HYPE joins BCH, BNB, and TRX as 2025’s solely rising L1 tokens, pushed by robust liquidity, secure provide constructions, and bettering community exercise.

HYPE joined BCH, BNB, and TRX as the one L1 gainers in 2025, in accordance with contemporary information shared by Crypto Koryo. The replace touted the BCH because the shining star, which is supported by its virtually forty % enhance, in addition to the truth that the availability is totally circulating and there’s no enterprise promote stress.

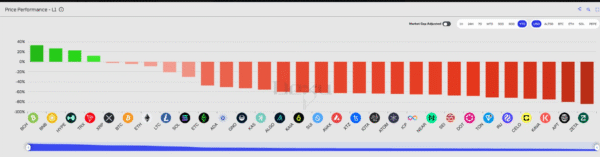

4 L1 Tokens Maintain Positive factors Amid Wider Market Declines

Market observers stated there have been comparable will increase within the worth of BNB, HYPE, and TRX, which recorded thirty %, twenty-five %, and fifteen %, respectively. Analysts pointed to secure liquidity, decrease volatility, and low provide dangers as key elements. The numbers had been from an L1 efficiency chart that was floating round trade channels and impartial market commentary.

Associated Studying: Hyperliquid Methods Strikes $411M in HYPE to Hypercore | Stay Bitcoin Information

Background discussions talked about Crypto Koryo’s latest put up, which outlined the availability and demand elements for BCH. Observer careworn that no unlocking, no basis affect, and no enterprise dumping formed its sturdiness. Analysts additionally cited potential ETF curiosity, in addition to good liquidity that improved the profile of BCH within the eyes of huge liquid funds.

Present updates knowledgeable that there have been distinctive developments in every of the 4 networks. Hyperliquid superior within the face of the DeFi sector, owing to the rise in buying and selling volumes and the rising consideration of establishments. Nevertheless, a scheduled token unlock induced non permanent promoting stress whereas new oversight indicators added uncertainty round platform operations and regulatory expectations.

Broader Shifts Form Efficiency Throughout L1 Networks

Bitcoin Money had its personal collection of modifications all year long. Builders had been made prepared for a scheduled lower within the period of time utilized in a block so as to enhance community throughput. A number of instances, the market turned extra secure, although volatility was nonetheless sometimes seen. Business blogs attributed these swings to national-level market repositioning, in addition to shifting liquidity circumstances throughout the foremost exchanges.

BNB skilled intervals of excessive exercise when the BNB Chain grew in its world footprint. A strategic street map to 2025 offered the expectation round quicker transactions and extra built-in AI. Sturdy buying and selling volumes affected the sentiment, however the token’s efficiency was topic to vital fluctuation due to altering market course and related compliance elements.

TRX continued regular development as its community moved forward on a number of initiatives. Elevated alternate volumes affected market consideration whereas actions by Justin Solar influenced sentiment. European regulatory changes had produced new operational constraints. These developments created alternating worth actions, however TRX managed to take care of general year-on-year features, which put it within the choose group of over-performing L1 belongings.

Analysts concluded that the distinction between these 4 gainers and the broader declining cohort of L1 highlighted altering investor preferences. They emphasised that secure liquidity, clear provide constructions, and clear technical roadmaps inspired selective capital inflows. A number of studies prompt potential market positioning and liquidation cycles with comparable traits would possibly happen sooner or later.

On-Chain Traits Point out Elevated Reliance on Verified Metrics for L1 Markets

Business watchers continued to watch on-chain habits for extra affirmation of those traits. They discovered liquid funds reallocated to belongings with predictable volatility profiles. Commentators prompt that this sample mirrored an growing degree of warning throughout buying and selling desks. Additionally they noticed a larger dependence on verifiable metrics versus promotional exercise in aggressive L1 ecosystems.

Trying ahead, analysts anticipate that the 4 highlighted tokens will encounter some challenges, corresponding to modifications in regulation and shifts in alternate dynamics. Nevertheless, they imagine that the structural elements supporting latest features are nonetheless relevant. They predict that liquidity stability will affect the course of markets as individuals modify publicity in periods of potential liquidation.