Knowledge reveals Bitcoin treasury firms have seen an explosive progress trajectory since 2023, gaining relevance as an necessary pillar of the market.

Public & Personal Firms Now Maintain Extra Than A Million Bitcoin

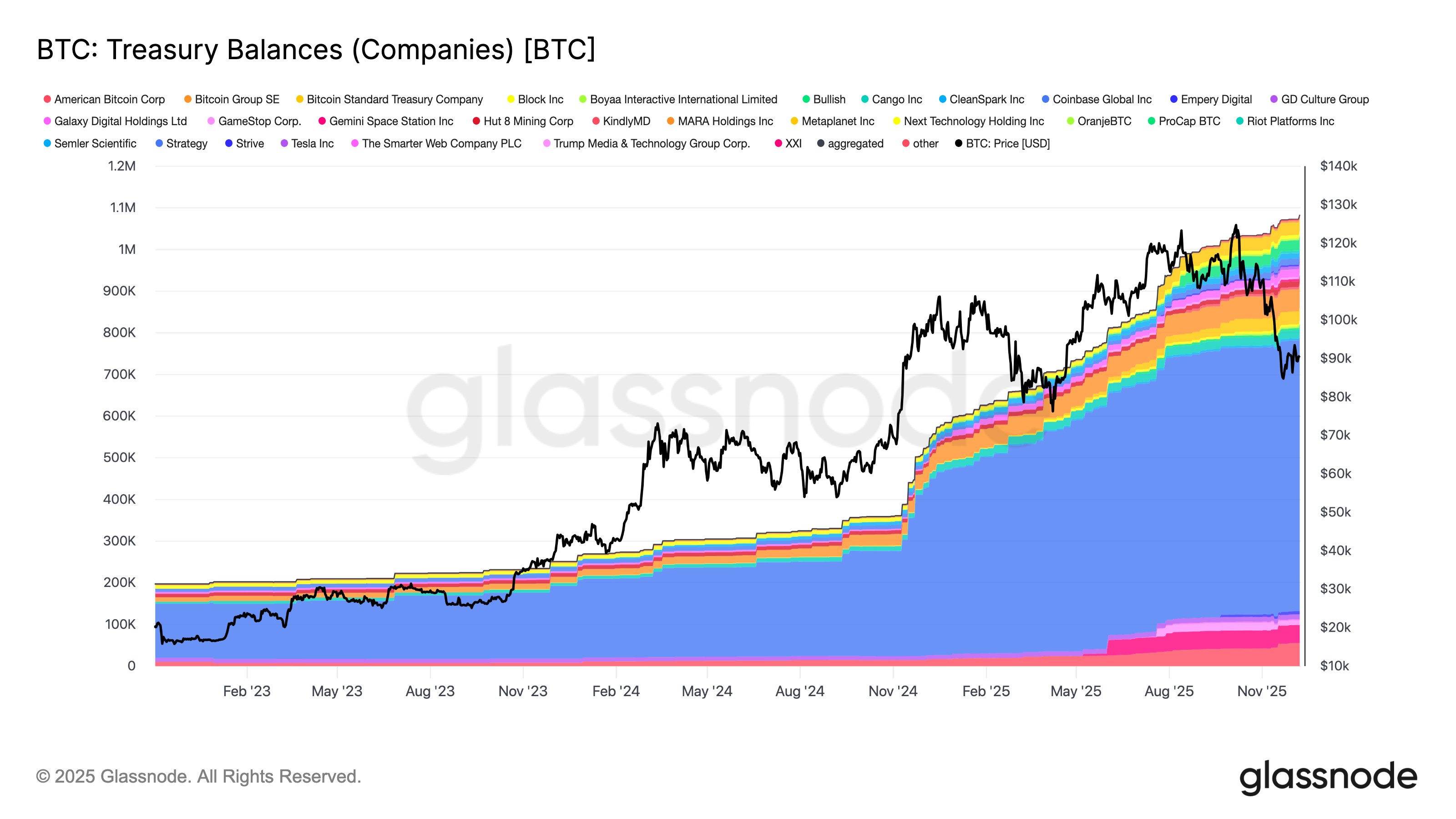

In a brand new publish on X, on-chain analytics agency Glassnode has talked concerning the development within the Bitcoin treasuries held by private and non-private firms. Under is the chart shared by Glassnode that reveals adjustments in each the holdings of the varied firms in addition to their mixed stability.

Appears to be like like the expansion in BTC treasuries has been notably sharp throughout the previous yr | Supply: Glassnode on X

As is seen within the graph, Bitcoin treasuries held by firms noticed gradual, however regular progress throughout 2023 and most of 2024, however in late 2024, the expansion turned way more speedy.

This sharp trajectory continued into 2025 and thus far, with the yr’s finish approaching, the uptrend hasn’t light. This could counsel that corporates have been accumulating BTC at a big tempo for a yr now.

In January 2023, the scale of the Bitcoin holdings that personal and public companies held stood at 197,000 BTC. At this time, that determine has grown to 1.08 million BTC, implying a large bounce of about 448%.

At this time, there are about 19.96 million tokens in circulation, so greater than 5.4% of the cryptocurrency’s provide is sitting within the treasuries of private and non-private firms. “Company stability sheets have gotten an more and more important pillar of demand for BTC,” famous the analytics agency.

A significant pressure behind the rise in Bitcoin company holdings is of course Technique (previously MicroStrategy). The Michael Saylor-led agency has been an everyday presence available in the market for a while now, collaborating in shopping for nearly each week and making no gross sales since December 2022.

Technique at present owns about 660,624 BTC, which implies that the treasury firm alone accounts for over 61% of all BTC holdings hooked up to private and non-private companies.

Whereas Technique has been a giant issue behind the surge in company holdings, it hasn’t been the one one. 2025 has seen the rise of treasuries like Metaplanet, which have additionally contributed to progress in BTC treasuries.

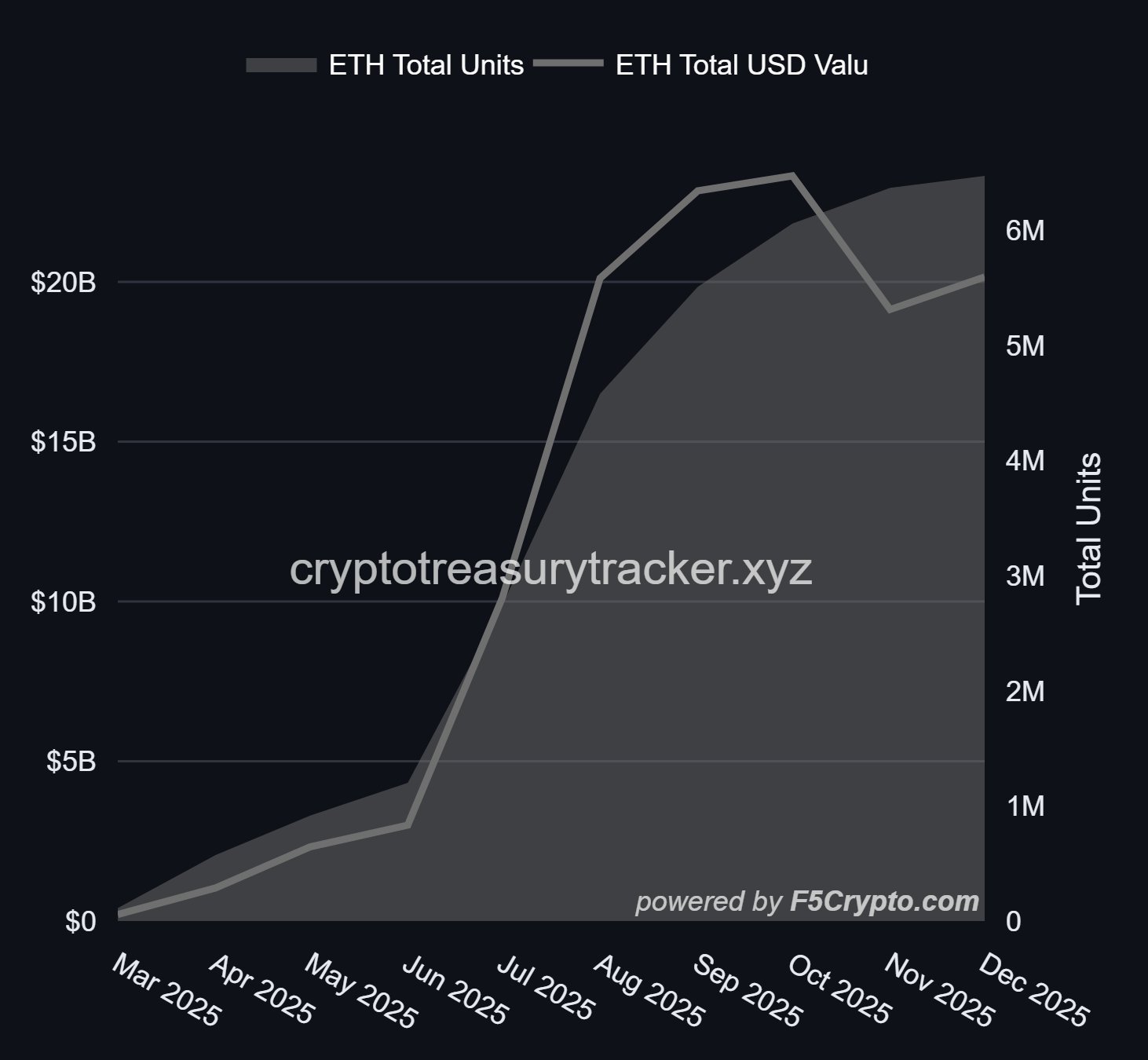

The yr has additionally witnessed a treasury motion associated to altcoins, with each Ethereum and Solana seeing a big quantity of accumulation. ETH treasuries went by some sharp progress in mid-2025, however throughout the current part of value decline, shopping for has slowed down.

That stated, it hasn’t hit a whole pause, as institutional DeFi options supplier Sentora has identified in an X publish that Ethereum treasuries added a big quantity throughout November.

The development in ETH treasuries over 2025 | Supply: Sentora on X

As displayed within the above chart, Ethereum treasuries added 309,000 ETH throughout November, and thus far in December, they’ve amassed one other 100,000 ETH.

BTC Value

Bitcoin surged to $94,500 on Tuesday, however the cryptocurrency has since confronted a drawdown because it’s now again at $92,200.

The value of the coin appears to have retraced throughout the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, cryptotreasurytracker.xyz, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.