Be a part of Our Telegram channel to remain updated on breaking information protection

US Securities and Alternate (SEC) Chair Paul Atkins stated that one of the best is but to come back for regulation of the crypto market business.

“You ain’t seen nothing but,” the SEC Chair stated on the Blockchain Affiliation Coverage Summit in Washington, DC, on Dec. 9. “So far as subsequent 12 months, all of the seeds that we’ve planted will be capable of begin seeding and sprouting. Then we’ll be capable of harvest the fruit.”

In the present day, I’ll be becoming a member of the @BlockchainAssn’s Coverage Summit for a hearth chat: “A View From the SEC.”

Tune in at 4:00 p.m. ET! https://t.co/NWkidQw1oY

— Paul Atkins (@SECPaulSAtkins) December 9, 2025

Atkins Says A Regulatory Reduction Framework Prime Precedence For 2026

Atkins stated that his prime precedence for 2026 will probably be his proposed “innovation exemption” for crypto and fintech initiatives.

The exemption is a proposed conditional and time-limited regulatory aid framework meant to decrease compliance prices and foster experimentation.

“I hope in a couple of month or so, in direction of the top of January, we’ll be capable of get that out,” he stated.

US Lawmakers Might Have Crypto Market Construction Markup Subsequent Week

US lawmakers are additionally engaged on a markup for a key crypto market construction invoice known as the CLARITY Act. In latest months, progress round this invoice has been slowed by a steady backwards and forwards between Republicans and Democrats in Congress. The longest US authorities shutdown in historical past led to additional delays.

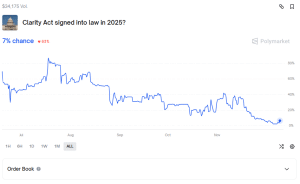

Contract asking if CLARITY Act will probably be signed into regulation this 12 months (Supply: Polymarket)

The stalled progress across the CLARITY Act has dampened optimism that the CLARITY Act will probably be signed into regulation this 12 months. Polymarket merchants have positioned the chances of this taking place at simply 7%.

Whereas the delays across the CLARITY Act persist, Senator Cynthia Lummis stated that she anticipates that the markup listening to for the Accountable Monetary Innovation Act would occur earlier than Congress breaks for the vacations.

A markup listening to entails lawmakers contemplating amendments and modifications earlier than a invoice is shipped to the Senate for a vote.

SEC Has Laid A Sturdy Regulatory Basis For Crypto

Atkins’ remarks come after US regulators, together with the SEC and the Commodity Futures Buying and selling Fee (CFTC), began implementing President Donald Trump’s pro-crypto agenda towards his aim to make the US the world’s “crypto capital.”

A standard theme with the SEC’s coverage strikes this 12 months is an easing of laws round digital asset corporations. This is available in marked distinction to the regulation-by-enforcement strategy adopted by former SEC Chair Gary Gensler that appeared aimed toward stifling progress and innovation within the crypto area.

In the course of the 12 months, the company unveiled “Venture Crypto,” a Fee-wide initiative that goals to modernize US securities laws in a approach that higher accommodates blockchain, tokenization, and decentralized finance (DeFi).

Shortly thereafter, the SEC additionally allowed in-kind creation and redemption of crypto ETPs (exchange-traded merchandise), which permits these merchandise to obtain or return precise crypto property when traders purchase or redeem shares. This makes the merchandise extra tax environment friendly.

In September, the SEC’s Division of Funding Administration additionally issued a “no-action” letter that enables registered funding advisers, regulated funds, and points to deal with sure state belief firms as permissible “banks” for the custody of crypto property.

Additionally this 12 months, the SEC authorised generic itemizing requirements for crypto ETFs (exchange-traded funds). These streamlined the approval course of for brand spanking new funds by eradicating the necessity for the SEC to assessment every utility on a case-by-case foundation.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection