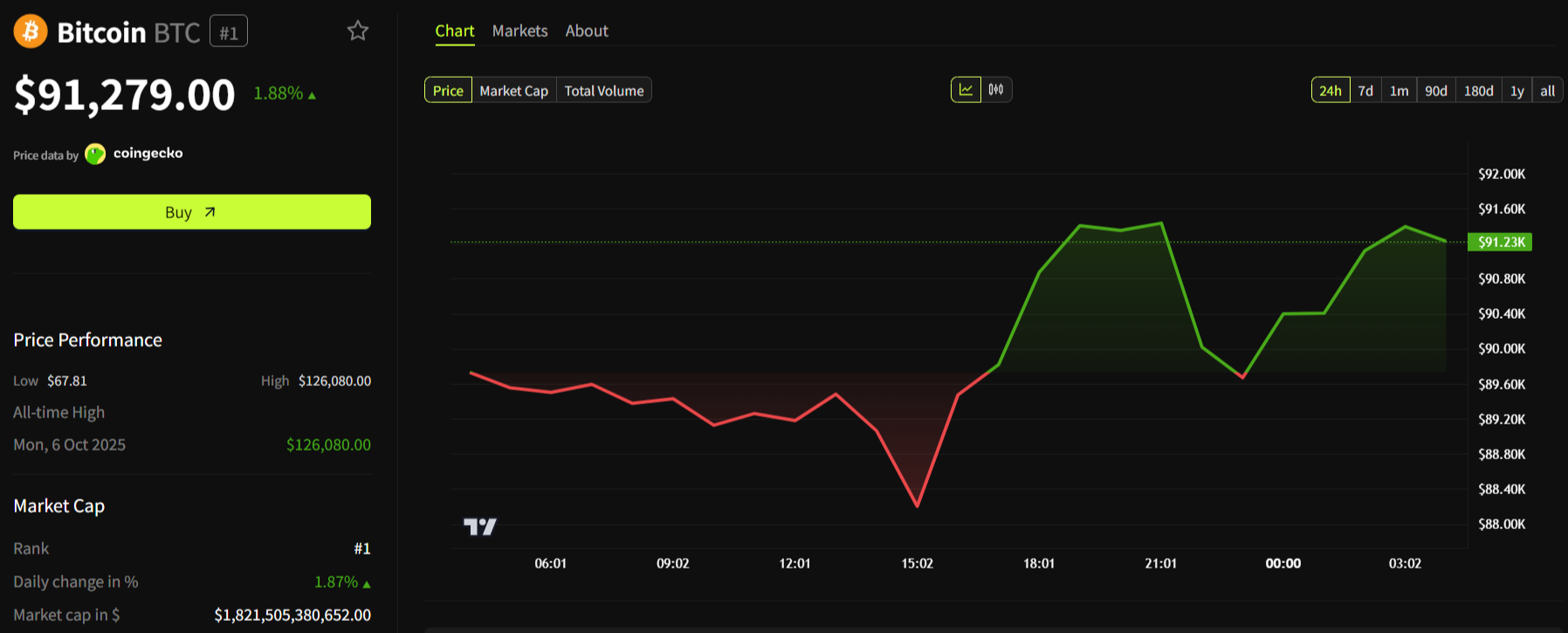

One enigmatic publish from Michael Saylor propelled Bitcoin over $4,000 in lower than three hours early in Asian morning on Monday. His “₿ack to Orange Dots?” message sparked hypothesis about MicroStrategy’s accumulation technique, pushing the digital asset from just under $88,000 to above $91,000.

This response highlights how the chief chairman’s communications can strongly affect market sentiment, even whereas the general market sentiment stays gripped by excessive concern.

Sponsored

Sponsored

Decoding the Orange and Inexperienced Dot System

Michael Saylor’s color-coded system wields main market affect. The “orange dots” denote every Bitcoin buy occasion by MicroStrategy, seen on the corporate’s StrategyTracker.com portfolio chart. Every marker represents one other step within the firm’s sturdy Bitcoin accumulation plan.

The chart’s inexperienced line shows the typical buy value of all acquisitions, serving as a efficiency benchmark. As of Dec 8, MicroStrategy held 650,000 BTC valued at $57.80 billion, with a mean price of $74,436 per coin. This place mirrored a achieve of 19.47%, translating to about $9.42 billion in unrealized earnings.

Lately, Saylor added a brand new twist to this visible vocabulary. His cryptic “inexperienced dots” have spurred hypothesis about potential technique modifications. The inexperienced dashed line—monitoring the typical price—has taken middle stage. Some analysts imagine increased shopping for exercise might transfer this metric upward.

Inside hours of Saylor’s replace, the worth soared above $91,000. The day’s vary stretched from $87,887 to $91,673, highlighting marked volatility across the sign.

Sponsored

Sponsored

Market Dynamics and Dealer Positioning

Regardless of the rally, market sentiment remained fragile. The Concern and Greed Index signaled continued anxiousness, however long-short ratios confirmed bullish dealer positioning. As concern and revenue transitioned, market psychology remained complicated.

Knowledge from CoinGlass revealed Binance and OKX reported 52.22% lengthy positions versus 47.78% quick, whereas Bybit’s bullish skew was even stronger at 54.22% lengthy and 45.78% quick. The newest four-hour futures quantity confirmed $106.77 million (56.23%) lengthy towards $83.11 million (43.77%) quick. Merchants appeared optimistic regardless of fearful sentiment metrics.

The break up between sentiment indicators and dealer positioning highlights immediately’s market complexity. Many are prepared to wager on sustained momentum, particularly after influential indicators from main holders, although concern persists within the background.

MicroStrategy’s affect extends additional. The corporate not too long ago constructed a $1.44 billion money reserve to cowl dividends and supply 21 months of liquidity. On December 1, 2024, it acquired 130 BTC for about $11.7 million at $89,960 per coin, bringing complete holdings to 650,000 BTC.

Strategic Evolution and Market Implications

The company method has shifted in current weeks. CEO Phong Le not too long ago admitted MicroStrategy might promote Bitcoin if the inventory drops beneath 1x modified Web Asset Worth—ought to fairness or debt not be raised. In November 2024, the mNAV touched 0.95, bringing this situation nearer to actuality.

This marks a transfer away from the previous “by no means promote” stance. Annual dividend necessities of $750 million to $800 million have compelled the agency to contemplate new liquidity, making its market function resemble a leveraged Bitcoin ETF. Shares have misplaced over 60% from highs, elevating questions on continued accumulation in unstable instances.