Be a part of Our Telegram channel to remain updated on breaking information protection

The Solana value has soared 4% within the final 24 hours to commerce at $138 as of three:55 a.m. EST on a 40% surge in day by day buying and selling quantity to $6.5 billion.

This comes at the same time as blockchain analytics agency Glassnode warns that Solana’s liquidity ”has contracted again to ranges sometimes seen in deep bear markets.”

It added that for SOL meaning realized losses now exceed realized income.

The low liquidity warning means that even small trades might trigger sharp value actions, making the market extra risky within the brief time period.

Liquidity might be assessed by way of a number of measures, together with the Realized Revenue-to-Loss Ratio (30D-SMA).

For Solana, this ratio has traded under 1 since mid-November, which means realized losses now exceed realized income. This alerts that liquidity has contracted again to ranges… https://t.co/KWA67kkGLm pic.twitter.com/cZELe5xzdD— glassnode (@glassnode) December 10, 2025

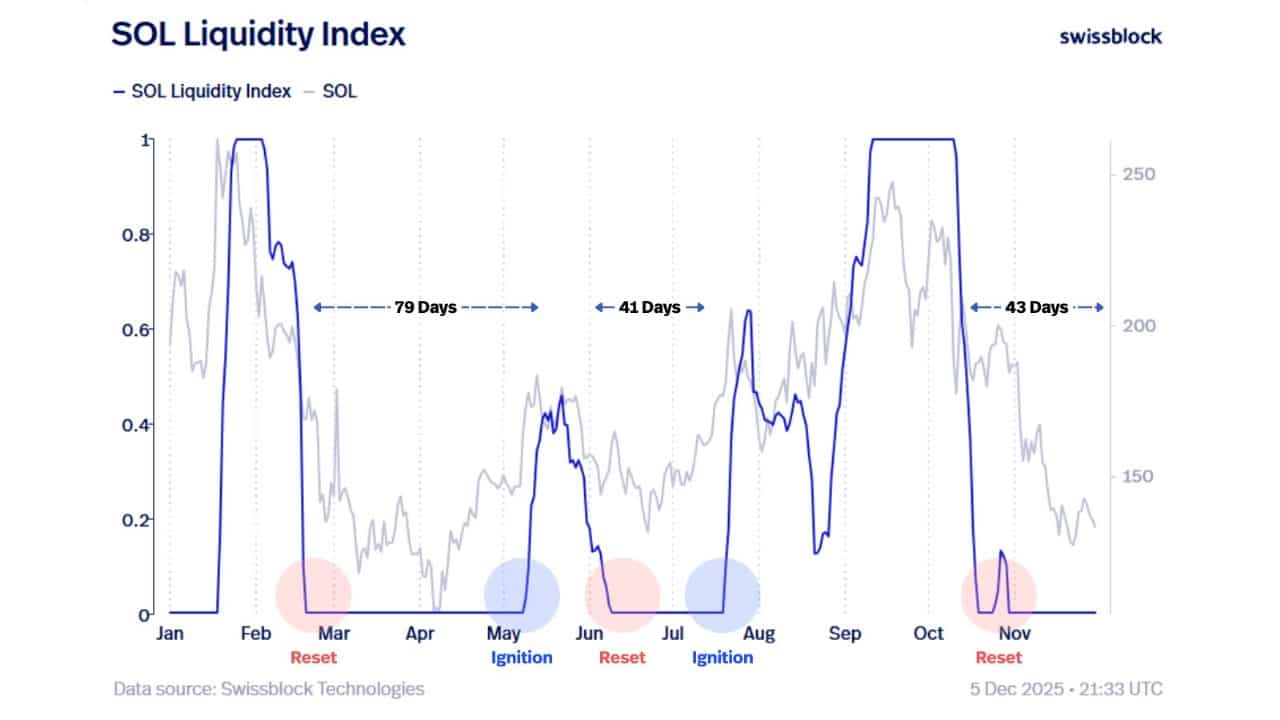

Solana’s on-chain liquidity index has dropped again to zero, marking one other clear “reset” section much like these seen in March, June, and November. Every of those resets has traditionally pushed SOL right into a cooling interval earlier than liquidity regularly rebuilds throughout an “ignition” section.

The chart highlights three main cycles lasting 79 days, 41 days, and 43 days. In all circumstances, liquidity collapses sharply, stays low for a brief stretch, after which climbs once more, typically supporting a brand new value upswing.

