Be part of Our Telegram channel to remain updated on breaking information protection

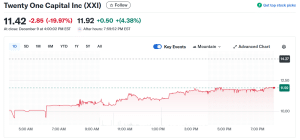

Bitcoin treasury agency Twenty One Capital ($XXI) plummeted 20% throughout its first day of buying and selling yesterday as Attempt launched a $500 million most well-liked inventory providing to amass extra BTC.

With backing from stablecoin issuer Tether, Bitfinex and Japan’s Softbank Group, Twenty One Capital was probably the most anticipated public debuts within the crypto sector this yr.

Twenty One Capital share worth (Supply: Yahoo Finance)

The corporate was listed by way of a Particular Objective Acquisition Firm (SPAC) merger with Cantor Fairness Companions and put in Strike founder Jack Mallers as CEO. It regained some misplaced floor in after-hours buying and selling with a 4.4% pump

Twenty One Capital “Not A Treasury”

Whereas it has been within the digital asset treasury (DAT) marketplace for lower than a yr, the corporate is already ranked because the third-largest company BTC holder globally.

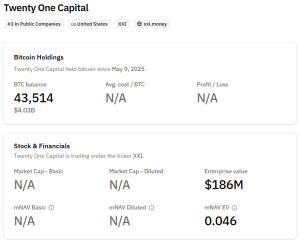

Twenty One Capital BTC holdings (Supply: Bitcoin Treasuries)

In accordance with Bitcoin Treasuries information, it holds 43,514 BTC on its steadiness sheet, rating it slightly below crypto miner MARA Holdings and company crypto treasury big Technique.

Even with its substantial BTC holdings, Mallers instructed CNBC in a Dec. 9 interview that the corporate is “not a treasury.”

“We don’t need the market to consider us and worth us as only a treasury asset,” he mentioned. “We do have numerous Bitcoin, however we’re additionally constructing a enterprise.”

“We’re constructing an working firm, we’re bringing numerous Bitcoin merchandise to market with the intent to have money circulation,” Mallers mentioned.

The CEO stopped in need of sharing Twenty One Capital’s precise plans, however did say that he sees “many alternatives in brokerage, alternate, credit score and lending.”

When pressed for extra data, Mallers mentioned that the plans shall be introduced “sooner somewhat than later.”

Attempt Declares $500M Providing To Purchase Extra Bitcoin

Whereas Twenty One Capital tries to get well from a rocky debut, Attempt has introduced a $500 million inventory gross sales program to double down on its Bitcoin-purchasing technique.

The publicly traded asset supervisor and Bitcoin treasury firm was co-founded in 2022 by American entrepreneur and politician Vivek Ramaswamy.

In a Dec. 9 assertion, Attempt mentioned that it intends to make use of the online proceeds from the sale for “normal company functions.” This contains, amongst different issues, “the acquisition of Bitcoin and Bitcoin-related merchandise and for working capital.”

Attempt broadcasts $500,000,000 SATA At-The-Market (ATM) program.

This system builds on the success of the upsized SATA IPO providing and can present the corporate with further capital for normal company functions, together with buying extra Bitcoin.

As of 11/7/25, we HODL…

— Attempt (@attempt) December 9, 2025

Attempt is at the moment the 14th-largest company BTC holder with 7,525 cash on its steadiness sheet.

Much like Twenty One Capital, Attempt entered the DAT area this yr after it introduced a pivot to a BTC treasury via a public reverse merger in Could. Attempt agreed to amass Semler Scientific in September, which positioned it as one of many largest company holders of BTC.

Saylor Pitches $50 Trillion Plan To UAE

Each Twenty One Capital and Attempt are following the Bitcoin-buying similar playbook pioneer by Michael Saylor’s Technique, which began buying Bitcoin in 2020 via a wide range of debt financing devices.

Earlier this week, Saylor proposed digital banking merchandise that he believes may result in as much as $50 trillion in capital inflows.

Talking on the Bitcoin MENA occasion in Abu Dhabi, Saylor mentioned that nations may use overcollateralized BTC reserves and tokenized credit score devices to create regulated digital financial institution accounts, which he says will be capable of provide increased yields than conventional deposits.

He outlined a construction through which digital credit score devices would make up roughly 80% of a fund that the merchandise could be tied to. This might then be mixed with a 20% allocation to fiat forex and a ten% reserve buffer to assist cut back volatility, he mentioned.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection