Technical indicators throughout a number of timeframes level to structural weak spot regardless of temporary breakout makes an attempt above $2.05 resistance throughout in a single day buying and selling.

Information Background

- XRP continues to face strain as its weekly efficiency deteriorates to -7.4%, including to the multi-session downtrend dominating early December.

- Regardless of persistent weak spot in worth, institutional demand stays sturdy by way of U.S. spot XRP ETFs, which have attracted $906 million in web inflows since launch — with no outflow days recorded.

- In the meantime, social sentiment has collapsed to excessive concern readings matching October lows, with Santiment reporting the best stage of bearish commentary in over 5 weeks.

- Traditionally, such extremes preceded short-term rebounds, together with the November 21 restoration.

- On-chain knowledge exhibits blended positioning: 6–12 month holders lowered publicity considerably, falling from 26.18% to 21.65%, whereas long-term ETF-driven demand continues to build up quietly within the background.

Technical Evaluation

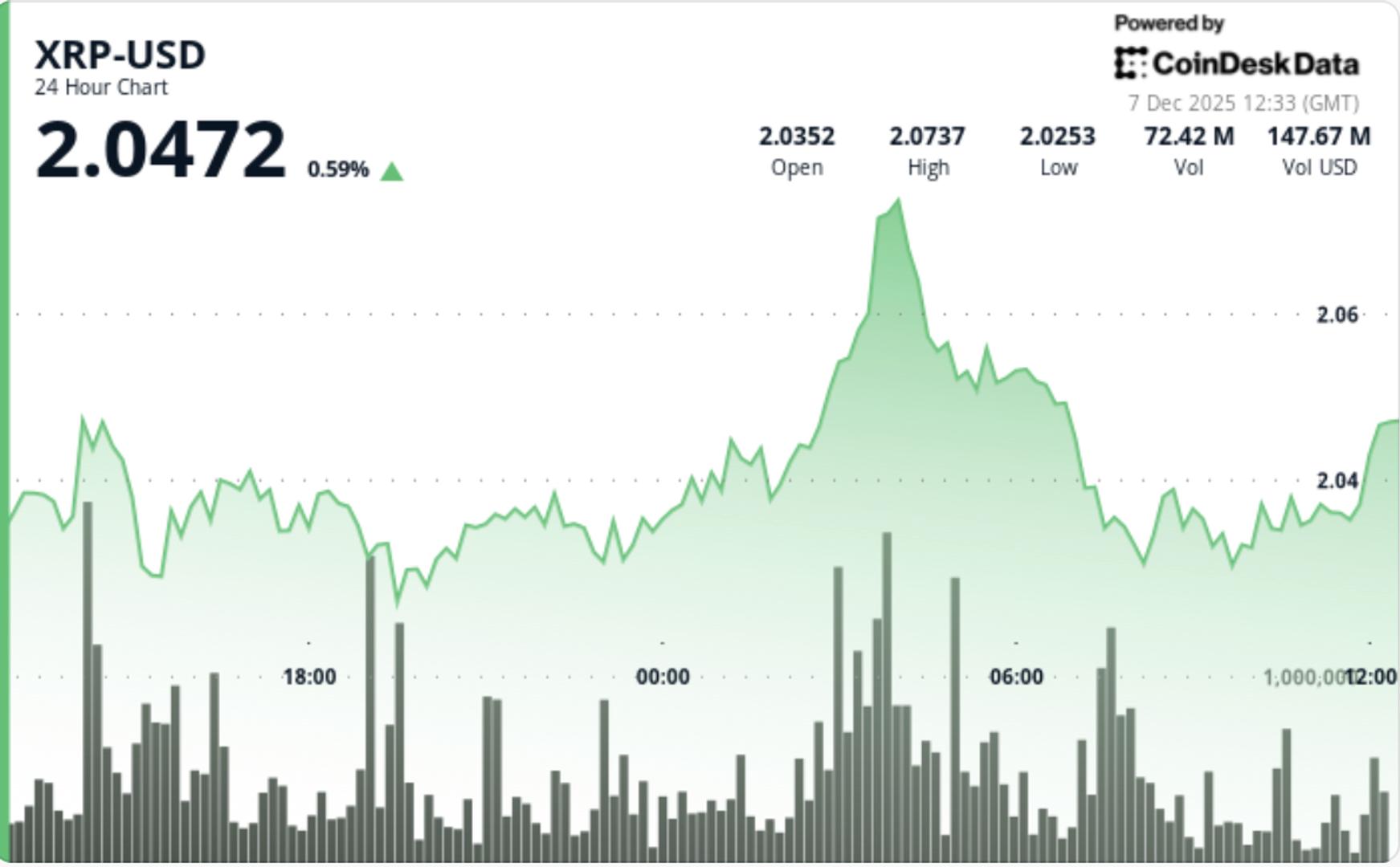

- XRP’s try to interrupt greater was initially profitable, with worth pushing by $2.05 on a 68% above-average quantity surge at 03:00. The breakout produced a pointy rally to $2.07, however the transfer lacked follow-through. Diminishing quantity into the retrace revealed fading momentum, and sellers shortly regained management.

- A persistent descending channel has now shaped on the 60-minute chart, that includes successive decrease highs and tightening worth compression. This construction displays an orderly trend-driven decline reasonably than a panic liquidation.

- Every bounce has been met with distribution, significantly close to $2.04–$2.05 — a zone that now doubles as instant resistance.

Momentum oscillators development downward throughout intraday timeframes, whereas the weekly TD Sequential indicator quietly flashes a possible reversal sign. - This creates an surroundings of short-term weak spot paired with early-stage long-term stabilization indicators.

Worth Motion Abstract

- XRP traded inside a $0.0563 vary (2.8%), transferring between $2.02 and $2.07 earlier than closing close to $2.032.

- The breakout to $2.07 was pushed by a 44.99M quantity spike (68% above SMA), however the rally totally retraced as quantity decayed.

- The 60-minute construction exhibits XRP declining from $2.040 to a help check at $2.029, with 1.08M quantity in the course of the low — clear proof of institutional distribution reasonably than opportunistic shopping for.

- XRP now consolidates round $2.030, the place holding this pivot turns into crucial to keep away from deeper testing of the $2.020–$2.025 zone.

What Merchants Ought to Know

- XRP’s short-term trajectory stays fragile as technical forces overpower in any other case supportive fundamentals like ETF inflows and long-term accumulation.

- A reclaim of $2.035 is required to revive intraday momentum, whereas a clear break again above $2.05 could be wanted to invalidate the descending channel.

- If $2.030 provides method, merchants ought to anticipate a retest of $2.020–$2.025, with psychological help at $2.00 serving as the ultimate line earlier than wider draw back opens.

- Sentiment is deeply unfavourable, which traditionally has aligned with early reversal setups, however till a technical set off emerges, the prevailing development stays downward.