Bitcoin climbed to a three-week excessive on Tuesday earlier than slipping again, a transfer that has merchants and analysts watching carefully.

Associated Studying

In keeping with TradingView knowledge, Bitcoin worth topped out at $94,600 late within the session — its highest stage since November 25 — then eased to about $92,450 on the time of reporting.

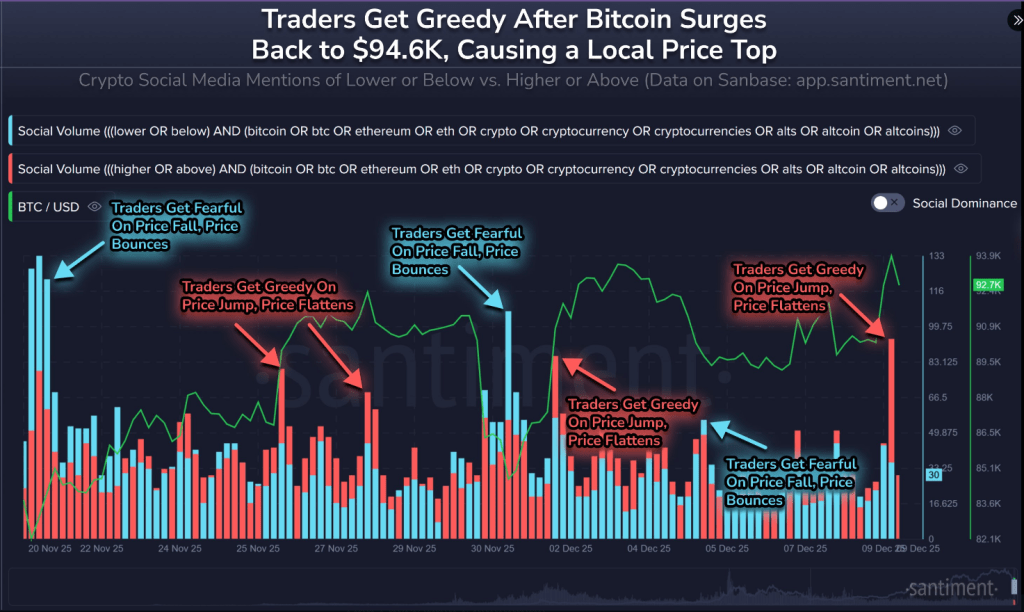

Santiment, a blockchain analytics agency, stated social chatter calling for “larger” and “above” exploded throughout the spike, however market motion remained uneven.

Bitcoin: Dealer Frenzy And Skepticism

Studies have disclosed that the surge drew heavy retail consideration and a flurry of social-media posts urging extra shopping for.

Some market watchers questioned how natural the rise was. A well known long-term investor utilizing the deal with “NoLimit” advised his 53,000 X followers that the $94,000 push seemed engineered: massive buys packed into a couple of minutes, skinny order books, then little follow-through.

🤑 Bitcoin loved a a lot wanted rebound again to $94.6K right now, reinvigorating merchants, inflicting them to FOMO again in and count on larger costs. In keeping with our social knowledge scraping X, Reddit, Telegram, & different knowledge, requires “larger” & “above” exploded.

🟦 Excessive bars point out… pic.twitter.com/o3U3yWkwkk

— Santiment (@santimentfeed) December 9, 2025

That sample, he argued, is how bigger merchants can create short-term concern of lacking out to allow them to promote into energy.

Santiment additionally highlighted a behavioral twist: smaller merchants seem to pile in after spikes, usually leaving them on the flawed aspect of strikes.

Volatility adopted the excessive, as costs pulled again by a pair thousand {dollars} inside hours. Alternate order depth and timing of enormous blocks, analysts say, matter so much when liquidity is shallow.

Fed Choice Might Shift Momentum

The US central financial institution assembly this week is a key wildcard. Market pricing on CME Group futures confirmed an 88% likelihood of a 0.25% fee reduce, which many merchants suppose helped gas the rally. But some analysts warned that any signal of hesitation about future cuts might dampen threat urge for food.

Past US coverage, subsequent week’s potential Financial institution of Japan fee motion is being watched as a result of a tighter stance there might raise yields and pull capital again to Japan, tightening world liquidity. That form of circulation can strain dangerous property throughout markets.

Liquidity, Establishments And The Greater Image

In the meantime, long-term holders pared again provide after a 36% correction from the all-time excessive, and a few addresses now maintain ranges seen in March.

Jessica Gonzales, an analyst cited in studies, stated M2 cash provide sits at about $22.3 trillion and stablecoin reserves stay elevated, suggesting there’s capital round however not essentially evenly distributed in markets.

Institutional strikes additionally characteristic: massive corporations akin to BlackRock and Technique have expanded crypto publicity, which might add a steadier purchaser base — or just shift the place threat sits.

Associated Studying

What Merchants Ought to Watch

Quick-term merchants ought to monitor order-book depth, massive commerce clusters, and the way worth reacts to any Fed wording about future cuts.

The following 25 days have been flagged as particularly vital by a number of observers as a result of liquidity swings and regulatory updates might flip the narrative quick. If a real broad-based bid varieties, costs might transfer shortly. If the Fed alerts warning, the alternative might occur.

Featured picture from Gemini, chart from TradingView