- Silver hit a report excessive above $63, reaching a $3.59T market cap and surpassing Microsoft.

- A 25bps Fed price minimize sparked heavy bullish positioning in metals, accelerating silver’s breakout.

- The metallic is now up 150% since early 2024 and shutting in on Alphabet’s valuation.

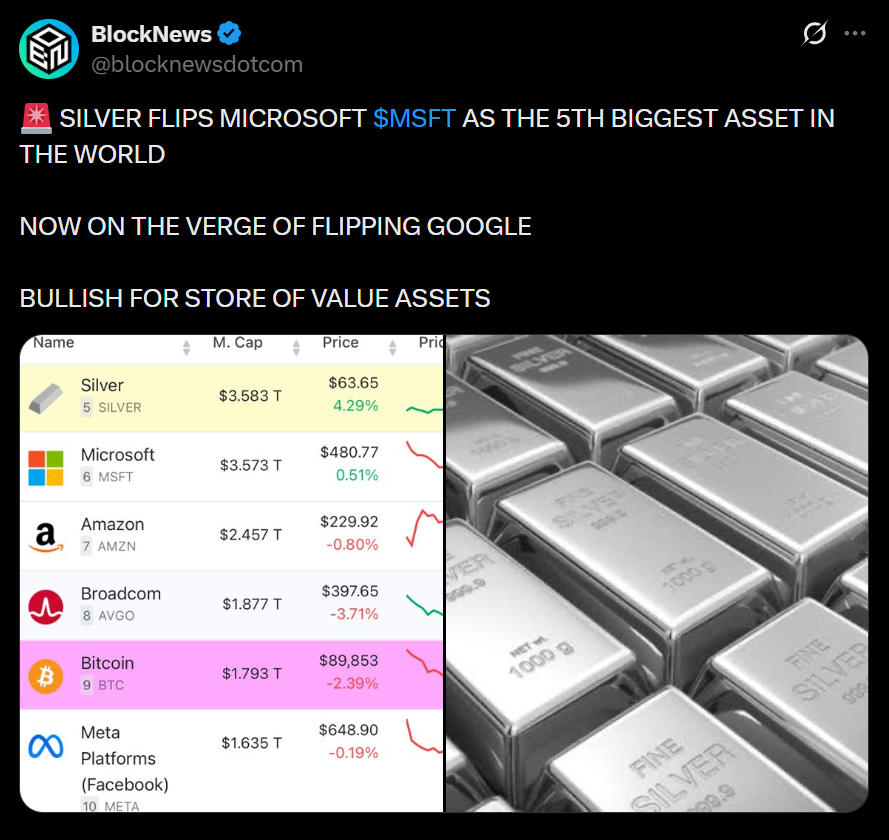

Silver pushed previous $63 right now, hovering to a $3.59 trillion market cap and overtaking Microsoft to develop into the world’s fifth-largest asset. The metallic is now up greater than 150% since early 2024, climbing from the $25 vary as traders more and more rotate into tangible hedges. It’s additionally the primary time silver has returned to all-time-high territory since 2011, when it peaked close to $50 earlier than retracing sharply for greater than a decade.

Fed Coverage Fuels a Highly effective Macro Tailwind

The most recent leg of silver’s rally erupted proper after the Federal Reserve delivered a 25bps price minimize, prompting markets to reset inflation expectations and push aggressively into metals. With borrowing prices falling and liquidity situations loosening, capital continues to shift towards property seen as defensive, scarce, and traditionally undervalued relative to gold. This macro setup has made silver one of many strongest-performing main property of 2025.

Silver Overtakes Microsoft — and Eyes Alphabet Subsequent

Silver’s market cap has now climbed above Microsoft’s $3.6 trillion valuation, pushing the metallic into the worldwide top-five asset rankings and placing Alphabet firmly in sight at $3.8 trillion. Amazon, sitting at $2.5 trillion, has additionally been left behind. With momentum constructing and industrial demand rising throughout vitality, battery tech, and manufacturing, analysts say silver’s structural re-rating could solely be getting began.

A Historic Repricing After a Decade of Suppression

After spending greater than 12 years suppressed in a large buying and selling vary, silver’s sharp breakout has reminded markets how aggressively the metallic can reprice as soon as macro sentiment turns. The renewed curiosity marks a transparent shift towards property benefiting from inflation hedging, industrial demand, and weakening actual yields. Whether or not silver can maintain its new place among the many world’s prime property will now rely closely on international liquidity developments and investor urge for food into 2026.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.