- Bitcoin didn’t reclaim its yearly open, stalling beneath $93,500 after the $92K push

- Analysts say $86K is the vital assist if BTC fails to kind a better low

- Trade BTC provide retains dropping as long-term holders take in extra of the float

Bitcoin managed to crack above $92,000 in the course of the Asia session, however the momentum light nearly immediately. The transfer seemed prefer it was constructing towards a clear retest of the yearly open at $93,500… till it didn’t. The rejection hit quick, pushing BTC/USD again right into a uneven vary and unraveling a few of the optimism that had constructed up in a single day.

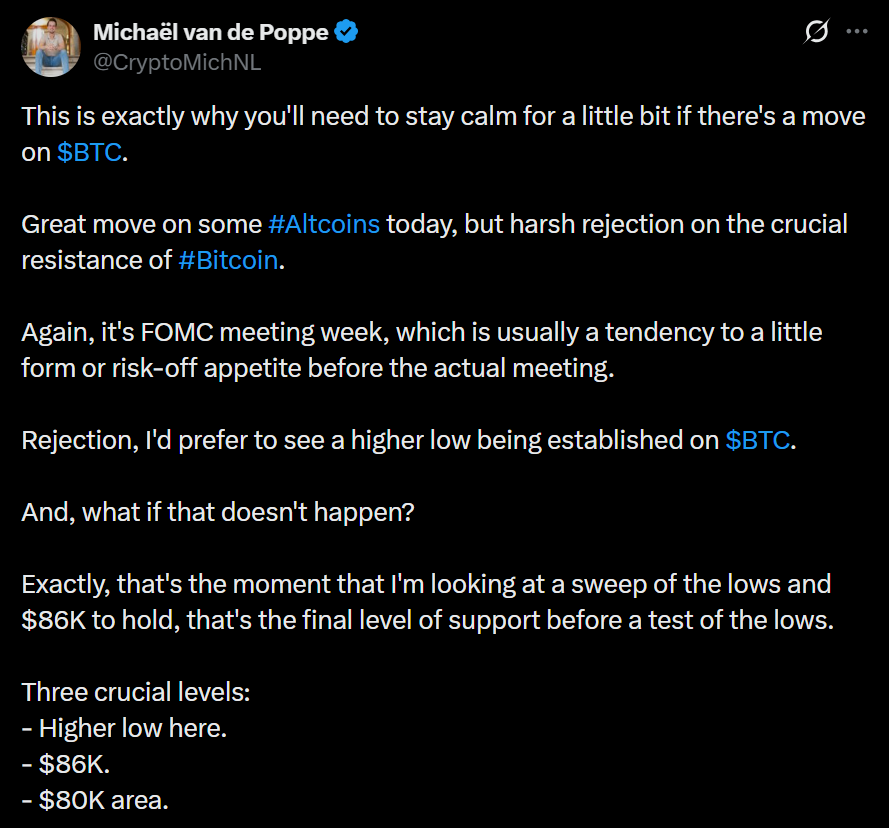

Crypto analyst Michaël van de Poppe captured the temper bluntly, saying that is “precisely why you must keep calm” throughout sudden surges. He highlighted the robust altcoin efficiency however identified that Bitcoin hit a wall at a vital resistance zone. Based on him, the subsequent clear sign can be forming a better low, though he warns that if BTC fails to carry that construction, merchants needs to be ready for one thing sharper.

$86,000 turns into the road within the sand

Van de Poppe pointed to $86,000 because the “remaining degree of assist” earlier than the market dangers retesting prior lows. If Bitcoin loses composure and fails to kind a better low, a sweep towards that $86K area turns into the state of affairs he’s watching most intently. The shift in momentum wasn’t helped a lot by Technique’s contemporary $1 billion value of BTC purchases, which surprisingly didn’t spark the arrogance increase many anticipated. The market’s response means that macro uncertainty and thinning liquidity are weighing heavier than even massive institutional buys proper now.

Liquidations keep modest as broader curiosity cools

Regardless of the volatility, liquidations throughout the crypto market remained surprisingly contained. QCP Capital famous that solely about $330 million was liquidated throughout 24 hours, a modest determine given the scale of BTC’s transfer. They stated the delicate response indicators a a lot bigger pattern: merchants are scaling again positioning as fatigue, warning, and easy market indifference set in.

Over the previous two weeks, BTC has been steadily leaving exchanges. QCP flagged greater than 25,000 BTC exiting order books, whereas Glassnode’s information suggests nearer to 35,000 BTC. That’s a significant shift — provide is migrating into longer-term custody. ETFs and company treasuries now maintain extra Bitcoin than exchanges, tightening obtainable liquidity and shrinking the tradable float.

Market outlook: calm earlier than a much bigger break

With resistance rejecting worth, alternate balances falling, and volatility creeping again in, merchants are getting ready for a bigger directional transfer. Whether or not that’s a sweep of the lows towards $86K or one other try at reclaiming $93,500 could hinge on macro circumstances and whether or not demand can return in pressure.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.