With the present November reset now confirmed, SOL is sitting in one other low-liquidity pocket. If earlier patterns repeat, the following transfer will depend upon how rapidly liquidity begins returning to the community.

A rising index has persistently signaled the start of recent momentum for Solana, making this metric key to watching the following potential restoration stage.

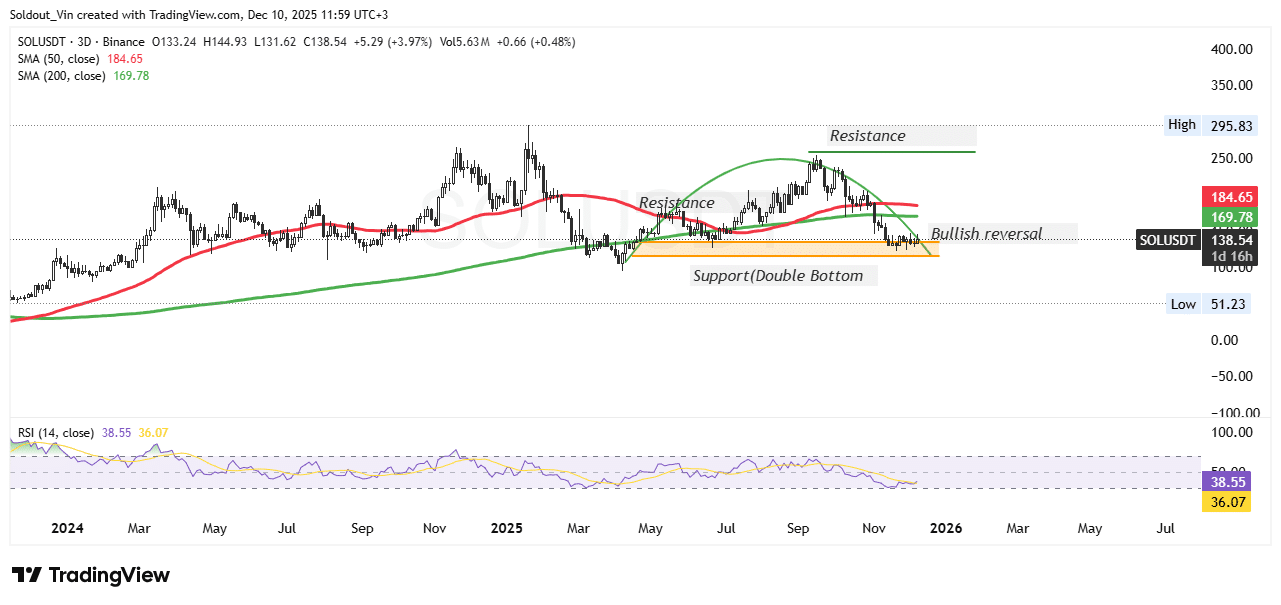

The SOLUSDT buying and selling pair is close to a serious multi-month assist zone round $130–$140, which has acted as a robust demand space prior to now and even fashioned the bottom of a double-bottom sample earlier within the yr.

This assist stage has repeatedly stopped deeper sell-offs, making it an essential area for bulls to defend. So long as SOL holds above this zone, the chance of a bullish reversal stays robust.

The value is at the moment positioned under each the 50-day SMA ($184.65) and the 200-day SMA ($169.79). This alignment exhibits that the broader pattern remains to be bearish, with sellers sustaining general management.

For bullish momentum to return, SOL should reclaim these two transferring averages, as they are going to act as main resistance boundaries on any upside try. A day by day shut above the 200-day SMA could be the primary clear sign of pattern restoration.

SOLUSDT Chart Evaluation. Supply: Tradingview

A descending wedge sample is forming on the chart. That is sometimes a bullish reversal sample, particularly when it seems close to a robust assist zone. The wedge exhibits that the speed of decline is slowing, and sellers are dropping energy. If SOL breaks above the wedge’s higher trendline, it might spark a transfer towards the following resistance ranges.

The rapid resistance lies at $155–$160, an space the place earlier breakdowns occurred and the place the value has struggled to maneuver increased. A breakout above this vary would probably entice new consumers and push the value towards the 200-day SMA. Above that, the following main zone sits between $200–$250, which aligns with earlier swing highs and the higher resistance highlighted within the chart.

The RSI close to 38 exhibits that SOL is near oversold territory. This means that promoting stress could also be easing and that the value may very well be making ready for a rebound. Failure to interrupt these ranges might outcome within the value consolidating or dropping barely.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection