The prospect of a “Trump Fed takeover” is quickly changing into a central macro theme for 2026, with some merchants arguing that markets nonetheless underestimate how radical the shift may very well be for world liquidity – and by extension for crypto.

Macro commentator plur daddy (@plur_daddy) describes it bluntly by way of X: “The Trump Fed takeover being underpriced is my main theme going into 2026 (therefore my gold wager). It is a momentous shift: the larger and extra convex the catalyst, the harder it’s for markets to cost it in correctly.”

Former Fed dealer Joseph Wang often known as “Fed Man” echoes the priority from contained in the plumbing, warning: “The market underestimates the chance of a Trump Fed. The Administration is exhibiting resourcefulness and dedication for decrease charges. That might set off the blow off high in equities, the place implied vol exhibits hypothesis nonetheless has room to run.”

The Trump Fed Takeover Isn’t Value In

That dedication is colliding with a bond market that seems to be pushing again by way of time period premium. Plur highlights the unfold between the 12-month T-bill and the 10-year Treasury as a clear gauge of that stress. He notes that the unfold “peaked proper earlier than inauguration on the generic ‘Trump will run it sizzling’ viewpoint,” then “bought crushed decrease as DOGE and Tariffs bought priced in.” It bottomed close to the tariff lows and “is now again to the highs,” a sample he reads as term-premium growth as “a type of protest to [Kevin] Hassett,” Trump’s presumed Fed decide.

Associated Studying

Towards that backdrop, the administration nonetheless has highly effective instruments to compress time period premium with out formally saying quantitative easing. Plur identifies three levers. First, de-regulating banks so they’re allowed – in follow, pressured – to carry extra Treasuries, boosting structural demand for presidency paper.

Second, lowering the Treasury’s weighted-average maturity by shifting issuance “to payments over longer dated notes,” which cuts the length the market has to soak up. Third, particularly for mortgages, “lever up the GSEs to purchase MBS,” narrowing mortgage spreads and transmitting simpler coverage to the housing market even when the coverage price strikes extra slowly. He argues that “all of those are fairly bullish for danger general however will take time to play out.”

For now, the surroundings stays awkward for directional danger bets, together with crypto. “Within the meantime, it has been a uneven and troublesome market, throughout the board. Fairness indices have grinded increased however the underlying rotations have been difficult to navigate. QT ended however liquidity continues to be comparatively skinny, and the truth that we’re going into yr finish doesn’t assist. Higher instances will come.”

The bullish pivot in his framework arrives with the calendar. “Within the new yr, fiscal lodging will re-expand on the implementation of OBBBA (+$10–15bn/mo). In the meantime now we have sell-side macro groups calling for $20–45bn/mo in T-bill repurchasing by the Fed, as quickly as Jan 1.”

Associated Studying

This combine would instantly ease pressures seen in funding markets: “This may go a great distance in the direction of easing the present liquidity points (see the SOFR–IORB unfold chart beneath). This isn’t traditional QE in that there’s little or no length being absorbed from the non-public sector, and primarily has the impact of increasing financial institution reserves. That is nonetheless bullish as a result of financial institution reserves are tight on the time, which is tied to the repo liquidity points.”

Will The Crypto Market Rise Once more?

On that foundation, Plur expects the macro backdrop in 2026 to look “higher than H2 ’25 has been, maybe extra on par with components of 2024.” His expression of the commerce is evident: “This ought to be sufficient for robust efficiency on gold given the Fed takeover angle, and continued melt-up in equities and choose commodities.”

For Bitcoin and the broader crypto market, nonetheless, his stance is notably extra cautious. “For BTC it’s harder to say. My base case continues to be a irritating interval of chop and re-accumulation.” Improved liquidity “ought to be favorable for BTC,” however he questions whether or not there might be “a cloth shift within the provide/demand imbalances now we have been seeing,” concluding: “I’ll hold watching it for now.”

In different phrases, the Trump Fed commerce is already driving high-convexity bets in gold, equities and commodities. Crypto stands to learn not directly from simpler reserves and decrease time period premium, however on this framework, the important thing constraint is now not simply macro liquidity – it’s whether or not contemporary demand is powerful sufficient to fulfill an more and more inelastic provide within the crypto market.

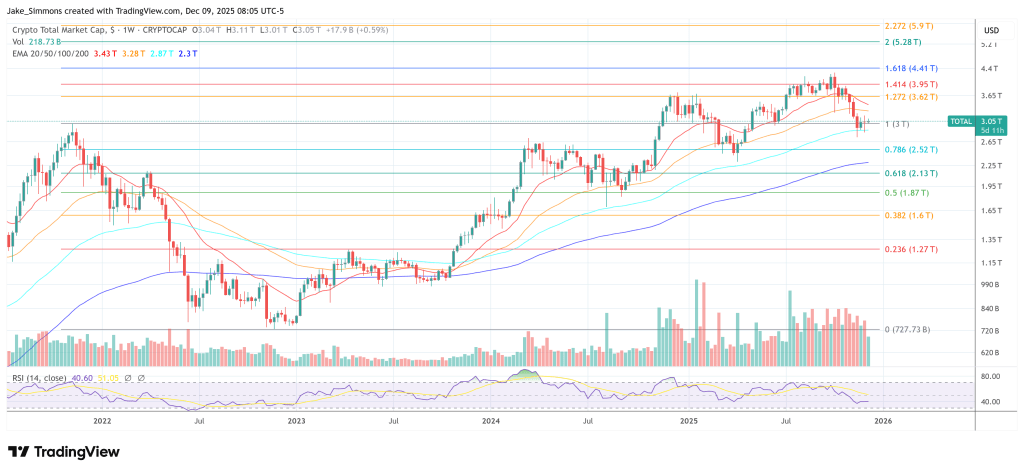

At press time, the whole crypto market cap stood at $3.05 trillion.

Featured picture created with DALL.E, chart from TradingView.com