Japan, the world’s largest international holder of US authorities debt, is stoking market nervousness as analysts warn {that a} potential large-scale bond sell-off could possibly be approaching.

The priority is rippling into the crypto sector, the place Tether, issuer of the USDT stablecoin backed primarily by over $113 billion in US Treasuries, faces renewed scrutiny over doable depeg dangers.

Sponsored

Analysts Warn Japan May Dump US Treasuries as Home Yields Surge

In keeping with the newest knowledge from the US Division of the Treasury, international urge for food for US Treasuries weakened in September. Complete abroad holdings edged all the way down to $9.249 trillion, a slight dip from August.

Nonetheless, Japan was the exception to this slowdown. The nation prolonged its nine-month shopping for streak, rising its holdings to $1.189 trillion, the best quantity it has held since August 2022. This reinforces Japan’s long-standing place as the most important international proprietor of US Treasuries.

“They purchased international debt as a result of Japanese bonds yielded virtually nothing,” an analyst said.

That unfold made US debt a sexy, low-risk yield various. However the macro backdrop is shifting. As BeInCrypto beforehand highlighted, yields on Japanese authorities bonds have climbed to their highest ranges in years.

With home yields enhancing, the motivation to proceed accumulating US Treasuries weakens. It additionally raises the likelihood that Japan could scale back its publicity if market situations or coverage priorities shift additional.

“Japan’s long-ignored debt disaster is surfacing, as its 230% debt-to-GDP burden collides with an enormous new fiscal enlargement underneath PM Sanae Takaichi, triggering a pointy spike in bond yields and investor alarm. A shock in Japan might reverberate worldwide, particularly given Tokyo’s position as the most important purchaser of U.S. Treasuries, elevating the stakes for international markets already strained by rising borrowing prices and shrinking fiscal room,” Lena Petrova said.

Sponsored

An analyst additional highlighted that the yield unfold between US and Japanese bonds has narrowed from 3.5% to 2.4% in six months. The hedged return on Treasuries has turned more and more unattractive. The put up warned that if the unfold approaches 2%, repatriation turns into economically compelling.

That would immediate Japanese establishments to promote US authorities bonds and reallocate capital domestically. Some fashions recommend as a lot as $500 billion could exit international markets in 18 months.

“Then there’s the yen carry commerce, roughly $1.2 trillion borrowed cheaply in yen and deployed world wide into shares, crypto, EM, something with yield. As Japanese charges rise and the yen strengthens, these trades flip poisonous. Positions unwind. Compelled promoting accelerates….For 30 years, Japanese yields acted because the anchor preserving international charges artificially low. Each portfolio constructed for the reason that mid-90s has quietly relied on that anchor. At the moment, it snapped,” the analyst added.

Sponsored

Tether’s US Treasury Publicity Attracts Focus

The query many analysts at the moment are asking is simple: If Japan begins decreasing its Treasury holdings, what does that imply for USDT? The priority arises as a result of Tether’s reserve construction is closely concentrated in the identical asset class that would come underneath stress.

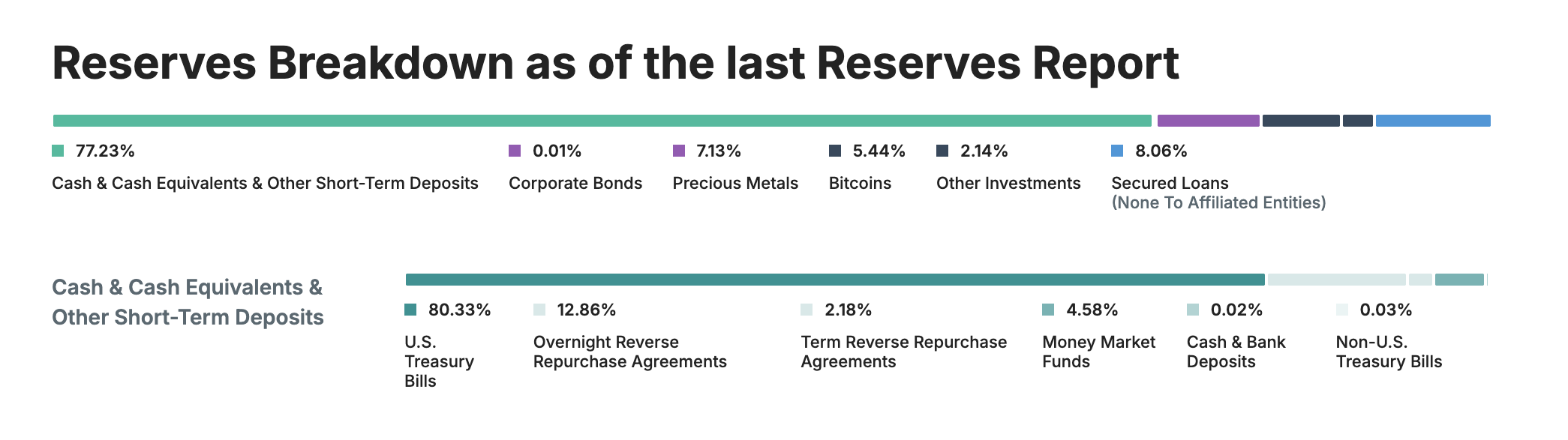

In keeping with Tether’s transparency report, greater than 80% of its reserves are in US Treasuries. This makes it a significant participant within the international Treasury ecosystem, and remarkably, the seventeenth largest holder of US authorities debt worldwide, surpassing many sovereign entities.

