On-chain knowledge reveals the Bitcoin Realized Cap Development indicator has continued to say no just lately, an indication new capital inflows lack momentum.

Bitcoin Realized Cap Development Has Been Heading Down Lately

As defined by CryptoQuant group analyst Maartunn in a brand new publish on X, the Bitcoin Realized Cap Development has been trending decrease just lately. The “Realized Cap” is an on-chain capitalization mannequin for BTC that calculates its complete worth by assuming the worth of every particular person token is the same as the spot worth at which it was final transacted on the blockchain.

That is in contrast to the standard market cap, which merely calculates the overall valuation of the asset by multiplying the variety of tokens in circulation with the present spot worth, contemplating the most recent worth of the cryptocurrency to be the one worth for all cash.

In brief, what the Realized Cap represents is the quantity of capital that the Bitcoin buyers as an entire used to buy the asset’s provide. However, the market cap is the worth that the buyers are carrying within the current.

The Realized Cap itself isn’t the indicator of curiosity within the present dialogue, however relatively the Realized Cap Development, measuring the 365-day modifications occurring within the Realized Cap.

Adjustments within the indicator naturally replicate the quantity of capital exiting or coming into the cryptocurrency. In different phrases, the Realized Cap Development comprises details about the asset’s netflow.

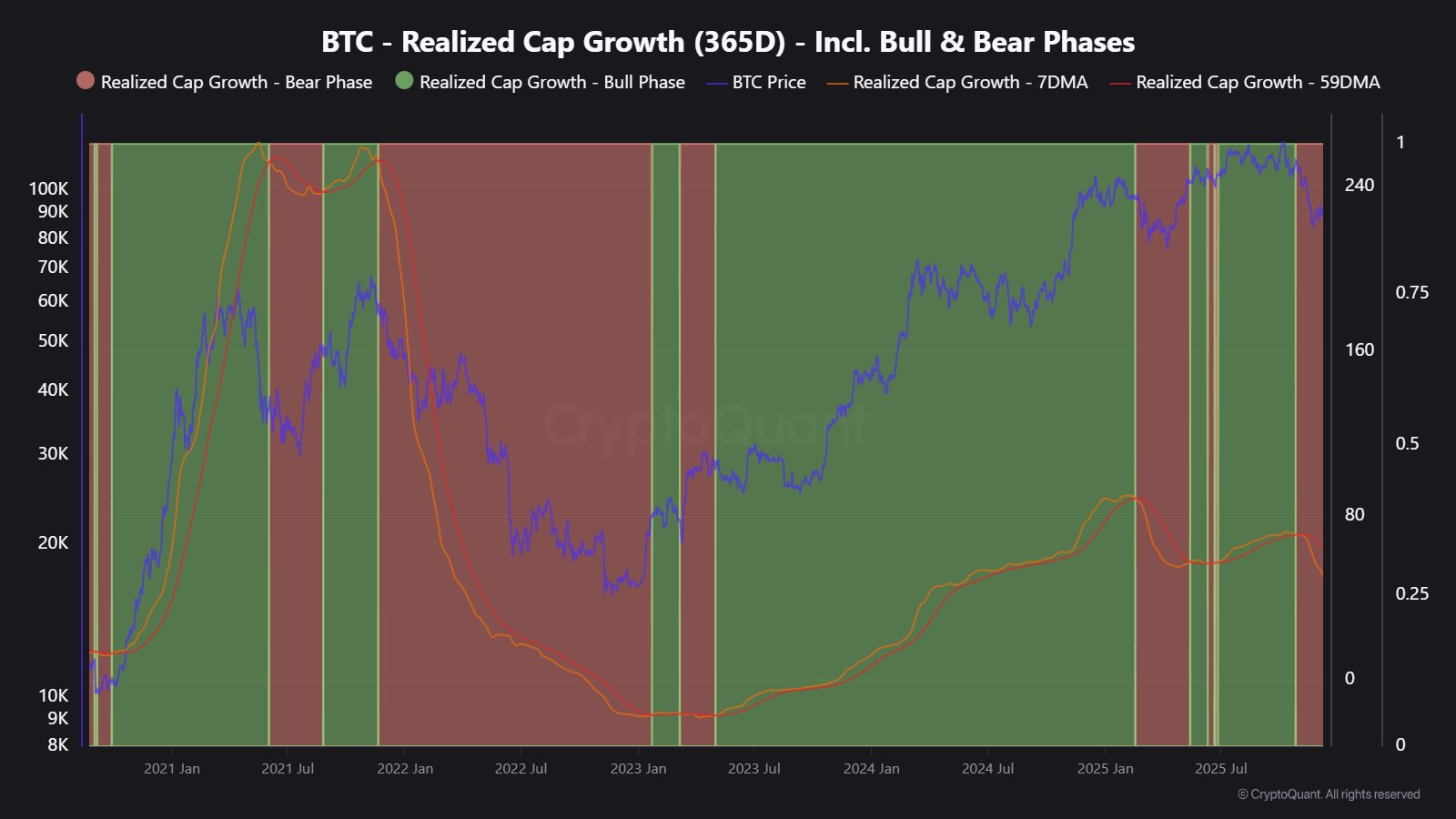

Now, right here is the chart shared by Maartunn that reveals the pattern within the 7-day and 59-day shifting averages (MAs) of the Bitcoin Realized Cap Development over the previous couple of years:

As displayed within the above graph, the Bitcoin Realized Cap Development has witnessed each its 7-day and 59-day MAs reverse down just lately, with the previous line crossing beneath the latter.

The pattern signifies that progress within the Realized Cap has been slowing down throughout the current market downturn. “This means Bitcoin is missing momentum from new value foundation inflows,” famous the analyst.

With the 7-day MA falling beneath the 59-day MA, the indicator is now flagging the present market to be in a “bear section.” The final time this sign maintained for an prolonged period was alongside BTC’s decline over the primary few months of 2025. It now stays to be seen how lengthy momentum from new capital inflows will keep weak for Bitcoin this time round.

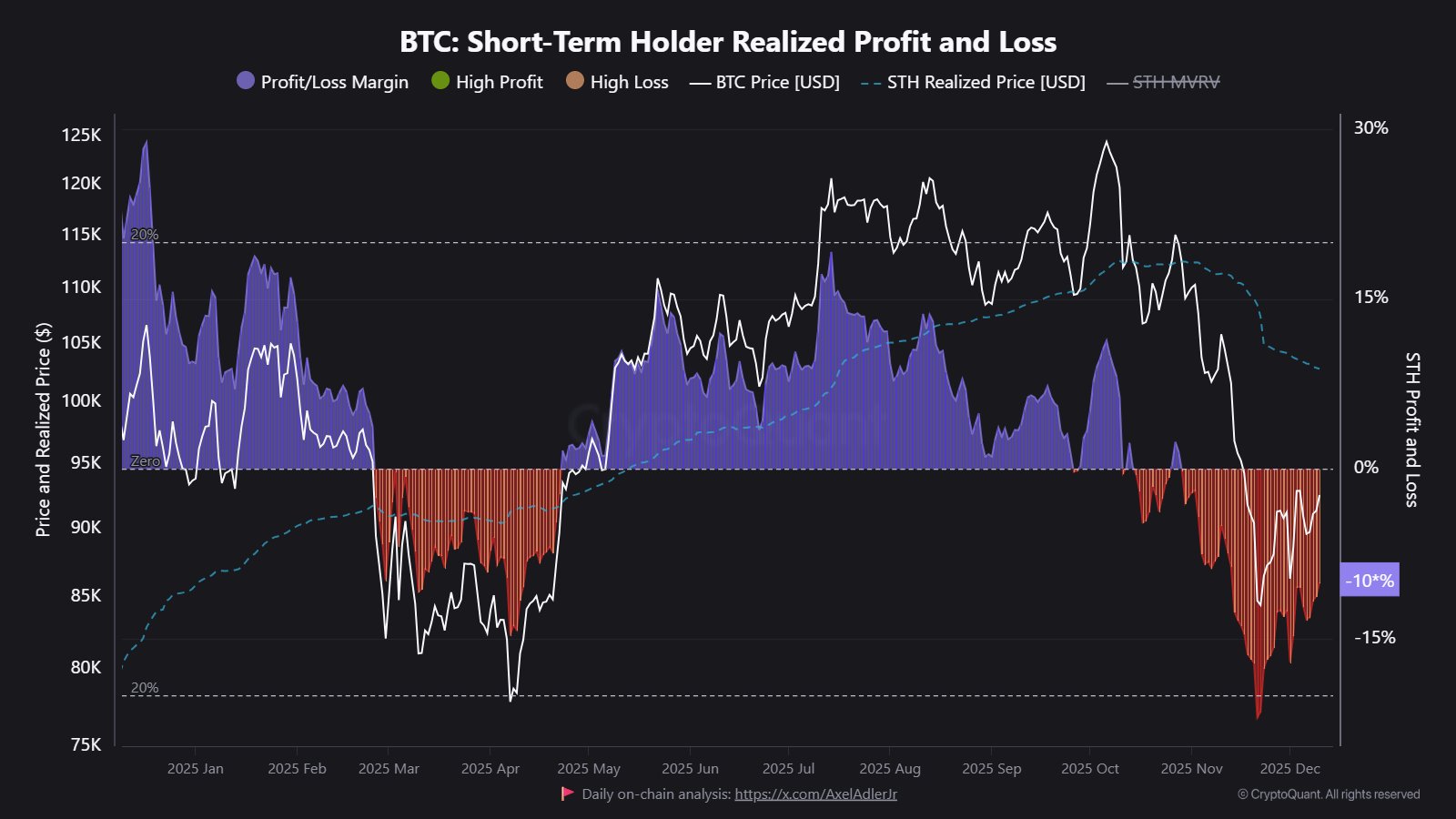

In another information, the Bitcoin short-term holders are nonetheless beneath a notable quantity of stress, as CryptoQuant writer IT Tech has identified in an X publish.

Quick-term holders (STHs) are outlined because the Bitcoin consumers who bought into the market throughout the previous 155 days. Regardless of the rebound BTC has seen since its November low, STHs are nonetheless in a lack of 10%.

BTC Worth

On the time of writing, Bitcoin is floating round $92,400, down 1.5% during the last 24 hours.