes Fed coverage steering much less predictable as markets give attention to the approaching change in management.

This uncertainty arises whereas the Fed tries to handle modest inflation above goal and a resilient financial system underneath tighter monetary situations. Errors in coverage or timing may simply rekindle inflation or trigger avoidable financial deterioration.

Historic tendencies present some context. Charlie Bilello notes that bull markets often outlast bears by 5 occasions, emphasizing the worth of compounding returns over market timing.

The continued rally may persist, however concentrated beneficial properties, financial stress, and doubts in regards to the Fed’s strategy make it unclear if markets can stay this resilient as financial coverage evolves.