Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth jumped 2.7% up to now 24 hours to commerce at $92,880 as of two:32 a.m. EST on buying and selling quantity that rose 17% to $52.7 billion.

The BTC worth pump comes because the crypto area expects the Federal Reserve Financial institution to chop rates of interest by 25 foundation factors right now following its two-day assembly.

Markets are pricing in an 87.6% chance of a fee minimize, in response to the CME Group FedWatch instrument.

However buyers additionally anticipate that policymakers will sign that additional easing just isn’t assured, given still-elevated inflation ranges and inner divisions inside the Federal Open Market Committee (FOMC).

Feedback from Fed Chair Jerome Powell will thus be key in shaping market sentiment.

GM folks,

Massive day forward. The Fed’s rate-cut

resolution drops right now, and the market is already virtually totally satisfied, with practically 90% odds pointing towards a minimize.However the actual query is: is that this already priced in, or does volatility kick in as soon as Powell speaks?

As we speak will… pic.twitter.com/meGpFW6igl

— Crypto Ideology ✍🏻 (@crypto_ideology) December 10, 2025

A hawkish tone from Powell might strengthen the US greenback and push Treasury yields larger, decreasing urge for food for non-yielding threat belongings like BTC.

With Bitcoin’s worth surging, US spot BTC ETFs (exchange-traded funds) recorded inflows of $151.9 million on Tuesday, in response to Coinglass.

