- In Q3 2025, institutional demand pushed Ethereum to a 66.76% achieve, led by BitMine, which elevated its holdings from 163k to 2.6M ETH — a 1,495% bounce in three months.

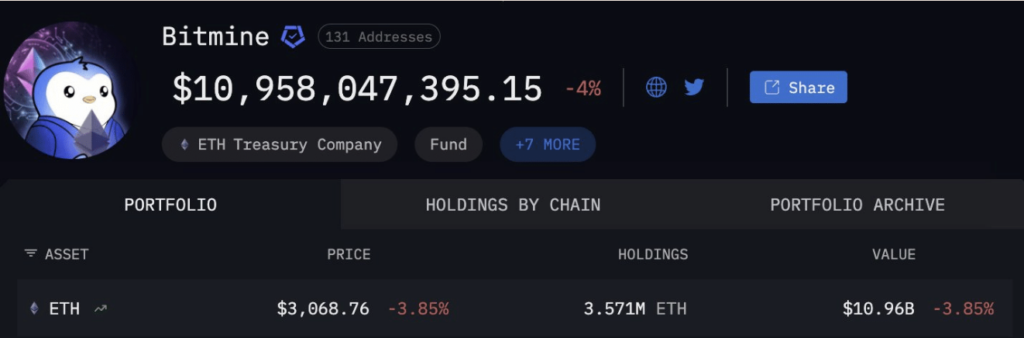

- BitMine continued accumulating in This autumn, including one other 900k ETH to succeed in a 3.7M ETH treasury, at the same time as its $11B ETH stake is now down 3.85% with ETH buying and selling close to $3,068.

- This rising divergence between aggressive institutional accumulation and weak market response raises doubts about one other Q3-style rally and places Ethereum’s $3,000 assist degree in danger if DAT-driven sentiment continues to melt.

Institutional demand for Ethereum in Q3 2025 didn’t simply rise — it went vertical. ETH posted a 66.76% achieve over the quarter, its strongest Q3 rally to this point.

On the middle of this surge sat one title that stored popping up on-chain: BitMine (BMNR).

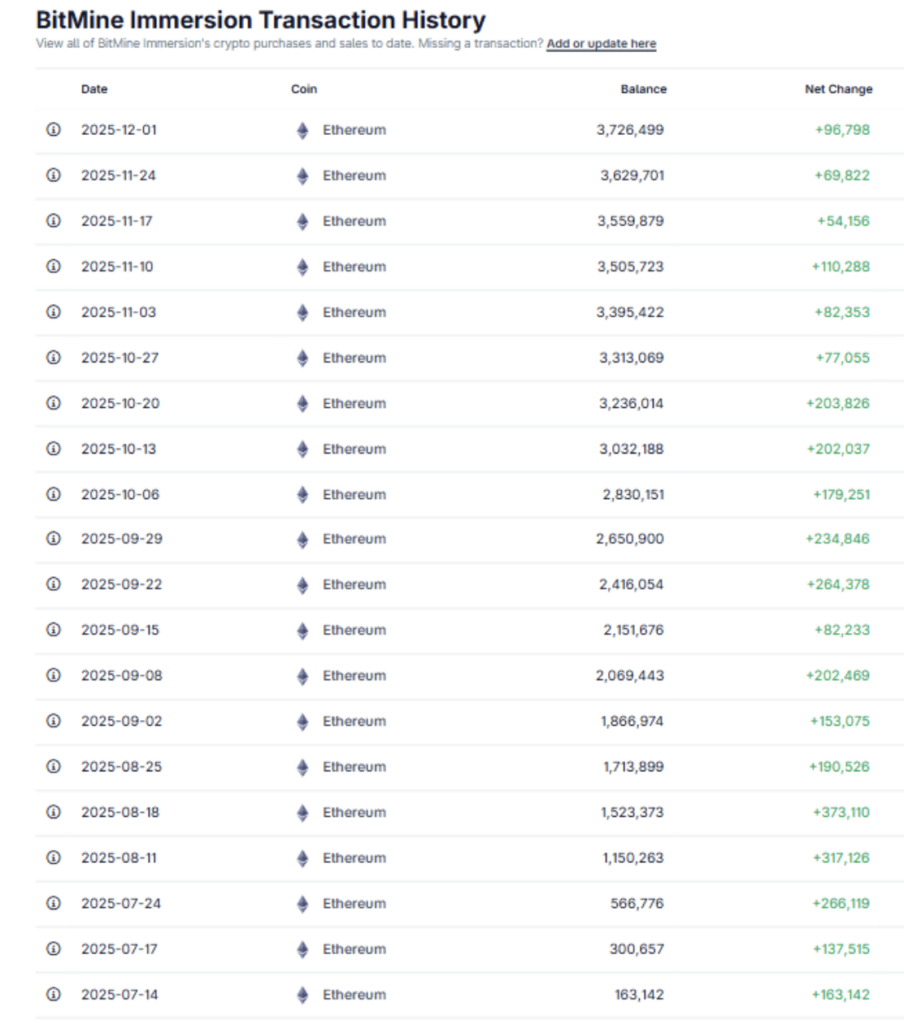

Transaction historical past tracked on CoinGecko reveals 11 separate ETH accumulation strikes from BitMine in Q3 alone. Not tiny buys both — collectively, they added up to an enormous stack.

BitMine’s Aggressive ETH Accumulation Shocked the Market

Initially of July, BitMine held round 163,000 ETH. By the tip of September, that quantity had jumped to 2.6 million ETH.

That’s an additional 2.44 million ETH in simply three months. Or put one other approach, roughly a 1,495% enhance of their Ethereum holdings.

Naturally, the market seen. On the every day chart, BMNR inventory climbed 45% in Q3, making it essentially the most bullish quarter within the firm’s historical past. Excessive valuations mirrored sturdy confidence in BitMine’s “ETH-heavy” treasury technique.

For a lot of merchants, it was another reason to remain bullish on Ethereum itself.

This autumn: BitMine Retains Shopping for Whereas ETH Begins Slipping

The fascinating half? BitMine’s conviction hasn’t pale in any respect — however the market’s response form of has.

In This autumn alone, BMNR has already executed 9 extra ETH transactions, bringing its treasury to roughly 3.7 million ETH. That’s one other 900,000 ETH in about three months, a 33% bounce in holdings.

Over the last bull market, this type of aggressive accumulation helped ETH rocket to $4,900. This time, it’s completely different.

Regardless of the shopping for, Ethereum is down about 26% on the quarter, underperforming even Bitcoin, which is down round 21% over the identical interval.

A chart shared on X highlights the shift clearly. BitMine now sits on an $11 billion ETH stake, but their ETH-heavy portfolio is down 3.85% at present costs close to $3,068.

Huge cash remains to be shopping for. The market, although, feels hesitant.

DAT Sentiment Divergence Places Ethereum’s Rally at Danger

This brings us to the important thing query:

Is enthusiasm for DATs (knowledge availability tokens / associated narratives) beginning to fade?

The divergence is evident:

- BitMine retains stacking ETH aggressively

- Ethereum’s worth retains sliding

- The broader market isn’t rewarding the habits the best way it did final cycle

If that pattern continues, ETH might lose certainly one of its strongest catalysts — large-scale, high-conviction institutional patrons anchoring the narrative.

With out that driver, a repeat of Q3’s +66% rally turns into a lot much less possible. And if sentiment round ETH and DATs weakens additional, even the $3,000 degree may come underneath stress.

The basics haven’t modified in a single day… however the best way the market is reacting to them clearly has.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.