A current put up by crypto analyst Stockmoney Lizards on X means that the present Bitcoin construction is giving bears “the right alternative” to brief the market right down to $40,000. His message was paired with a chart exhibiting Bitcoin falling beneath an necessary resistance ever because it broke beneath $100,000, creating what seems to be a clear continuation setup for merchants anticipating deeper losses.

Nevertheless, though the chart highlights an identical bearish construction in 2022, the evaluation behind his put up factors to a extra layered interpretation of what could come subsequent for Bitcoin.

The Setup Bears Consider Is Lastly Right here

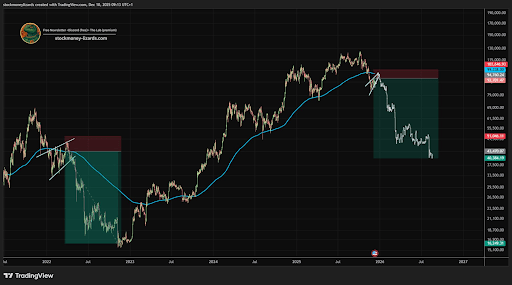

Within the chart he shared, Stockmoney Lizards confirmed how Bitcoin’s newest breakdown resembles the 2022 sample, when the worth motion rejected a serious resistance degree and fell sharply into what later turned a big accumulation zone. The present construction exhibits an identical rejection simply above the $100,000 zone, adopted by a drop beneath the weekly EMA50. This transfer has introduced Bitcoin right into a area that’s much like the vary the place accumulation shaped within the earlier cycle.

An overlay of the brand new value motion on high of the earlier one exhibits the trail downward appears nearly predetermined, creating the impression that the Bitcoin value is establishing a pure decline to as little as $40,000 within the coming weeks and months. Bitcoin is at present buying and selling at $90,240. A crash to $40,000 would imply wiping out roughly 55% of its worth from right here, successfully erasing the whole progress it has constructed over the previous two years.

Bitcoin Worth Chart. Supply: @StockmoneyL On X

Why The Excellent Brief Is Not The Analyst’s Actual Message

After the put up gained traction, Stockmoney Lizards stepped in to make clear that his message had been taken too actually. His invitation for merchants to brief right down to $40,000 was deliberately exaggerated, and the market doesn’t behave this manner.

He clarified that he doesn’t foresee a collapse right into a deep bear market. As a substitute, he believes Bitcoin could consolidate, presumably sweep native lows, however not have a chronic breakdown. Moreover, he famous that the worst-case situation could be a contact of the weekly EMA200, and this isn’t a spot the place bull markets finish. The true midterm prediction is the next transfer for the Bitcoin value.

Earlier than posting the supposedly bearish prediction, Stockmoney Lizards had shared one other evaluation describing Bitcoin as being near the endboss on the weekly EMA50 indicator.

Bitcoin Worth Chart. Supply: @StockmoneyL On X

That earlier chart supplied a clearer view of his precise stance. In it, he predicted that Bitcoin was approaching a serious technical pivot and that he anticipated upward motion into the top of December and Q1 2025. Due to this fact, the weekly EMA50 is the barrier that Bitcoin must reclaim with a view to launch its subsequent section of bullish momentum.

Featured picture created with Dall.E, chart from Tradingview.com