Bitcoin Worth Set For A Sustained Breakout

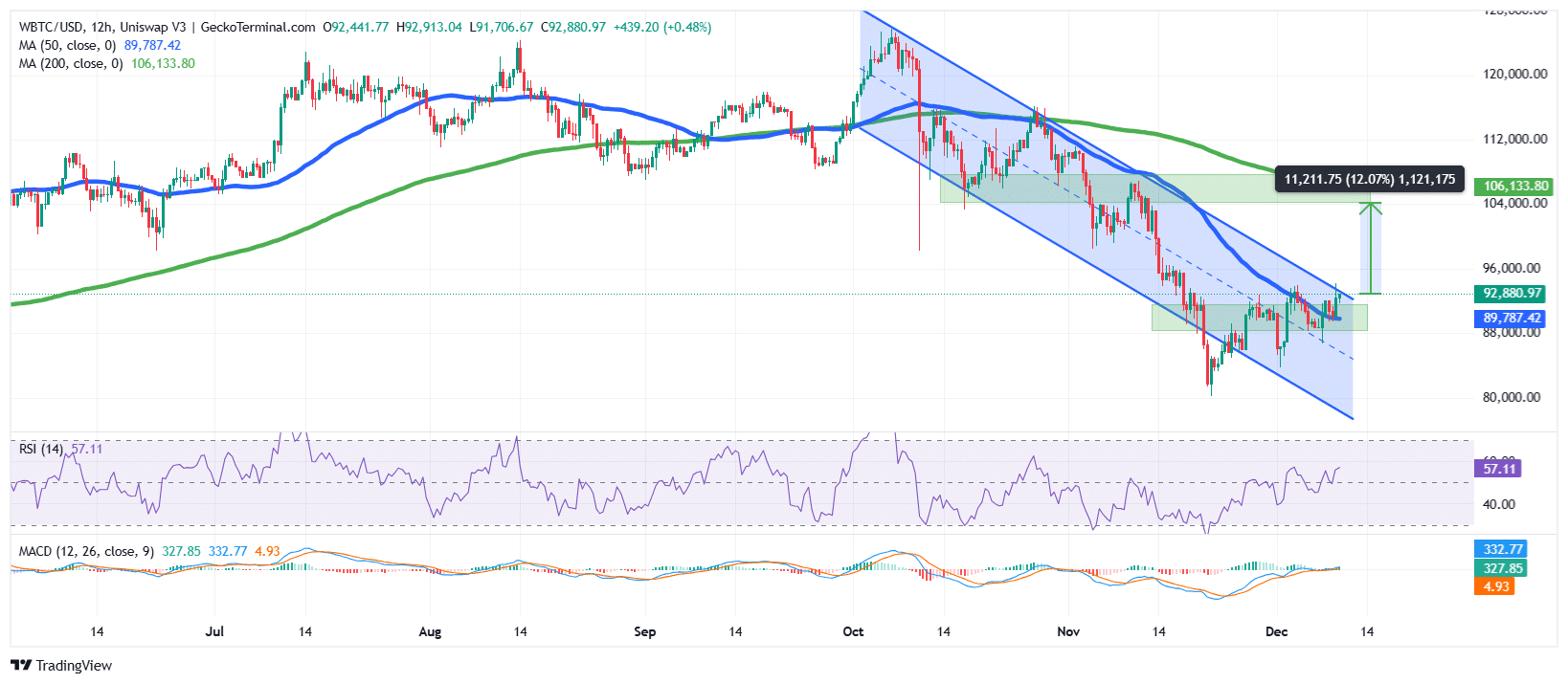

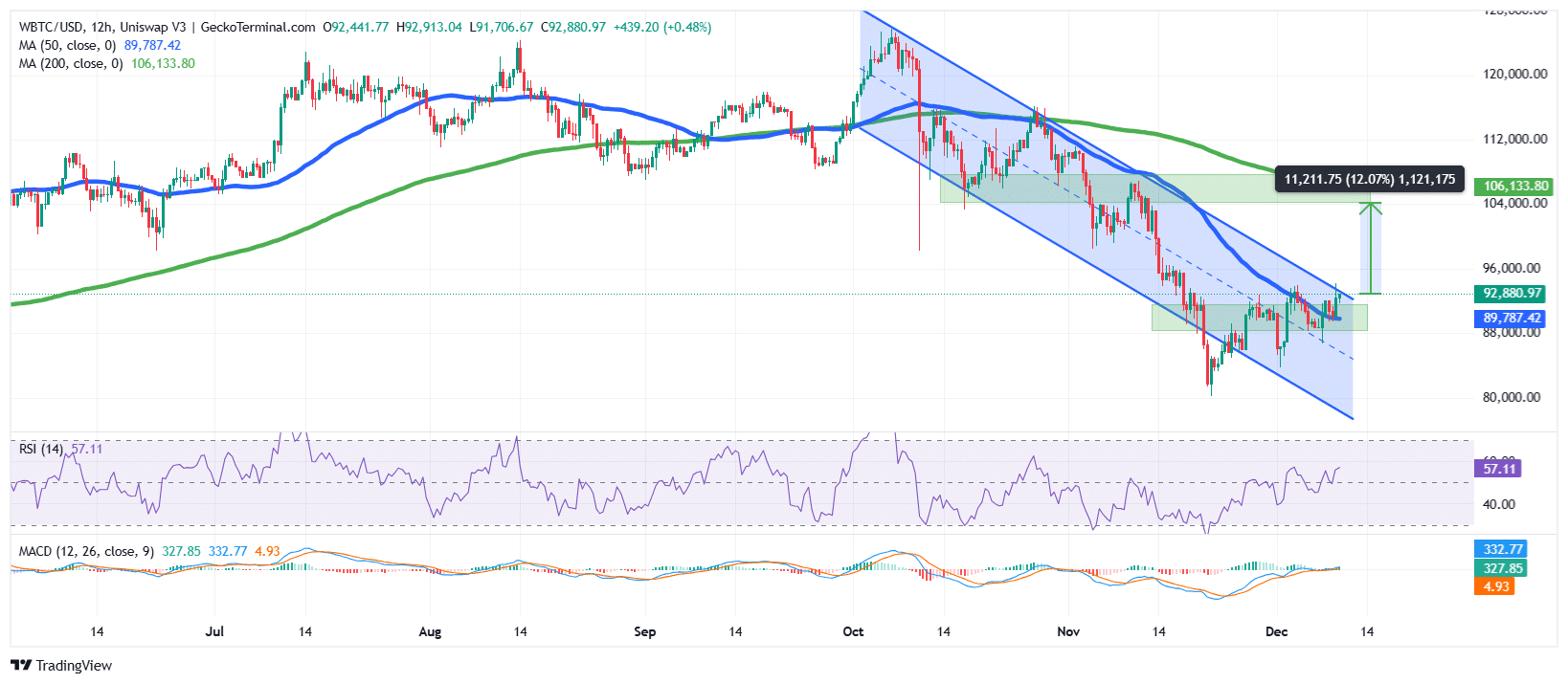

After hitting a neighborhood excessive of round $126,000 in October, the BTC worth has been on a sustained downtrend inside a falling channel sample, which is a sign that bears have been in management.

The sustained downtrend allowed the bears to push Bitcoin beneath the decrease boundary round $82,000 earlier than it recovered and consolidated inside the $88,000 zone.

The $88,000 zone has stored BTC buying and selling just under the $94,000 space, which now acts as resistance if Bitcoin have been to maintain an uptrend.

BTC is now buying and selling inside the higher boundary of the falling channel and is poised for a breakout, because it has crossed above the 50-day Easy Shifting Common (SMA) at $89,787. The 200-day SMA nonetheless trades above the Bitcoin worth on the 12-hour chart, inserting it because the long-term resistance space ($106,133).

In the meantime, consumers could also be regaining some footing, because the Relative Energy Index (RSI) has recovered above the 50-midline stage.

Furthermore, the Shifting Common Convergence Divergence (MACD) indicator can also be displaying indicators of a restoration, with the blue MACD line crossing above the orange sign line. The inexperienced bars on the histogram are additionally surging above the zero line, which might point out that BTC’s worth could also be regaining momentum.

BTC Worth Set To Surge over 12%

Based on the BTC/USD chart evaluation, the BTC worth may very well be gearing up for a restoration above the falling channel.

If the present uptrend continues, Bitcoin’s worth might surge 12% to focus on the $104,119 resistance space.

Nevertheless, on the draw back, if BTC fails to breach the $94,000 barrier once more, the following assist stage may very well be at $84,500, coinciding with the decrease boundary of the falling channel.

Based on Ali Martinez, a outstanding crypto analyst on X, FOMC assembly occurs often set off Bitcoin corrections.

Out of the seven FOMC conferences held thus far this yr, six have led to Bitcoin $BTC corrections, with just one producing a short-term rally: https://t.co/02PgIMwa5z pic.twitter.com/79WtggnckT

— Ali (@ali_charts) December 10, 2025

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection