Markets are nonetheless digesting the speed lower, and as a substitute of a clear development, we get a session the place every story immediately feeds into positioning. Nothing breaks, nothing rallies, however merchants deal with each datapoint as a sign as a result of liquidity is skinny and route is unclear.

TL;DR

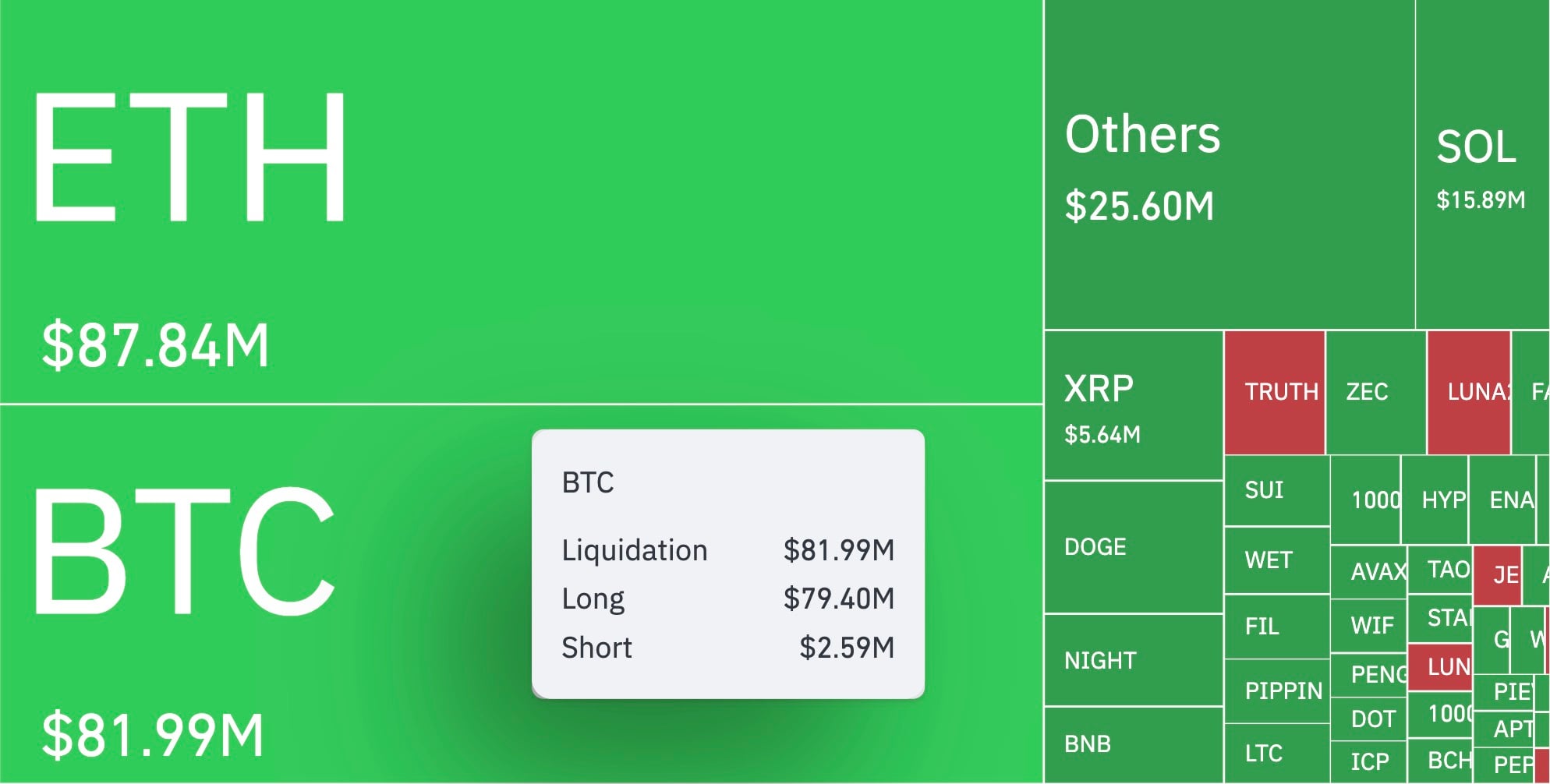

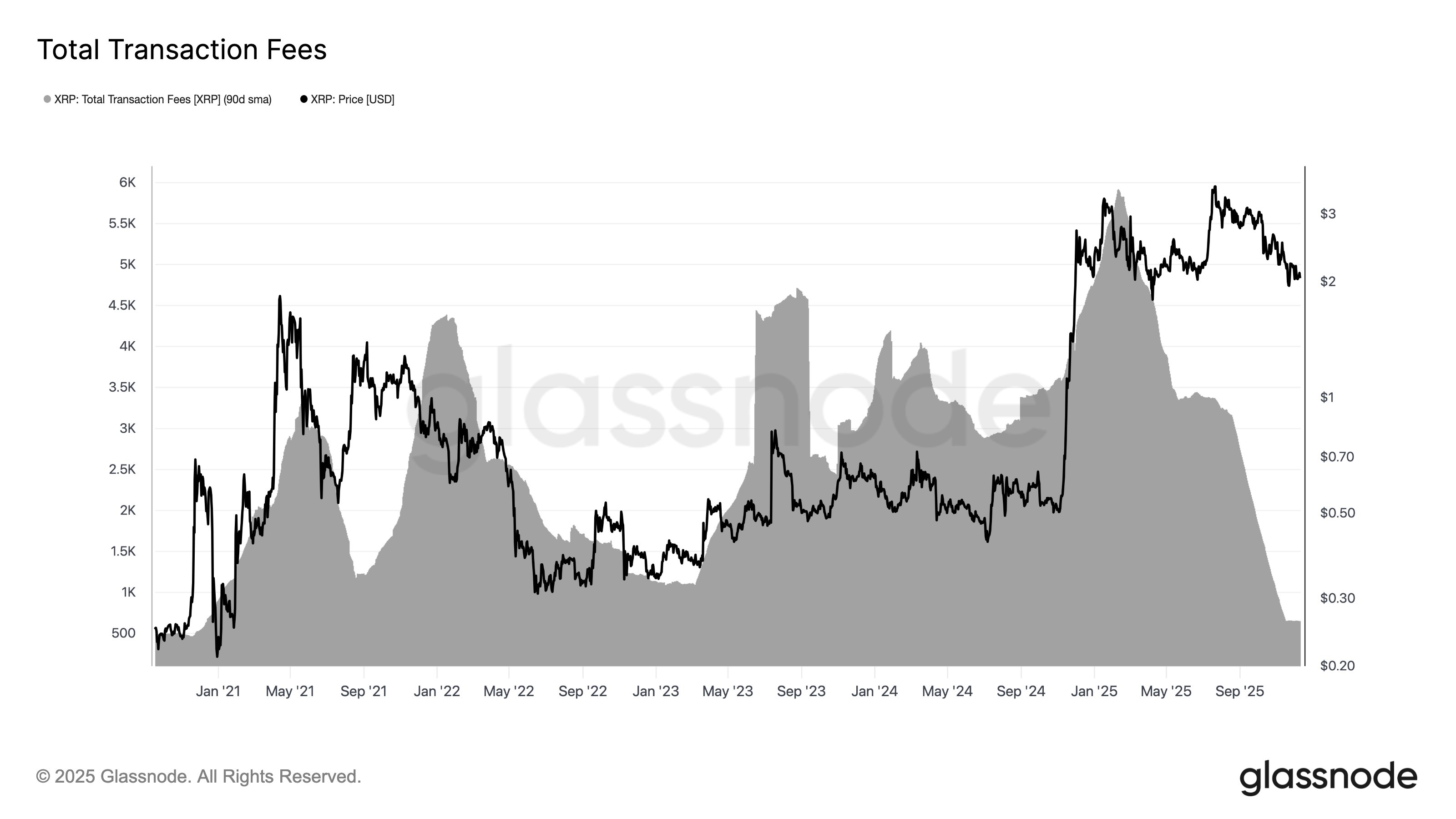

- XRP payment income falls 89% to the weakest stage in 5 years.

- NYSE unveils a Satoshi Nakamoto statue throughout XXI’s buying and selling debut.

- Bitcoin posts a 4,100% liquidation imbalance, with lengthy merchants taking the hit.

XRP eyes brutal 89% drop in charges

In keeping with Glassnode’s knowledge, XRPL payment exercise has skilled its largest drop since 2020. The 90-day common has dropped from round 5,900 XRP per day in February to solely 650 XRP as of in the present day. This almost straight-line unwind leaves the community at its quietest level since December 2020.

The timeline matches the chart ultimately. XRP tried to keep up the $3 threshold in August and September however didn’t generate demand in October. It has since fallen into the $2.00-$2.05 vary, exhibiting worth motion that seems sluggish somewhat than pressured. TradingView’s two-day candles present no actual bid aggression — solely delicate makes an attempt to stabilize.

The query for the market is straightforward: Is that this a brief drop in interplay, or an indication that XRPL exercise has peaked? With a decline this deep, sentiment won’t get well till charges cease falling.

Bitcoin creator Satoshi stuns main U.S. alternate

The NYSE put in a statue of Satoshi Nakamoto — one thing the market didn’t count on to see in essentially the most conventional buying and selling venue in america. The piece was created by Italian artist Valentina Picozzi, and Twenty One Capital organized the set up as a part of its first week on the alternate.

The timing is notable as a result of XXI’s debut was rocky. Shares opened at $10.74, slid to $11.42 by the tip of the session, and completed the day nearly 20% beneath the SPAC’s earlier shut of $14.27. That isn’t the beginning the corporate needed.

XXI controls round 42,000 BTC price round $3.9 billion. This locations it among the many prime three public Bitcoin holders. Nevertheless, the agency didn’t current a roadmap, and CEO Jack Mallers is pushing the concept that XXI isn’t making an attempt to repeat Technique.

Mallers mentioned the corporate desires to construct brokerage, buying and selling, lending and different providers round its Bitcoin stack, however he didn’t present any product particulars.

On the identical time, one other company participant, Try Asset Administration, introduced a $500 million fairness elevate to build up extra Bitcoin. Try already manages 7,525 BTC, price about $699 million, and ranks 14th amongst company holders.

Glassnode estimates that, since 2023, company and personal Bitcoin reserves have risen 448%, from 197,000 BTC to 1.08 million BTC. Right now’s headlines replicate this development, at the same time as XXI’s first buying and selling session was much less profitable than anticipated.

Bitcoin prints 3,065% liquidation imbalance

The derivatives map by CoinGlass confirmed a type of outsized liquidation spreads of late, the place the imbalance tells the entire story. Within the 12-hour timeframe, Bitcoin displayed $81.99 million in liquidations, with $79.40 million originating from lengthy positions and solely $2.59 million from brief positions. This 3,065% ratio is a transparent signal that lengthy merchants stepped in too early after the Fed announcement.

Bitcoin slipped from the $92,000 space into the low $90,000s, briefly encountering the identical resistance that restricted upside earlier within the week. Though nothing on the chart alerts a breakdown, the leverage wipeout signifies that lengthy positioning grew to become overcrowded.

Whereas it doesn’t set the long-term development, it forces each intraday dealer to rethink danger and keep away from assuming a rebound just because the Fed lower charges.

Crypto market outlook

The market enters Thursday with warning and concern. Bitcoin trades round $89,500-$90,500 with no actual conviction. XRP holds close to $2 with a payment backdrop that doesn’t encourage patrons both.

Bitcoin (BTC): Buying and selling at $92,000 as the primary upside set off, $94,500-$95,000 because the extension zone, $88,000 because the speedy assist stage and $80,600 because the deeper stage.

XRP: Obtained $2.12-$2.18 as the primary resistance band, $2.28-$2.34 because the extension pocket, $1.98-$2.00 because the preliminary assist, $1.92 because the break stage and $1.82-$1.85 because the deeper assist space.