An experiment in Prague would possibly find yourself mattering extra for Bitcoin than the same old ETF influx chart.

Talking on the “Crypto In America” present on 10 December, Coinbase Head of Institutional John D’Agostino highlighted that the Czech Nationwide Financial institution has begun testing Bitcoin in its nationwide treasury and for funds, and argued that this kind of transfer by a Eurozone central financial institution is prone to unfold.

Czech Bitcoin Pilot Might Unfold Throughout Eurozone

“The Czech nationwide financial institution selected very properly of their service suppliers,” he stated, including that the central financial institution is “placing Bitcoin on their nationwide treasury and they’re experimenting with and studying in actual time utilizing Bitcoin for funds.” The pilot is small — “1,000,000 {dollars} of Bitcoin” — however for D’Agostino the sign will not be within the measurement, it’s in who’s doing it and why.

He drew a deliberate distinction with earlier sovereign experiments: “No disrespect to El Salvador… this wasn’t a ‘I wish to shake up my financial system as a result of I’m heading within the fallacious path’… That is, we’re a secure Euro zone nation… we don’t have to do that.”

Associated Studying

As a substitute, the Czech transfer adopted “all of the bells and whistles” of a conventional course of: RFPs, vendor choice, formal adoption into coverage. That, he urged, is strictly what makes it harmful — for the established order. “That kind of factor is contagious and I can see extra Euro zone [countries] following swimsuit very very shortly,” he stated.

The remark didn’t are available in isolation. All through the interview, D’Agostino hammered a constant thesis: institutional adoption has at all times been much less about excellent regulatory readability and extra about liquidity, credible market construction and having the “proper” varieties of members within the pool.

“I’ve at all times been a little bit of a skeptic on the argument that the rationale establishments haven’t invested… is regulatory readability,” he stated. Readability is “high three,” however in his rating it comes after liquidity and sits alongside alpha potential. If two of the three are current, “folks will discover a approach.”

Bitcoin’s spot ETFs, in his view, have already created one thing the asset beforehand lacked: a cohort of structurally compelled members. “The ETFs, in my opinion, are type of the surrogate business customers of Bitcoin,” he argued. They “must rebalance… it’s codified into their enterprise mannequin,” appearing as a stabilizing drive much like industrial customers in commodities markets.

Associated Studying

A Eurozone central financial institution experimenting with Bitcoin on its stability sheet pushes that logic one step additional up the meals chain. D’Agostino didn’t spell out a grand idea of “Bitcoin as reserve asset” — he was cautious, nearly lawyerly, about what he might say — however the implication will not be terribly refined: when a central financial institution with entry to regular EU funding “doesn’t have to do that” and nonetheless chooses to, it normalizes Bitcoin inside essentially the most conservative layer of the financial system.

That sits alongside a broader reputational restore job he thinks the trade nonetheless has to complete. Crypto, he argued, has had no extra structural failures than different markets — he pointed to the London Metallic Alternate’s cancellation of billions in nickel trades as an under-discussed parallel to FTX — however “we are inclined to push the jokers to positions of prominence,” whereas TradFi “does a very good job of hiding their jokers.”

Between cleaner narratives, ETF-driven “surrogate” demand and now a Eurozone central financial institution quietly wiring 1,000,000 {dollars} into Bitcoin, D’Agostino’s message was that the institutional story is much less a few sudden wave and extra about erosion. “There’s no wave,” he stated earlier within the dialog. “It’s this gradual erosion versus this crashing wave.”

If he’s proper in regards to the Czech experiment being contagious, that erosion could quickly be occurring from the within of the Euro system as properly, not simply from asset managers in New York.

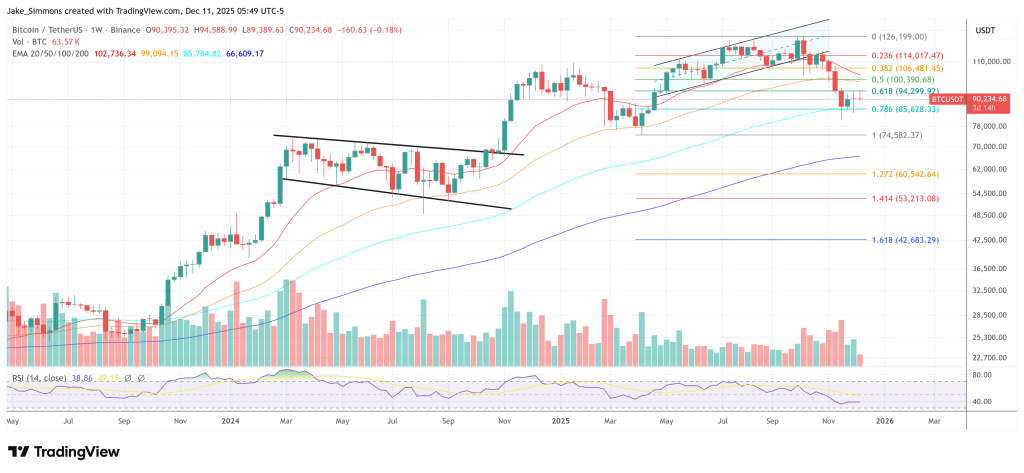

At press time, BTC traded at $90,234.

Featured picture created with DALL.E, chart from TradingView.com