- Pepe stays closely down however reveals early indicators of stabilizing after months of decline

- A potential Fed price minimize and bullish 2026 Bitcoin forecasts might enhance PEPE

- If markets ignore the speed minimize once more, PEPE might face one other correction

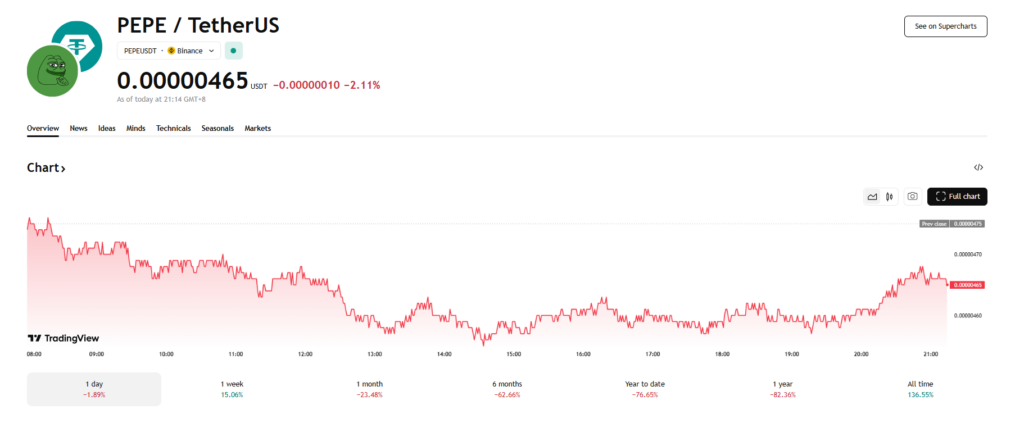

Pepe has spent the previous few months sliding additional down the market rankings, now sitting across the sixtieth spot by market cap. The token has dropped greater than 83 % since December 2024, with the broader market downturn pulling memecoins sharply decrease. Even so, PEPE has managed small beneficial properties over the previous week, suggesting that promoting stress might lastly be easing. This comes as merchants search for indicators of stability throughout the market after an October crash that delivered the biggest single-day liquidation occasion in crypto historical past.

Fed coverage might determine the following main worth course

The October crash was sudden, particularly as a result of it occurred shortly after the Federal Reserve minimize rates of interest by 25 foundation factors. Macroeconomic uncertainty overshadowed the coverage transfer and triggered broad risk-off habits, sending PEPE sharply decrease. With one other potential price minimize on the horizon after this week’s FOMC assembly, merchants are watching carefully to see whether or not liquidity returns to danger belongings. If markets reply positively, PEPE may benefit from renewed inflows much like earlier durations of easing.

A robust BTC outlook might assist a wider memecoin restoration

Past short-term Fed-driven volatility, main establishments like Bernstein and Grayscale count on Bitcoin to hit a brand new all-time excessive in 2026. Their outlook suggests BTC might get away of its conventional four-year cycle and set off a broader sentiment shift throughout crypto. If Bitcoin rallies into 2026, memecoins like PEPE are likely to comply with the broader development, traditionally benefiting from waves of speculative capital and stronger retail enthusiasm when the market turns risk-on once more.

However a repeat of October stays an actual danger

Regardless of the potential of a rebound, merchants can’t ignore that price cuts don’t all the time spark speedy bullish momentum. October’s worth motion confirmed how rapidly macro fears can override liquidity boosts. If markets fail to answer the Fed’s subsequent transfer, PEPE might face one other downturn as volatility stays elevated. For now, the token sits in a fragile place the place sentiment can flip rapidly relying on how macro occasions unfold.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.