Be a part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor signaled Technique could purchase extra Bitcoin this week after he posted a screenshot of the SaylorTracker chart with the caption, “₿ack to Orange Dots?”

Traditionally, comparable Sunday posts have been adopted by bulletins that the corporate has acquired extra BTC.

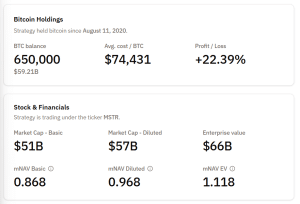

A contemporary buy would elevate its holdings above 650,000 BTC, presently valued at over $59 billion with an unrealized achieve close to 22%.

If the corporate does certainly announce one other Bitcoin acquisition later at present, it is going to see the corporate’s massive BTC reserves climb to above 650K cash, gathered at a mean worth of $74,431.

Technique BTC holdings (Supply: Bitcoin Treasuries)

Saylor’s query as as to whether the corporate ought to return to “orange dots” refers back to the dots on the SaylorTracker chart. Final week, Technique added its first inexperienced dot to the chart when it established a $1.4 billion USD reserve to cowl dividend fee obligations.

Technique’s Latest Shopping for Exercise Might Be Early Sign Of A Bear Market

Technique has continued shopping for throughout worth weak point, though latest tranches have been smaller than earlier within the 12 months.

Previously two months, the corporate’s BTC purchases have been principally below 1,000 cash. The one exception was on Nov. 17, when Technique purchased 8,178 BTC for $836 million, the corporate’s web site exhibits.

Commenting on Technique’s Bitcoin shopping for exercise, CryptoQuant warned that the slowdown and the institution of the $1.4 billion USD reserve could possibly be pre-emptive strikes by the corporate to arrange for a drawn-out bear market.

JPMorgan Says Technique Holds Key To BTC Route, MSCI Exclusion Danger Looms

Given Technique’s substantial holdings within the largest crypto by market cap, JPMorgan analysts stated that the corporate holds the important thing to BTC’s future course.

Analysts led by managing director Nikolaos Panigirtzoglou stated that the ratio between Technique’s enterprise worth and its BTC holdings, or mNAV, has remained above 1. They known as this an “encouraging” signal for the general market.

The report got here after Technique’s inventory worth plummeted greater than 54% over the previous six months, coinciding with a broader digital asset treasury (DAT) agency pullback.

Together with the correction seen within the DAT panorama, Technique can also be getting ready for a potential elimination from MSCI indexes subsequent month. If this occurs, JPMorgan stated it might result in as much as $12 billion in misplaced shopping for energy for Technique’s inventory (MSTR). MSCI’s resolution is scheduled for Jan. 15.

Cantor Fitzgerald final week slashed its worth goal for Technique’s share worth by 60%, however it maintained its “purchase” score for MSTR and stated fears of a selloff are ”overblown.”

Saylor has reportedly been in talks with MSCI, and Attempt CEO Matt Cole urged MSCI to rethink its proposal to take away treasury corporations from its indexes, warning that it could scale back traders’ entry to ”the fastest-growing a part of the worldwide economic system.”

https://t.co/5gdKWpFATh

— Matt Cole (@ColeMacro) December 5, 2025

Worries that MSTR could also be compelled to promote Bitcoin whether it is delisted from MSCI indexes is “flat fallacious,” Bitwise CIO Matt Hougan stated final week.

“I perceive why bears need to embrace the MSTR ‘doom loop’ thought,” he stated in a Dec. 3 be aware to shoppers. “It might certainly be very dangerous for the bitcoin market if MSTR needed to promote its $60 billion of bitcoin in a single go. However with no debt due till 2027 and sufficient money to cowl curiosity funds for the foreseeable future, I simply don’t see it occurring.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection