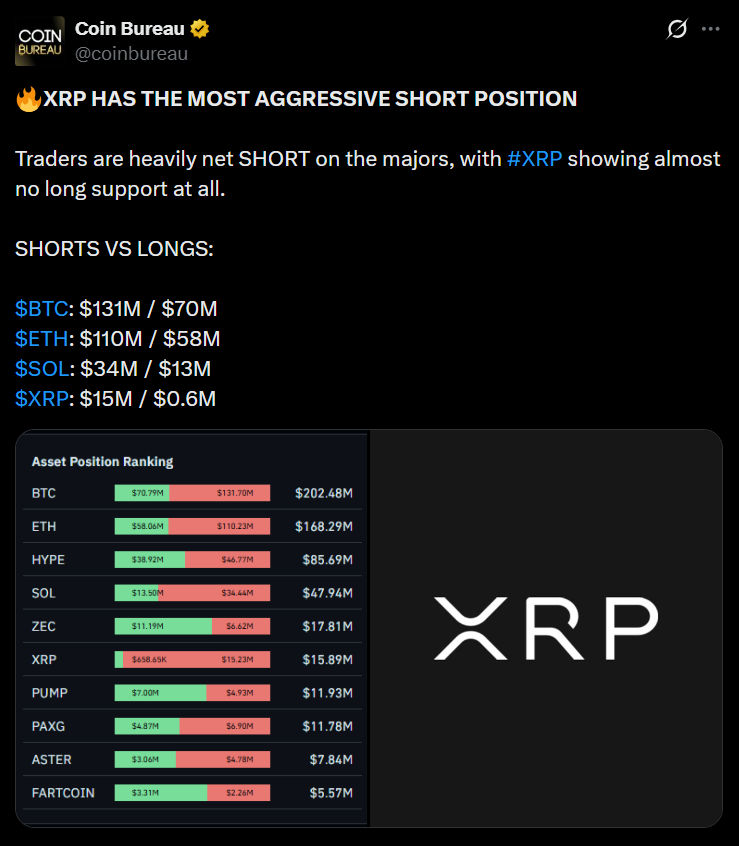

- XRP shorts sit close to $15M vs. solely $600K in longs, the worst imbalance amongst main property.

- Excessive quick strain places the altcoin vulnerable to dipping towards $1.80 if liquidations hit.

- Merchants are suggested to attend for cleaner dips fairly than getting into throughout heavy draw back strain.

Ripple’s XRP is sitting in a tough patch proper now as merchants pile into quick positions at a tempo that no different main altcoin is dealing with. The imbalance between consumers and sellers has widened dramatically, leaving XRP on a slippery slope the place even small strikes may set off outsized reactions. In contrast to Bitcoin, Ethereum, and even Solana, none of them have come near this stage of short-heavy positioning, making XRP the riskiest of the group for the time being.

Merchants Outnumber Holders in a Large Means

Contemporary knowledge from Coin Bureau reveals simply how dramatic the hole has grow to be: XRP shorts complete almost $15 million, whereas longs sit at solely about $600,000 — a distinction so massive it nearly feels unreal. This stage of strain can pull the value down quick if circumstances worsen or liquidations stack up. When the short-side outweighs the lengthy facet by this a lot, the market tends to lean into the weaker path, pushing worth motion decrease fairly than giving it any actual likelihood to rebound.

Evaluating XRP In opposition to BTC, ETH, and SOL

To place issues in perspective, right here’s the snapshot merchants are : Bitcoin sits with $131M in shorts vs. $70M in longs, Ethereum has $110M vs. $58M, Solana has $34M vs. $13M. None of these look nice, however XRP stands out as the one asset the place shorts overwhelm longs by such an enormous ratio. At its present worth close to $2.08, a full liquidation wave may simply drag XRP towards $1.80 — almost a 15% slide from the place it trades right now.

Greatest Technique: Keep Affected person and Watch for Cleaner Ranges

With the market trying like this, taking a recent entry into XRP turns into a dangerous transfer. The smarter technique is solely to observe for cleaner dips and keep away from forcing positions in the midst of heavy quick strain. A affected person method may repay, particularly if XRP stabilizes later this cycle. Shopping for close to the decrease finish of a correction usually provides merchants the upside they want as soon as momentum lastly swings again.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.