Michael Saylor’s trace a couple of contemporary Bitcoin buy has renewed speak amongst merchants and buyers, at the same time as on-chain stress indicators level to a harder stretch for the community. The combo of heavy shopping for by public corporations and indicators of miner pressure is drawing consideration from each bulls and bears.

Associated Studying

Saylor’s Tracker Alerts

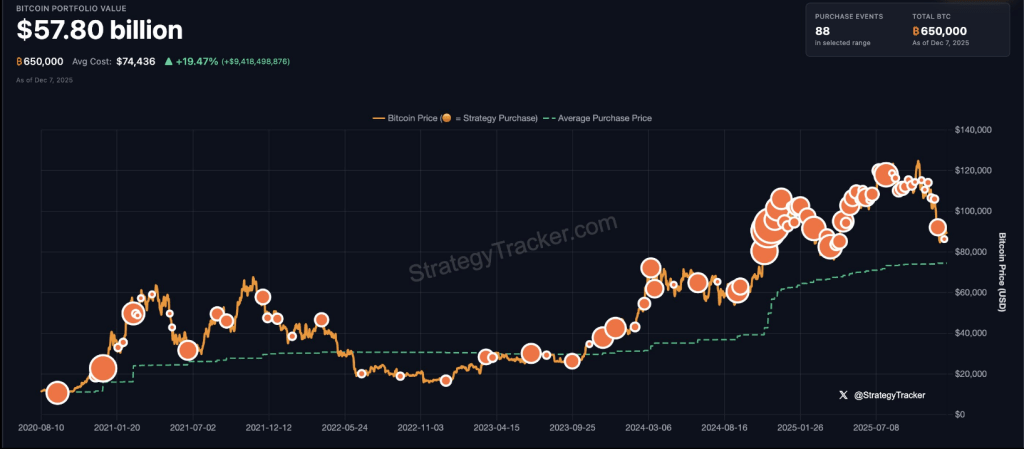

In accordance with a StrategyTracker chart shared by Michael Saylor, Technique holds about 650,000 BTC with a portfolio worth close to $58 billion. The chart lists a median buy value of $74,436 and exhibits 88 confirmed purchase occasions over time.

Saylor captioned the picture “Again to Orange Dots?” — a brief, acquainted cue that has usually come earlier than a brand new accumulation spherical.

Technique’s most up-to-date reported transfer was a 130 BTC purchase, which inserts the corporate’s lengthy behavior of including in periods of market concern. That sample issues as a result of when an entity repeatedly buys by way of downswings, it shapes how different buyers react.

₿ack to Orange Dots? pic.twitter.com/npB0NWSZ52

— Michael Saylor (@saylor) December 7, 2025

Company Shopping for Continues

Based mostly on stories from BitcoinTreasuries.NET, the highest 100 public corporations now maintain about 1,059,453 BTC mixed. ABTC reportedly added 363 BTC, the biggest improve this week, whereas Cango Inc. bought 130.6 BTC.

Different names cited in current filings embody Bitdeer, BitFuFu, Hyperscale Knowledge, Genius Group, and Bitcoin Hodl Co. These strikes present that some corporations preserve increasing reserves even when costs wobble.

For market watchers, regular company accumulation generally is a calming drive, although it doesn’t erase broader promote stress.

On-Chain Stress Indicators

In accordance with Glassnode charts shared by the Bitcoin Archive, the Hash Ribbon has shifted bearish once more, an indication that some miners are going through stress and even pausing operations.

Quick-Time period Holder NUPL has fallen beneath zero, which means many current consumers are holding cash at a loss. Traditionally, episodes the place miners are squeezed on the similar time new holders are underwater have appeared close to important lows.

That consequence just isn’t sure, however the mixture of technical miner pressure and unrealized losses amongst short-term wallets is the sort of setup merchants watch intently.

Associated Studying

What Merchants Are Watching Now

Merchants are monitoring whether or not the miner stress and losses amongst contemporary consumers will coincide with renewed shopping for by huge holders.

Some anticipate that company purchases and purchases by Technique may blunt draw back and spark a rebound. Others stay cautious as a result of on-chain indicators level to actual pressure.

Market motion round main occasions, like central financial institution bulletins, has additionally proven Bitcoin can stall earlier than coverage strikes after which transfer sharply after.

Featured picture from Unsplash, chart from TradingView