- XRP ETFs absorbed greater than 506 million tokens in underneath a month.

- Two main chart patterns level to upside targets between 14 and 15 {dollars}.

- Analyst expects XRP might speed up towards 10 {dollars} in 2026 if inflows proceed.

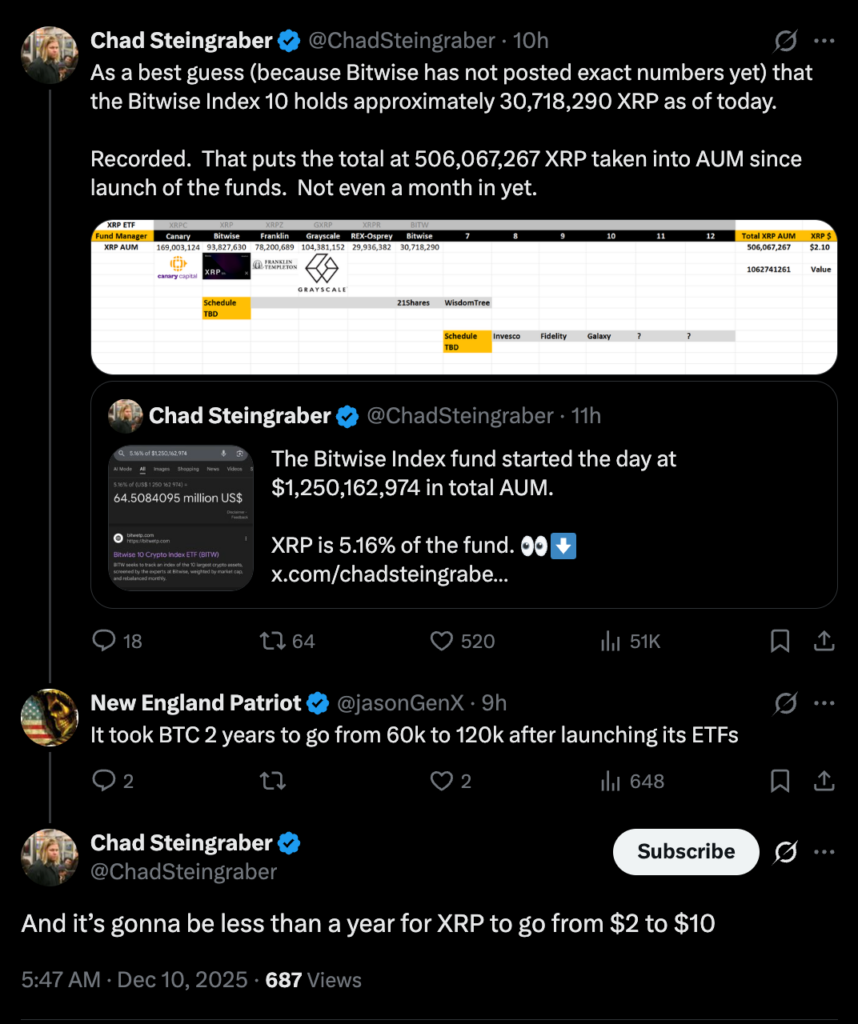

XRP could also be getting ready for a fast repricing section, in response to analyst Chad Steingraber, who believes the asset might transfer from 2 {dollars} to 10 {dollars} in underneath a 12 months. His outlook follows the robust early demand for XRP exchange-traded funds, which launched in mid-November and have already absorbed greater than 944 million {dollars} value of XRP. These inflows characterize over 506 million XRP getting into ETF custody in lower than a month, now accounting for roughly 0.74 p.c of all circulating provide.

Institutional Allocation Provides Gas to the Rally Setup

XRP’s inclusion within the new Bitwise Crypto 10 ETF, which opened with greater than 1.25 billion {dollars} in belongings, additional strengthens the institutional narrative. XRP represents 5 p.c of the fund, and early estimates counsel greater than 30.7 million XRP have been added to its portfolio. Steingraber argues that if ETF adoption continues at this tempo, XRP might mirror the efficiency of Bitcoin following its ETF debut and speed up towards the 10-dollar area in 2026.

Chart Patterns Level Towards the $14–$15 Worth Targets

From a technical perspective, XRP has damaged above a multimonth symmetrical triangle on the two-week chart, signaling a possible shift into a brand new development section. The measured transfer from this sample factors towards the 14 to fifteen greenback vary. A second formation, a bull flag creating on larger time frames, reinforces the identical targets. If consumers keep management and make sure a breakout above higher resistance, the technical panorama suggests room for a serious rally within the coming months.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.