Such focus has benefits and vulnerabilities. Treasuries provide excessive liquidity and traditionally sturdy worth stability. Nevertheless, if a significant international creditor like Japan begins to unwind its holdings, the ensuing volatility in bond costs or yields might tighten liquidity situations, not directly pressuring massive holders like Tether.

“Japan can be pressured to promote US bonds, the remainder of the world will observe. Tether will endure a pointy depeg and Bitcoin will sink because of this. MicroStrategy can be pressured to promote and it will additional depress the Bitcoin worth. Japan ➡️Tether➡️Bitcoin On this order,” a market watcher wrote.

Sponsored

Including to those issues, S&P International Scores downgraded its evaluation of Tether’s means to take care of its peg, shifting USDT from a rating of 4 (constrained) to five (weak). In keeping with the analysis,

“5 (weak) displays the rise in publicity to high-risk property in USDT’s reserves over the previous yr and chronic gaps in disclosure. These property embody bitcoin, gold, secured loans, company bonds, and different investments, all with restricted disclosures and topic to credit score, market, interest-rate, and foreign-exchange dangers.”

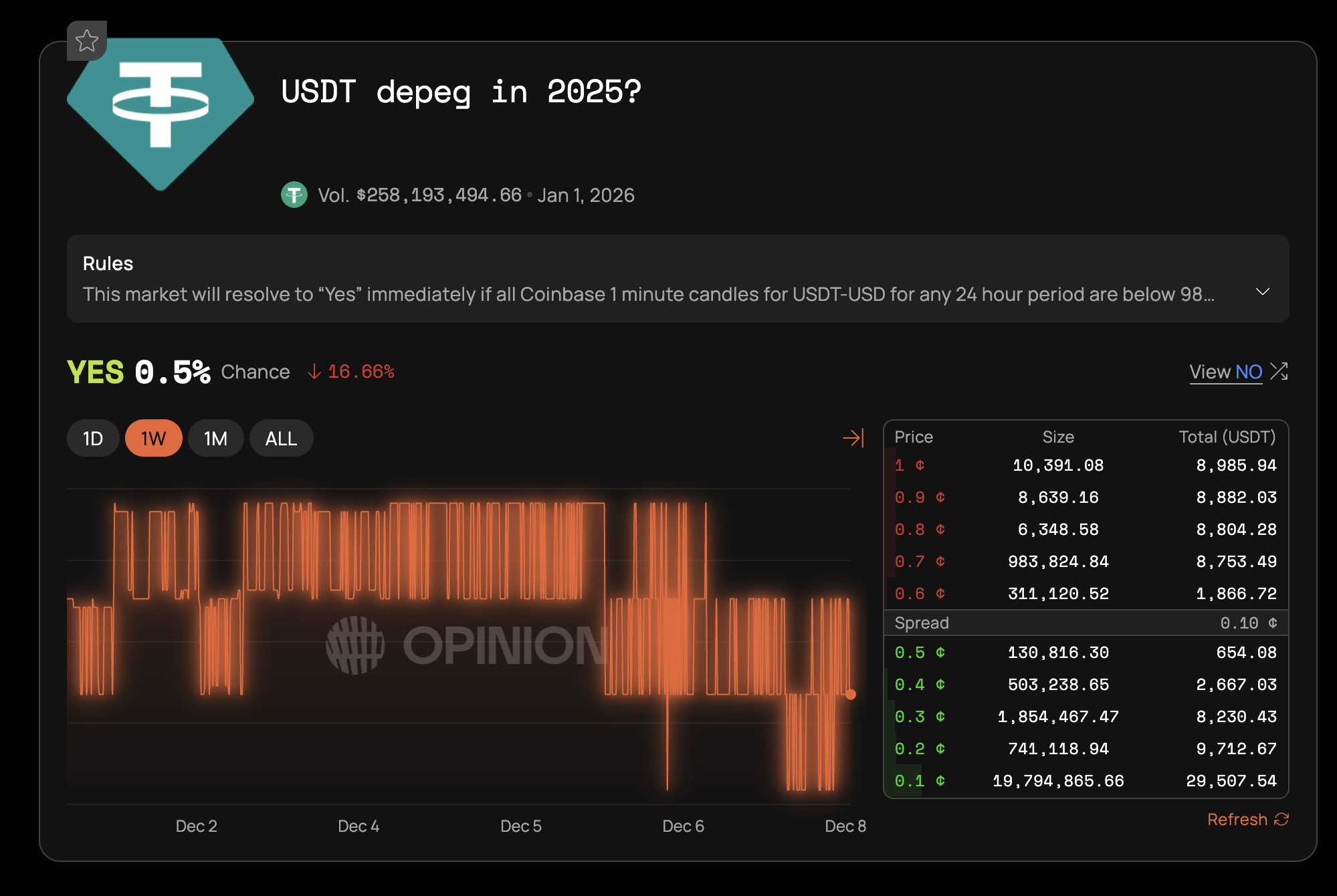

Regardless of these macro-driven issues, most market individuals see little likelihood of a pressured Tether depeg. Merchants on the Opinion prediction market assign a 0.5% chance to the state of affairs, exhibiting excessive investor skepticism.

A number of elements clarify this skepticism. Tether has maintained its peg throughout earlier market crises. The agency generated $10 billion in revenue via Q3 2025, providing a considerable buffer in opposition to reserve swings.

Though Japan’s Treasury exit could possibly be vital, it would doubtless unfold regularly. US Treasury markets stay huge and may take in stress from promoting with out enormous disruptions. Even so, the mix of Japan’s yield rise, S&P’s downgrade, and Tether’s reserve combine requires shut monitoring.