- Rietveld believes XRP might attain $10–$20 inside one to 2 years because of Ripple’s GTreasury acquisition.

- GTreasury processes $5–$10 trillion yearly, creating potential actual company demand for XRP settlement flows.

- Integration might drive long-term utility, liquidity wants, and structural worth development that helps greater value targets.

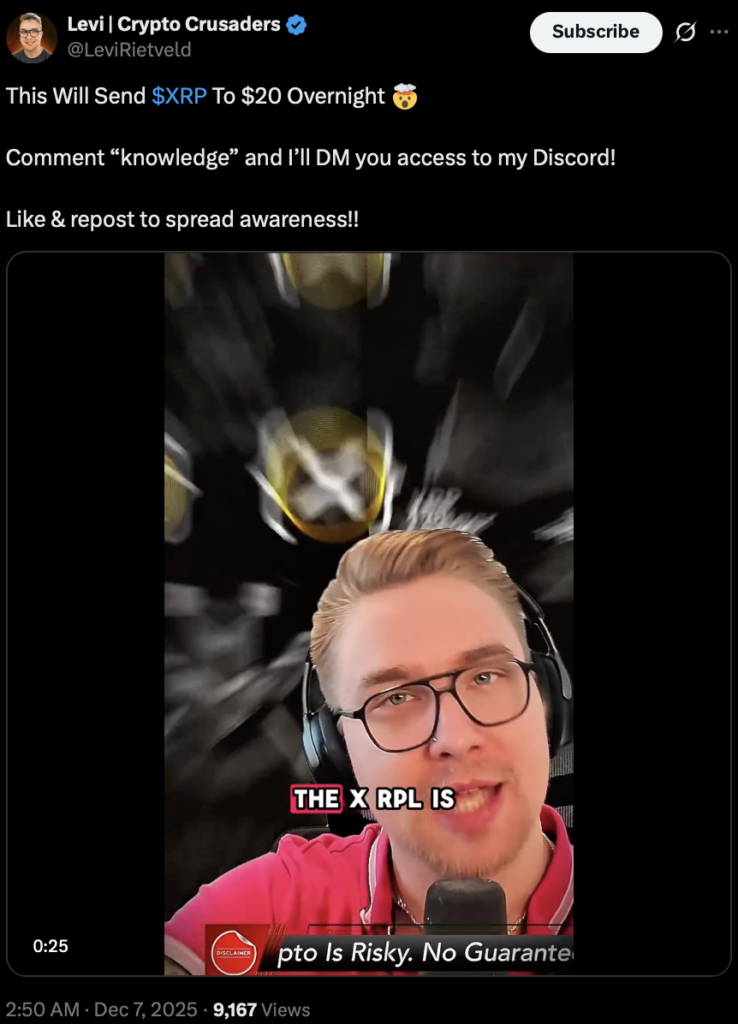

Crypto Crusaders creator Levi Rietveld stirred up an entire lot of chatter this week after dropping a surprisingly assured prediction: he believes XRP might climb to someplace between $10 and $20 over the following one to 2 years. It wasn’t only a random moonshot declare both — he tied it on to Ripple’s accomplished acquisition of GTreasury, a deal that many individuals within the house are quietly calling a turning level. GTreasury handles someplace between $5 to $10 trillion in cross-border fee flows annually, and Rietveld thinks these flows will ultimately settle throughout the XRP Ledger as soon as Ripple absolutely integrates the whole lot. It’s a giant declare, yeah, however not with out some logic behind it.

Rietveld’s Targets and the Math Behind Them

Rietveld centered closely on scale and effectivity slightly than hype. With XRP buying and selling round $2.05 proper now, a transfer to $10 would imply roughly a 387% leap, whereas $20 can be nearer to an 875% climb — numbers which will look intimidating however aren’t extraordinary in crypto cycles. He insists these targets aren’t guesswork, however merely the pure final result of corporate-level utilization colliding with a settlement asset constructed for velocity. As soon as GTreasury’s large shopper base begins settling by means of Ripple’s rails, he argues, XRP beneficial properties utility that didn’t exist earlier than. And in crypto, utility tends to pull value together with it eventually.

GTreasury’s Place in This New System

Ripple’s $1 billion acquisition of GTreasury formally closed after the preliminary announcement again in October 2025. GTreasury isn’t some small fintech startup — it’s a significant treasury administration platform that world companies have relied on for many years. Their system handles fee routing, liquidity administration, cross-border operations, and extra. Rietveld identified that this long-established basis is now basically sitting inside Ripple’s construction. If those self same flows migrate to the XRP Ledger, the demand for XRP liquidity might rise sharply, just because settlement at that scale requires deep, dependable infrastructure.

Why This Integration Might Be a Actual Recreation Changer

Rietveld didn’t current the mixing as some imprecise narrative; he framed it as a sensible, measurable shift. GTreasury’s shoppers transfer huge quantities of capital every day — trillions per 12 months. These companies need quick settlement, predictable prices, and safe channels, and Ripple’s system is constructed to ship precisely that. Introducing XRP because the settlement asset on this atmosphere offers it one thing it has struggled to take care of prior to now: constant real-world demand.

This places XRP in entrance of an entire new class of customers who really want environment friendly settlement slightly than speculative upside. That kind of utilization helps long-term worth in a method most crypto belongings by no means get to expertise. Primarily based on this mixture of scale, company integration, and structural demand, Rietveld believes XRP might realistically hit $10 to $20 earlier than 2027 — and whether or not individuals agree or not, his reasoning has captured loads of consideration already.

The put up XRP’s Daring New Outlook – Right here is Why a $10 to $20 Goal Abruptly Doesn’t Sound So Wild. first appeared on BlockNews.