- Monero gained 1 p.c whereas the crypto market dropped practically 3 p.c, exhibiting clear relative energy.

- A current breakout, sturdy privacy-sector demand, and short-heavy positioning supported XMR’s stability.

- XMR is consolidating constructively and will goal the $470–$500 vary if it breaks above the low-$400s.

Monero gained roughly 1 p.c over the previous 24 hours whereas the broader crypto market fell practically 3 p.c — a transparent signal of relative energy throughout a risk-off session. As a substitute of reacting to the macro selloff, XMR steadied itself across the $400 zone, supported by agency demand and technical consumers ready at decrease ranges. This divergence reveals Monero isn’t merely avoiding volatility; it’s consolidating after a well-defined bullish breakout that has launched new buy-side curiosity into the chart.

Privateness Demand Provides Monero Its Personal Market

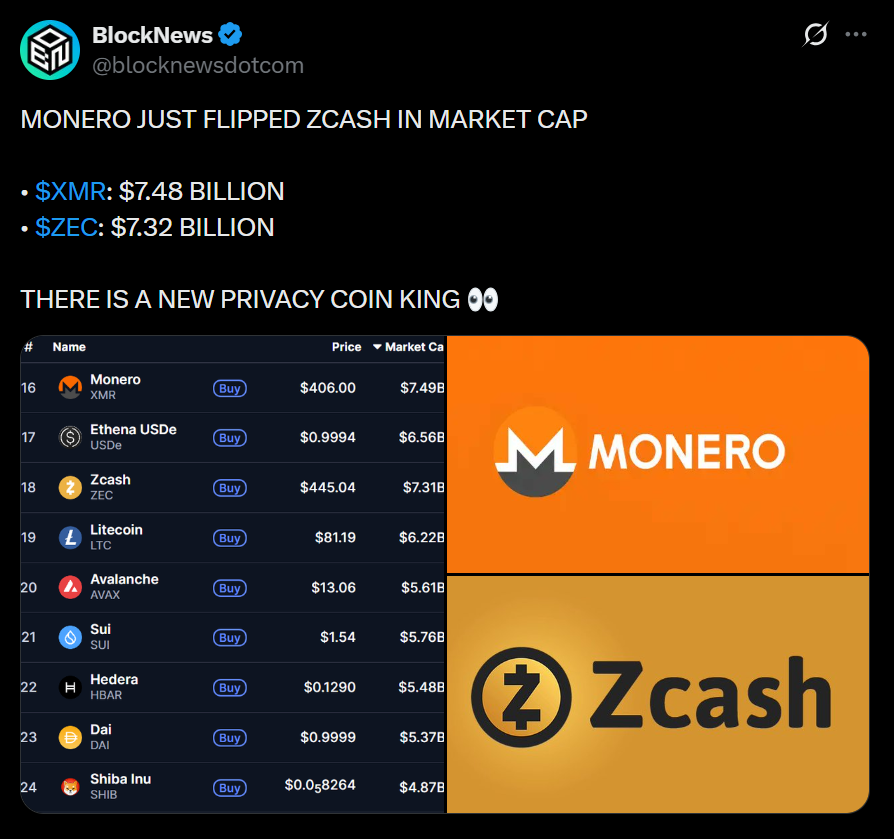

Whereas most altcoins commerce as extensions of macro circumstances, Monero continues to learn from sturdy privacy-sector demand. Latest studies present privateness cash attracting regular flows from MENA, CIS, and Southeast Asia, with Monero capturing the biggest share. Improvement efforts, equivalent to new safety audits and infrastructure updates, additional reinforce confidence amongst long-term holders. That is sticky, utility-driven demand — not fleeting hypothesis — which helps clarify why XMR rose whereas most different altcoins slid.

Shorts Cushion the Draw back as Macro Headwinds Hit

Deeply short-heavy derivatives positioning has additionally helped Monero resist the market pullback. Detrimental funding charges point out merchants leaning quick into XMR, and when an asset with sturdy spot demand and a bullish chart is closely shorted, selloffs are sometimes absorbed as a substitute of amplified. Shorts protecting on dips — mixed with Monero’s traditionally resilient holder base — saved XMR steady at the same time as macro volatility despatched different alts sharply decrease. This structural benefit helps clarify why XMR oscillated tightly quite than becoming a member of the broader decline.

Why Monero Stayed Agency When Every part Else Fell

Monero’s capability to flip inexperienced throughout a market-wide crimson day stems from three converging forces: a accomplished bullish breakout, a rising narrative round privacy-focused property, and derivatives positioning that reduces draw back strain. Collectively, these elements allowed XMR to sidestep the selloff and construct energy whereas different cryptocurrencies misplaced momentum. For now, the $395–$400 band stays the important thing demand zone — and if resistance breaks, the subsequent leg larger might unfold rapidly.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.