The primary week of December ends in a market that behaves nearly precisely like late 2021, when crypto cracked earlier than equities even observed something was incorrect. The distinction at this time is the part of U.S. financial coverage: easing mode on, inflation is slowing, but costs act like they already consumed your entire future cycle earlier than the cycle even arrived.

That expectation hole is what retains sentiment fragile and makes each bounce look short-term. Narratives flipped a number of occasions this week, and danger urge for food slipped beneath the burden of macro uncertainty that retains bleeding into each chart from SHIB to Bitcoin.

TL;DR

- SHIB erased its two-week buildup and returned to the beginning line.

- XRP posts the weakest top-10 weekly outcome however retains $2 alive.

- Bitcoin sits beneath the Bollinger mid-band with Santa Rally odds relying on this flip.

Shiba Inu (SHIB) in December: Maintain or promote?

The week opened with simple optimism round SHIB. The meme coin added about 12% within the earlier two weeks, and the construction regarded clear sufficient for continuation. Then the weekend closed in, poured chilly water on your entire setup, and in simply two days the worth erased nearly all positive factors, dropping straight again to $0.0000084 — the precise stage the place early-month bullish speak started.

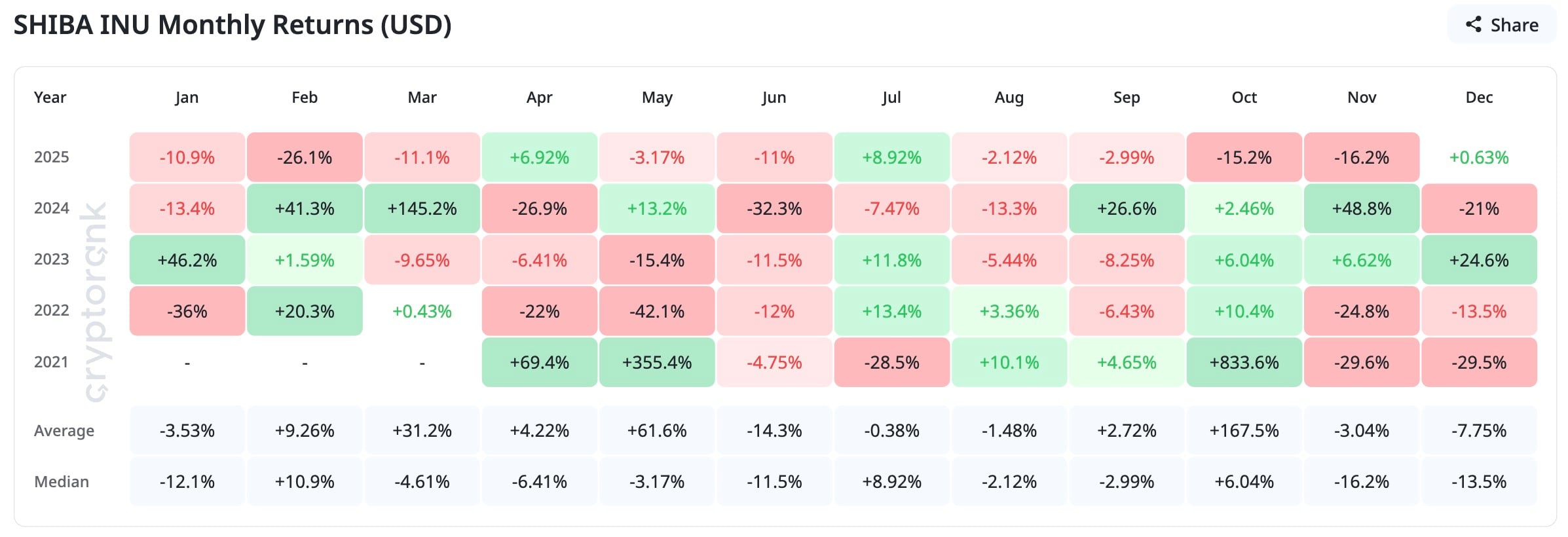

SHIB’s worth historical past doesn’t assist with confidence both, as a result of 2023 stays the one December wherein the meme coin managed a correct surge.

That is the place macro expectation creep reveals up. The market trades as if the easing part is already totally priced in, which compresses cycles and removes endurance from speculative trades. When that occurs, belongings like SHIB don’t get the runway they often want.

SHIB’s December query — maintain or promote — has a rational reply for now: no clear cause to carry until Bitcoin breaks its mid-band. The market confirmed in 2021 how danger belongings react when expectations overshoot actuality, and the identical sample is surfacing.

Nonetheless, SHIB can change route as quick because it loses steam if Bitcoin confirms energy, as a result of meme cash stay tethered to BTC throughout high-fear phases.

XRP bulls defend $2 worth base

Whereas the crypto market traded like a journey with no secure rhythm, XRP delivered its personal model of managed chaos. It printed the weakest weekly efficiency in your entire prime 10 at -7.24%, but the token refused to lose the $2 base. That issues greater than the colour of the weekly candle, as a result of the entire market is drifting via a macro backdrop the place expectations dominate precise coverage. In unsure occasions, spherical ranges turn out to be psychological anchors.

Perhaps it’s the $230 million in ETF inflows this week, perhaps it’s the $897 million since launch, or perhaps it’s merely holders refusing to give up a stage that defines sentiment far past the chart, however the $2 line stayed intact even because the market cracked round it.

That is the place the 2021 parallel is available in once more: crypto rolled over two months earlier than the S&P 500 again then.

XRP sits in the identical pocket now. If macro expectations for future easing have already been absorbed, belongings with weaker weekly momentum have a tendency to check their flooring repeatedly.

However the truth that XRP didn’t lose $2 even beneath weekly strain is an indication of positioning that also prefers protection over capitulation. The extent turns into the gateway: lose it and sentiment resets, however maintain it and any Bitcoin upside spills over quick.

Bitcoin to resolve destiny of Santa Rally 2025: Bollinger Bands

Bitcoin is correct on the level the place December is determined. The every day Bollinger mid-band sits overhead, and BTC is beneath it, urgent however not flipping. If Bitcoin can reclaim it and shut a weekly candle above, the trail opens towards $94,300.

If it fails, the market turns to $84,400 as the principle goal, and December turns into a dialog about harm management as an alternative of the seasonal rally.

This setup is even sharper when paired with fairness alerts. Bloomberg’s Mike McGlone broke down why the following 5% within the S&P 500 carries uneven that means. Upward is the consensus — a easy continuation commerce. Downward is a near-historic valuation drawdown equal to nearly 12% of GDP, a scale that has solely appeared throughout careworn durations like 2007’s exit wave.

That dynamic feeds straight into Bitcoin. Crypto fell sooner than equities in 2021 as a result of high-beta belongings worth expectation turns earlier than safer ones. If the S&P rejects right here, Bitcoin won’t want a lot to do the identical, particularly with worth already sitting beneath its mid-band. If the index holds, Bitcoin has sufficient technical construction to ship a December breakout, as a result of this flip is the one lacking factor.

Macro danger provides yet another variable: the Saylor issue. If equities drop, MicroStrategy’s leveraged publicity turns into a strain level. It’s not simply the liquidation danger however the delusion danger — the narrative that Bitcoin has an unstoppable company holder behind it. If that narrative weakens, liquidity reacts immediately.

Crypto market outlook

The query of whether or not a bear market has already begun resurfaces as a result of the autumn of 2025 mirrors 2021, with crypto breaking sooner than equities whereas cycle pace accelerates and costs behave as if your entire easing path is already priced in.

The following Fed assembly dangers delivering a well-recognized chilly bathe that resets expectations after inflated valuations and compressed phases pushed markets forward of coverage actuality.

Key ranges to look at subsequent week:

- Bitcoin (BTC): $94,300 is the upside set off if BTC flips the every day mid-band, and $84,400 is the draw back goal if rejection holds.

- Shiba Inu (SHIB): $0.0000090 is the upside set off if SHIB rebuilds momentum, and $0.00000775 is the draw back goal if the early-month base provides out.

- XRP: $2.22-$2.30 is the upside set off if XRP breaks the quick ceiling, and $1.93-$1.97 is the draw back goal if the $2 line lastly slips.