- ASTER has dropped over 40% in This autumn, however whales lately purchased 2.9 million tokens, hinting at long-term confidence.

- The group is shifting towards fundamentals with a 77.8M token burn and buybacks rising from $3M to $4M per day.

- These strikes recommend a possible provide rotation from short-term sellers to long-term holders, establishing a bullish 2026 outlook.

For all of the noise, the memes, the joy — the market at all times circles again to fundamentals ultimately. And recently, Aster has turn into a reasonably clear instance of that cycle taking part in out in actual time. When its Q3 launch hit, the token went full risk-on, ripping greater than 300% in a single quarter. It was such a wild run that merchants have been brazenly evaluating it to Hyperliquid (HYPE). The humorous factor? HYPE solely managed a few 14% transfer in the identical interval, which exhibits simply how aggressively capital flowed into Aster.

However This autumn has been a complete completely different story. The hype cooled off, liquidity thinned out, and ASTER dropped greater than 40% already — a transfer sharp sufficient to shake out late patrons and rattle anybody who jumped in anticipating a straight-line moonshot.

Volatility Bites Again as ASTER Nears Its ICO Baseline

Trying on the chart, Aster’s drawdown is beginning to reduce deeper. One other 30% slide would ship the token proper again to its ICO baseline, which is a reasonably harsh reversal for one thing that seemed unstoppable just some months in the past. The velocity of the rise — and the velocity of the autumn — highlights how speculation-heavy this market will get when the hype machine fades. Numerous late-entry HODLers are sitting underwater now, and a few are already capitulating outright.

Even so, conviction hasn’t vanished totally. AMBCrypto lately highlighted that whales scooped up round 2.9 million ASTER tokens, which suggests massive gamers nonetheless see a long-game alternative right here. And actually, a few of the dev group’s newest strikes do assist clarify why the smarter cash hasn’t walked away.

Buybacks, Burns, and a Pivot Towards 2026

Now that the hype cycle has cooled, ASTER is shifting its focus again to fundamentals — one thing it in all probability wanted. The challenge’s 2026 roadmap feels rather more structured, and the pivot began with a reasonably aggressive 77.8 million token burn. Burns shrink circulating provide, and that form of tightening can repay later if demand returns.

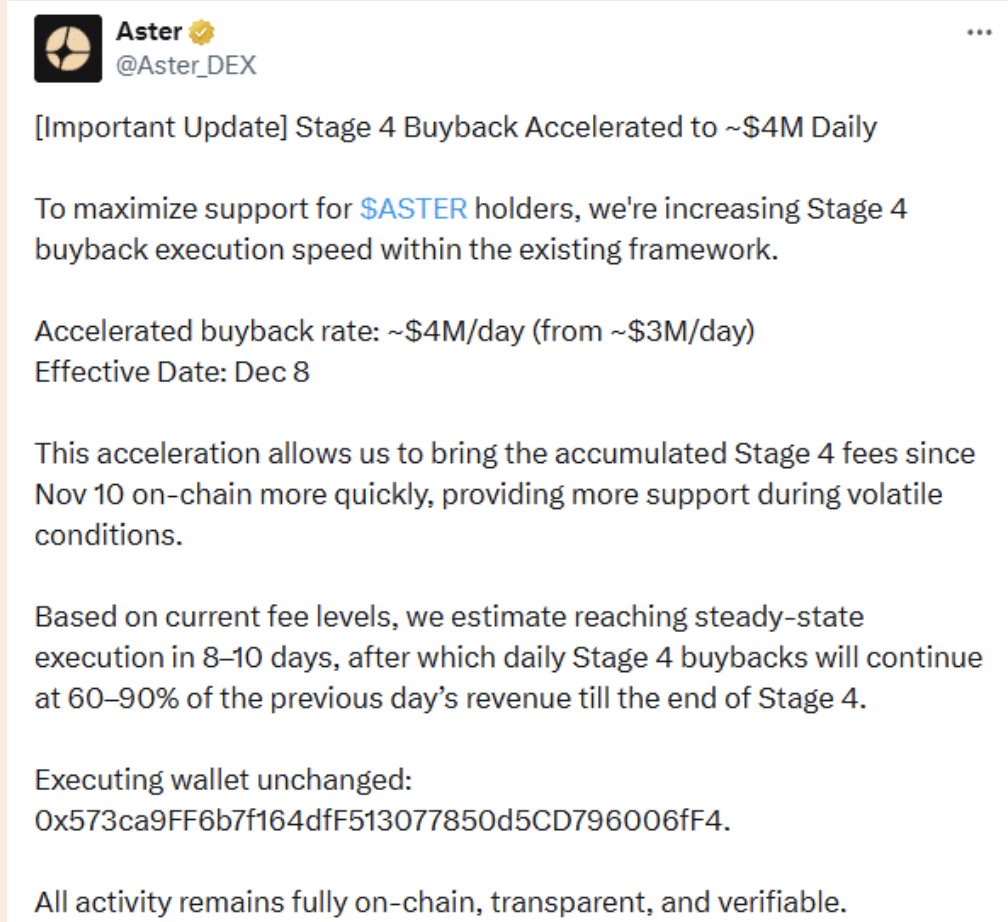

Constructing on that, the group is ramping its buyback throughput from $3 million to roughly $4 million per day. That’s a giant soar. And it tells you precisely the place their priorities are proper now: strengthen the token’s supply-side mechanics earlier than anything.

In the meantime, the order books aren’t precisely thick — the bid-wall is scaling down, and it’s struggling to soak up the promoting strain behind ASTER’s 40%+ drawdown. With that in thoughts, leaning into provide discount is smart. Fewer tokens floating round strengthens every remaining one, which might enhance long-term confidence and slowly shift sentiment again in ASTER’s favor.

Why This Might Be the Begin of a Longer-Time period Rotation

Given all this, the current whale accumulation doesn’t look random. It appears to be like extra like early positioning forward of an even bigger structural shift. With burns, buybacks, and a extra disciplined roadmap taking form, ASTER is likely to be coming into the early section of a provide rotation — away from short-term holders and into the fingers of long-term believers.

If that rotation continues, Aster might be setting the inspiration for a stronger runway heading into 2026, even when the present value motion feels tough. Typically the largest setups get constructed quietly, proper after the hype has burned off and everybody else walks away.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.