- LINK change reserves have dropped to a 16-month low, signaling lowered promoting strain and rising shortage.

- CCIP adoption continues spreading, with main new integrations throughout AI layers, stablecoin infrastructure, and 12 completely different chains.

- LINK holds help close to $13.31, with upside targets at $15.01 and $17.68 if momentum sustains.

Chainlink began the week in a fairly regular spot, hovering round $13.70 on Tuesday and managing to carry above a key help band that merchants have been expecting weeks. The fascinating factor is how the basics hold tightening on the identical time — change reserves dropping, whale orders popping up, and a complete wave of latest integrations rolling in. It nearly feels just like the community is quietly gearing up for one thing, even when the value hasn’t totally proven it but.

Trade Reserves Hit a 16-Month Low as Shortage Builds

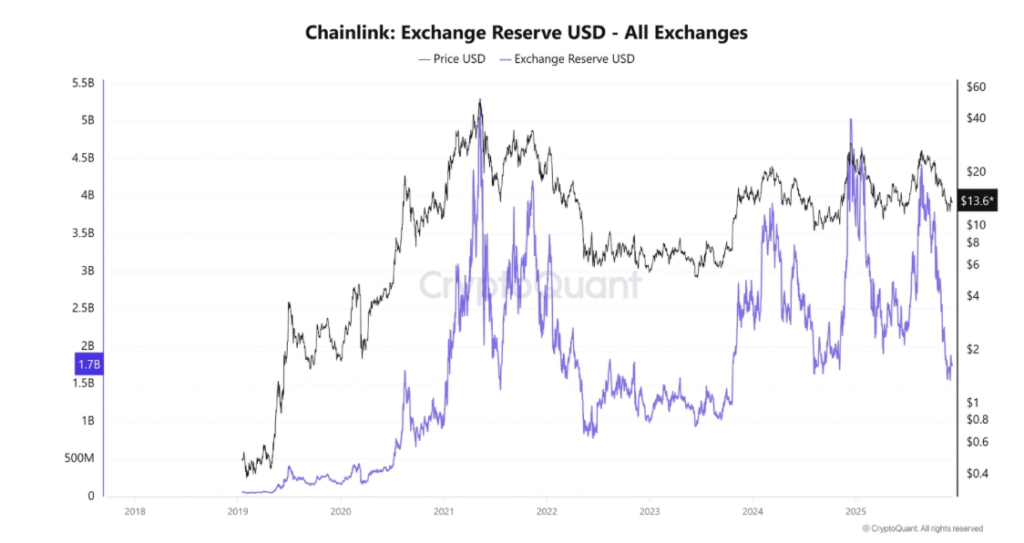

CryptoQuant’s information reveals the whole LINK held on exchanges fell to 1.55 billion on December 1 — the bottom level since August 2024 — earlier than bouncing barely to round 1.7 billion on Tuesday. That’s nonetheless very low in comparison with the previous 12 months. Much less provide sitting on exchanges means fewer tokens able to be dumped, and traditionally that sort of drain tends to line up with bullish phases.

On prime of that, CryptoQuant’s broader abstract information factors to cooling market situations, bigger whale buys, and purchase dominance throughout each spot and futures markets. Collectively, these indicators trace at a possible transfer increased if LINK can hold holding its construction with out slipping again right into a heavier correction.

CCIP Integrations Maintain Increasing Chainlink’s Ecosystem

Adoption-wise, Chainlink has been on a roll once more this week. Codatta — an AI-focused layer — simply introduced it’s utilizing Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to switch XNY between Base and BNB Chain securely. A day earlier, Steady (the StableChain backed by Bitfinex and PayPal Ventures) confirmed its personal integration of CCIP to allow cross-chain LBTC transfers.

And past these two, the community logged 12 new integrations throughout six completely different providers spanning a dozen chains — Base, Bitcoin, BNB Chain, Celo, Ethereum, Polygon, Solana, TON, TRON and extra. It’s the sort of real-world growth that reinforces LINK’s long-term utility and builds institutional consolation across the protocol. Each week, the momentum feels a bit louder.

Value Outlook: LINK Finds Assist and Eyes the Subsequent Ranges

LINK broke above its descending trendline on December 2 — a construction fashioned by connecting a number of highs since early October — and rallied practically 9% the next day. The transfer misplaced some steam afterward, with value pulling again and discovering help round $13.31. As of Tuesday, LINK is buying and selling barely above that zone, hovering close to $13.67.

If LINK continues to float upward, the subsequent goal is the 50-day EMA at $15.01. A clear shut above that opens the door to the subsequent main resistance at $17.68. The day by day RSI at 47 is creeping towards the impartial 50 mark, hinting that bearish strain is fading, and the MACD stays in a bullish crossover from final week — one other small however related affirmation.

If value slips once more, although, LINK may fall again towards the $13.31 help space earlier than trying one other push.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.