- BlackRock moved 2,196 BTC value over $200M to Coinbase Prime as a part of ongoing fund rebalancing.

- IBIT confronted $135M in outflows however nonetheless leads all spot BTC ETFs with $60B+ in web inflows.

- U.S. Bitcoin ETFs turned inexperienced total, boosted by robust demand for Constancy’s FBTC.

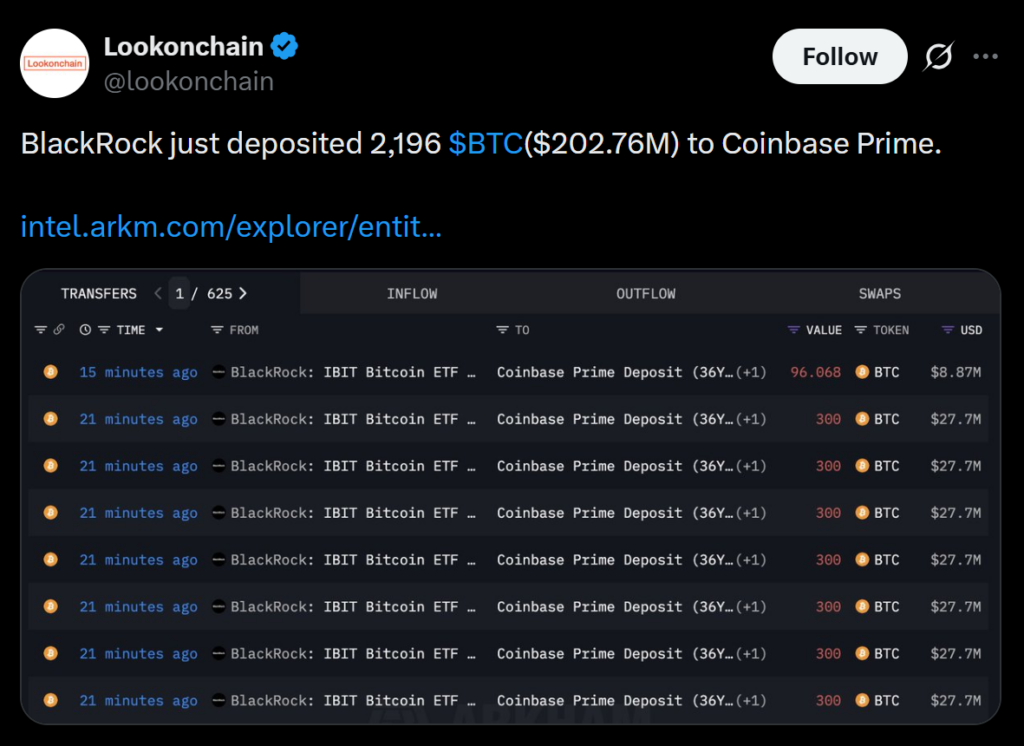

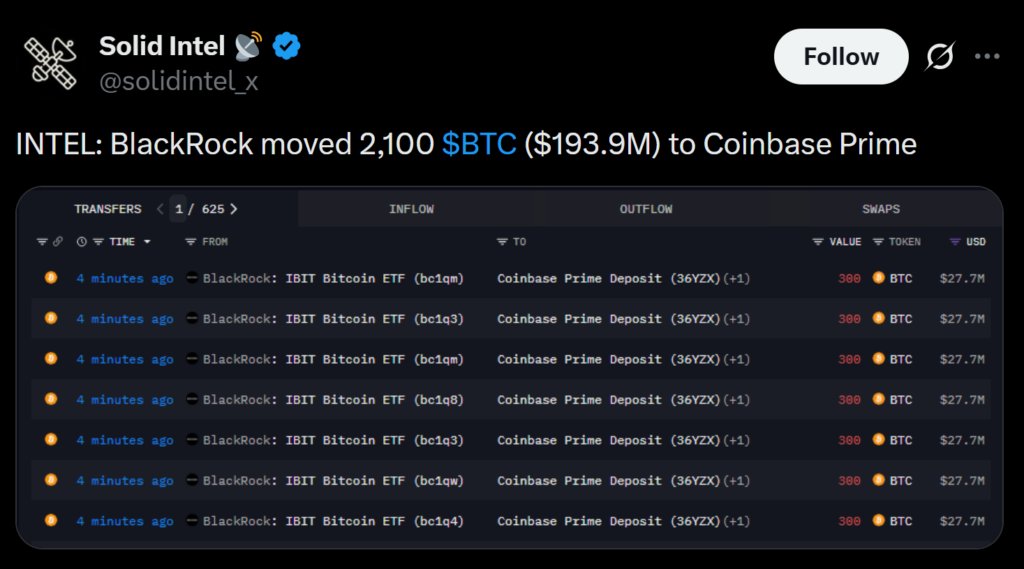

BlackRock transferred 2,196 Bitcoin — valued at greater than $200 million — to Coinbase Prime this morning, in accordance with new information from Arkham Intelligence. The shift displays the agency’s ongoing rebalancing because it manages liquidity and demand throughout its crypto funding merchandise. These transfers have change into extra frequent as institutional flows into digital property fluctuate week by week.

IBIT Sees Withdrawals however Nonetheless Dominates the ETF Panorama

The agency’s flagship Bitcoin ETF, IBIT, registered round $135 million in web outflows yesterday, marking the one U.S. spot Bitcoin ETF to see withdrawals through the session. Regardless of the dip, IBIT stays the business chief, pulling in additional than $60 billion in web inflows since debuting earlier this 12 months. Analysts say occasional outflows are anticipated at this scale and symbolize routine market rotation slightly than structural weak spot.

U.S. Spot Bitcoin ETFs Flip Inexperienced on Constancy-Led Inflows

Whereas BlackRock confronted outflows, the broader ETF market turned optimistic. U.S. spot Bitcoin ETFs collectively completed the day within the inexperienced due to a powerful surge from Constancy’s FBTC, which helped offset withdrawals from IBIT. This implies that institutional urge for food stays wholesome whilst capital shifts between issuers.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.