- Polymarket exhibits 98% odds the Fed will minimize charges by 25 bps on Wednesday.

- Up to date 2025 SEP projections might shift expectations for subsequent yr’s fee path.

- Merchants are looking ahead to indicators of rising disagreement throughout the FOMC.

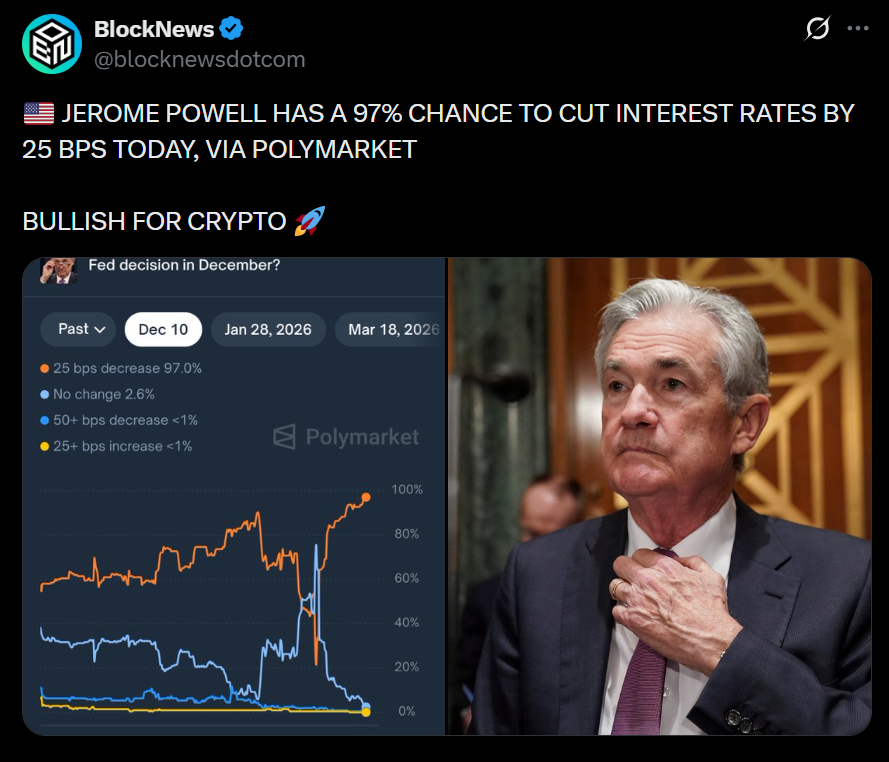

The Federal Reserve’s closing assembly of the yr kicked off Tuesday morning, with the central financial institution set to announce its final financial coverage choice of 2025 on Wednesday at 2:00 p.m. ET. Merchants overwhelmingly anticipate a 0.25% interest-rate minimize — the Fed’s third of the yr — with prediction market Polymarket pricing in a 97% likelihood of a minimize. This stage of confidence marks one of many strongest consensus readings of the yr throughout macro markets.

All Eyes on the Fed’s Up to date 2025 Abstract of Financial Projections

Alongside the coverage choice, the Fed will launch its up to date Abstract of Financial Projections (SEP), outlining officers’ expectations for GDP development, inflation, unemployment, and the interest-rate path by way of 2026 and past. The final SEP, revealed in September, projected only one fee minimize for 2026 after three cuts in 2025. Any upward or downward revisions might considerably reshape market expectations for subsequent yr’s liquidity surroundings.

Inner Divisions on the Fed May Resurface

One other key focus will probably be whether or not dissent resurfaces throughout the FOMC. The October assembly revealed two members voted in opposition to the earlier 25 bps minimize, signaling rising inner disagreement over the tempo of easing. Markets will probably be watching whether or not the break up widens — or whether or not Fed management presents a extra unified stance heading into 2026.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.