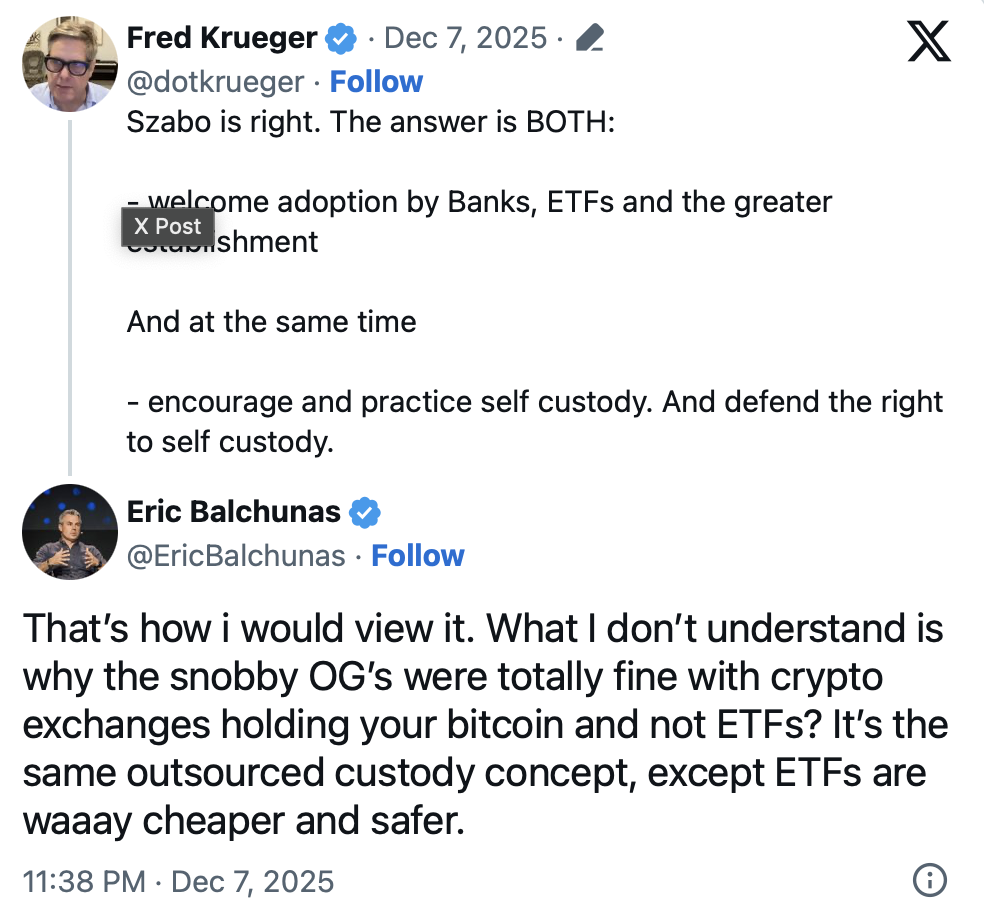

- Investor Fred Krueger backed Nick Szabo’s “each paths” method, arguing Bitcoin ought to welcome banks and ETFs whereas fiercely defending the proper to self-custody, trying to bridge purists and institutionalists.

- The controversy escalated as Bloomberg’s Eric Balchunas defended ETFs as cheaper and safer, whereas critics like Sam Wouters warned that ETFs lock customers out of withdrawal freedom, turning Bitcoin into “a fowl in a cage.”

- At its core, the conflict is not nearly merchandise, however about Bitcoin’s identification: whether or not it stays a instrument of sovereignty and exit, or evolves right into a mass-market asset largely managed via conventional monetary rails.

A surprisingly fierce debate has erupted proper within the heart of Bitcoin’s ideological universe, with long-time trade veterans clashing over what the way forward for custody, sovereignty, and ETF-driven adoption ought to really appear like. The argument isn’t simply technical — it’s philosophical, emotional, and actually, it’s getting sharper by the day.

The most recent spark got here from investor Fred Krueger, who jumped in to assist Nick Szabo’s push for a dual-path technique.

Bitcoin’s Self-Custody Debate Heats Up as ETFs Take the Highlight

Krueger inspired followers to embrace conventional rails — banks, ETFs, and institutional wrappers — but in addition struggle arduous to protect Bitcoin’s authentic promise of non-public management.

“Szabo is correct,” Krueger mentioned. “The reply is BOTH: welcome adoption by Banks, ETFs, and the better institution… and on the identical time, encourage and apply self-custody. And defend the proper to self-custody.”

His place makes an attempt to bridge the now-widening hole between Bitcoin “purists,” who imagine sovereignty is the whole level, and ETF defenders who argue that large-scale adoption requires acquainted, regulated infrastructure.

This all traces again to a debate sparked on Nov. 30, when Bram Kanstein argued that gold was such an environment friendly type of cash that it was finally changed by paper claims — credit score devices that got here from nothing however belief.

Szabo responded with a fast historical past lesson: gold was centralized in vaults as a result of it wasn’t theft-resistant, and retailers most popular practicality over purity. That’s how gold morphed into paper receipts, after which into wire-based settlement techniques.

Bitcoin fixes a lot of this — velocity, verification, open entry — however not every part. Szabo confused that one key weak spot nonetheless stays.

“Bitcoin is, with out additional work, nonetheless beneath one of the best trust-based strategies in its theft resistance,” he warned.

This, in his view, is why Wall Road leans closely towards third-party custody and ETFs.

ETFs vs. Self-Custody: A Sharp Philosophical Divide Emerges

That remark widened the rift.

Bloomberg’s Eric Balchunas questioned why “snobby OGs” fortunately belief exchanges with custody however oppose ETFs. In his view, each depend on third-party custody — however ETFs are “approach cheaper and safer.”

Analyst Sam Wouters pushed again arduous:

“You’ll be able to withdraw from an trade at any time. An ETF is a fowl in a cage,” he mentioned.

He argued that freedom to exit is the worth proposition — even when most customers don’t self-custody right this moment. With ETFs, that possibility merely doesn’t exist.

Balchunas countered that ETFs develop adoption massively, push possession into hundreds of thousands of palms, and assist Bitcoin evolve right into a extra steady financial asset.

However critics replied that Bitcoin wasn’t created to take a seat below company management. They fear that ETFs may finally give establishments an excessive amount of perceived affect over the protocol.

As the talk escalated, Balchunas insisted that self-custody is “a ache” and could be “very costly” when finished via apps and exchanges. However others rapidly identified that many platforms supply no withdrawal charges, tight spreads, and no annual charges — not like ETFs.

Balchunas later added:

“All I do know is I bought a ledger factor, then the app went out to supply BTC, and it was 1.4% minimal to transform my $. Some have been 2–3%. For an ETF particular person, that’s insanely costly, worse than the Seventies.”

Nonetheless, many in the neighborhood argue that Bitcoin exists exactly as a result of companies and establishments can’t be trusted on their phrase alone.

A Defining Second for Bitcoin’s Future

Bitcoin continues to dwell between two worlds — one constructed on sovereignty and self-possession, the opposite on scalability and mass-market comfort. What began as a disagreement about ETFs has now reworked right into a a lot deeper ideological fault line.

This isn’t only a debate anymore.

It’s the start of Bitcoin’s subsequent chapter — and whichever aspect beneficial properties momentum will form how the world interacts with Bitcoin for many years to return.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.