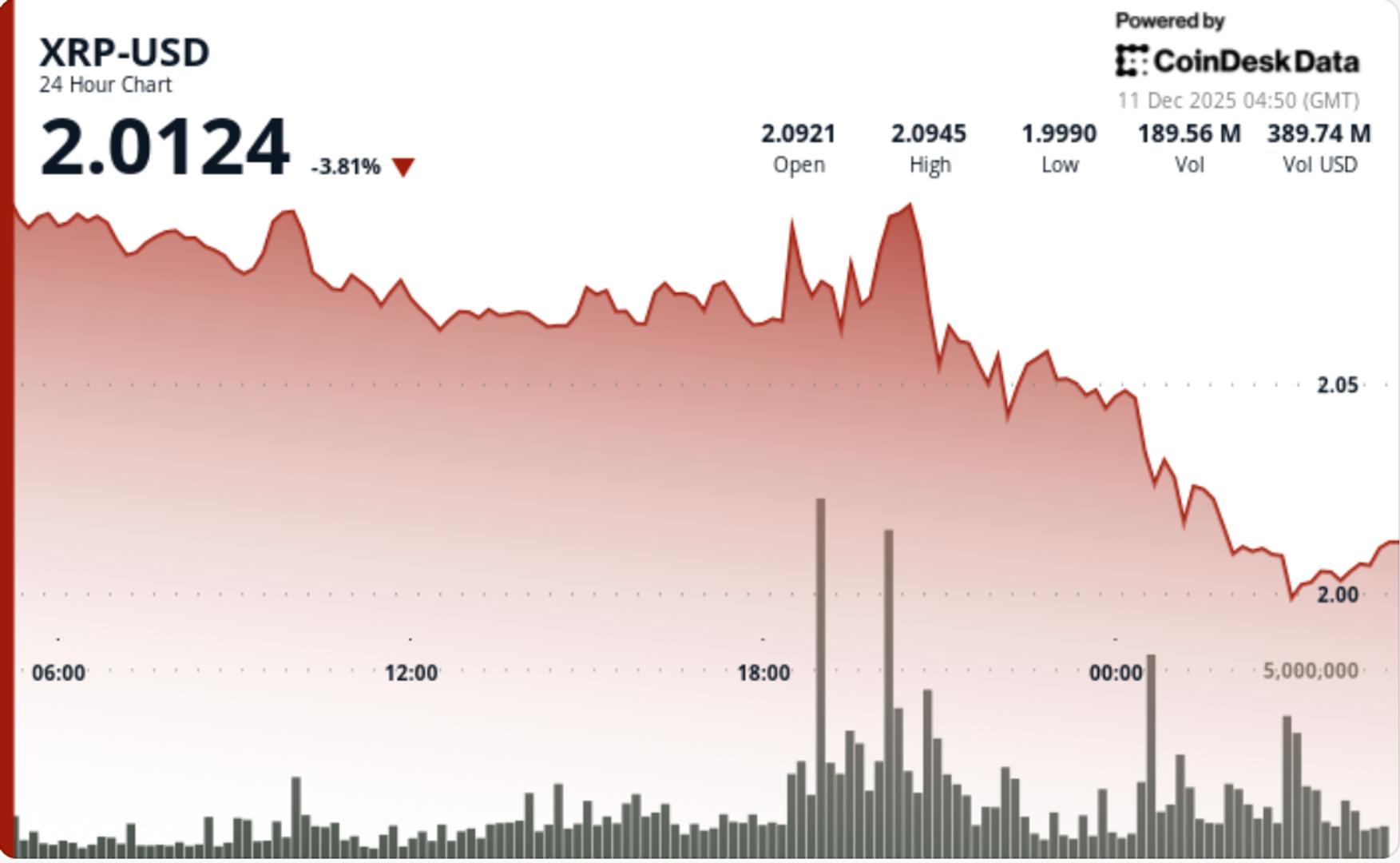

Institutional flows jumped greater than 50% above pattern on Wednesday as XRP failed once more to interrupt via the $2.09–$2.10 ceiling. Sellers slammed the token off resistance and compelled a clear transfer again into the $2.00 psychological shelf, leaving the broader construction caught in multi-week compression whereas ETF inflows quietly tighten provide beneath.

What to Know

- XRP slipped from $2.09 to $2.00, dropping 4.3% on the session and underperforming the broader crypto market by roughly 1%.

- The rejection was decisive: a 172.8M quantity spike (205% above the day by day common) hit proper as XRP tagged $2.08, flipping the complete transfer right into a failed breakout.The selloff didn’t come from retail panic.

- Quantity throughout the session ran 54% above the 7-day common — traditional institutional distribution above resistance quite than emotional dumping.

- Alternate balances dropped from 3.95B to 2.6B tokens over the past 60 days, compressing provide at the same time as spot value failed to carry the breakout try. That divergence is establishing an more and more uneven construction as XRP trades in a narrowing multi-month triangle

Information Background

- U.S. spot XRP ETFs pulled in over $170 million in weekly inflows, marking one other week with zero outflows.

- Heavy spot promoting continues to hit the $2.09–$2.10 band, the place XRP has now failed a number of instances.

- Market makers flagged rising distribution stress forward of yesterday’s transfer, with heavy affords sitting above $2.10.

- Alternate provide continues to grind decrease, falling to 2.6B tokens, strengthening long-term provide compression.

- Regardless of the ETF help, XRP lagged broader crypto as CD5 fell 3.1% on the day — suggesting the transfer was token-specific quite than macro-driven.

Value Motion Abstract

XRP dropped 4.3% from $2.09 → $2.00

• Intraday vary: 5.4% as resistance rejection triggered high-volatility unwind

• Quantity: 172.8M peak at 19:00 UTC (up 205% above day by day common)

• A number of rejections at $2.08–$2.10 created a tough ceiling

• Late-session stabilization shaped greater lows close to $1.999–$2.005

• Relative efficiency: lagged broader crypto by ~1%

Technical Evaluation

- Help:$2.00 psychological shelf. Under that sits a delicate zone at $1.95, aligned with prior demand clusters.

- Resistance:$2.09–$2.10 is the dominant wall — the session created a transparent provide shelf right here. Any shut above $2.10 flips the complete construction short-term bullish.

- Quantity Construction: 54% above weekly averages = institutional flows, not noiseThe 172.8M spike precisely on the failed breakout confirms aggressive sellers defending the extent.

- Sample: Multi-month triangular compression tightening as alternate provide falls. Value stays mid-range; neither breakout nor breakdown confirmed.

- Momentum skewed bearish short-term after clear rejection. Bounce makes an attempt capped under $2.08 on declining quantity is the same as a weak follow-through.

What Merchants Are Watching.

- Can $2.00 survive a second take a look at? A clear break exposes a quick transfer towards $1.95.

- ETF inflows stay the largest offset to identify weak point — any slowdown removes the ground.

- A breakout requires a number of hourly closes above $2.10 with sustained >100M quantity.

- Compression now extraordinarily tight — the subsequent transfer needs to be bigger than the final.

- Alternate stability drop is the wildcard: thinner provide = quicker swings as soon as route confirms