- AAVE jumped almost 9% after the Fed charge minimize, with merchants reacting strongly to the upcoming V4 improve.

- Derivatives exercise rebounded quick, as Open Curiosity rose by $34M and leverage returned to the market.

- On-chain exercise and protocol charges elevated alongside worth, pointing to actual utilization behind the transfer.

AAVE has quietly become one of many clearer winners following the Federal Reserve’s newest charge minimize. Whereas a lot of the market reacted cautiously, Aave’s token pushed increased, climbing about 9% on the day and buying and selling close to $205 at press time. The timing wasn’t random. Consideration rapidly shifted to Aave’s upcoming V4 improve, and merchants appeared to love what they noticed.

On the heart of the replace is a redesigned liquidation engine, constructed to enhance capital effectivity whereas tightening danger controls throughout the protocol. It’s a technical change, positive, however one with actual penalties. And judging by how the market reacted, that message landed nearly instantly.

Liquidation Engine Triggers a Return of Leverage

Following the V4 announcement, derivatives merchants moved quick. After a comparatively quiet stretch earlier within the week, positioning started to broaden once more. CoinGlass information exhibits Open Curiosity jumped by roughly $34 million prior to now 24 hours, a noticeable shift from the flat habits seen earlier than.

That rise factors to rising leveraged participation, doubtless from bigger merchants prepared to lean into the improve narrative. Nonetheless, increased Open Curiosity cuts each methods. Whereas it helps momentum on the way in which up, it additionally makes worth extra delicate to sharp strikes if sentiment flips. Volatility danger hasn’t disappeared — it’s simply modified form.

On-Chain Exercise Begins to Catch Up

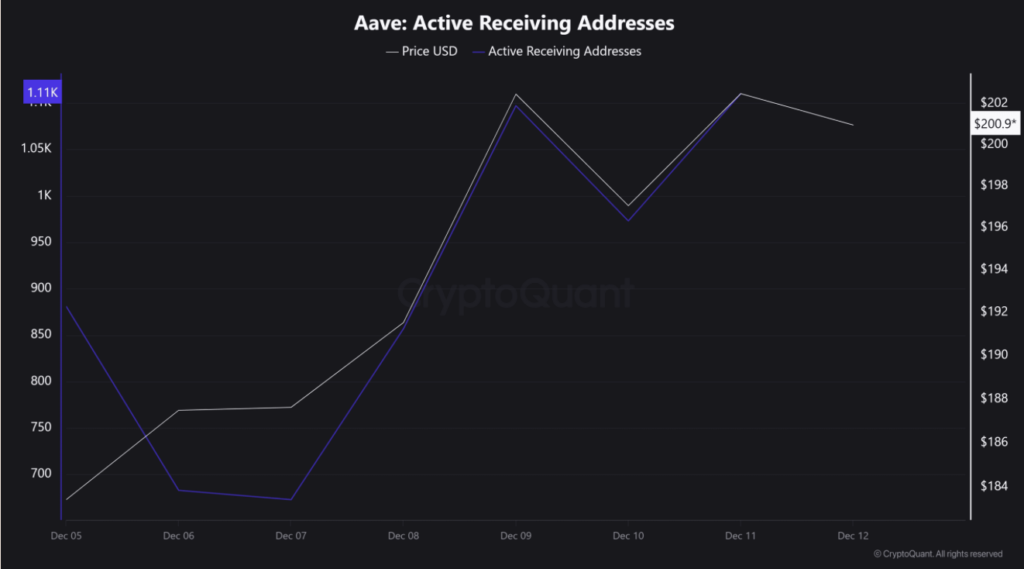

The rally didn’t keep confined to cost and derivatives. On-chain metrics picked up as properly. In accordance with CryptoQuant, Energetic Receiving Addresses almost doubled after December 7, climbing to round 1.2K at press time.

That form of transfer suggests broader participation, not only a handful of whales shuffling tokens. Extra wallets getting concerned often alerts rising engagement throughout the community.

On the similar time, Aave’s protocol income ticked increased. Token Terminal information exhibits weekly charges elevated by about $0.3 million, bringing complete charges to roughly $15.47 million. That income comes from lending curiosity and liquidation exercise, tying the value transfer again to actual utilization on the protocol.

In different phrases, this wasn’t only a speculative pop. Community fundamentals moved with it.

Liquidity Cluster Units the Subsequent Space to Watch

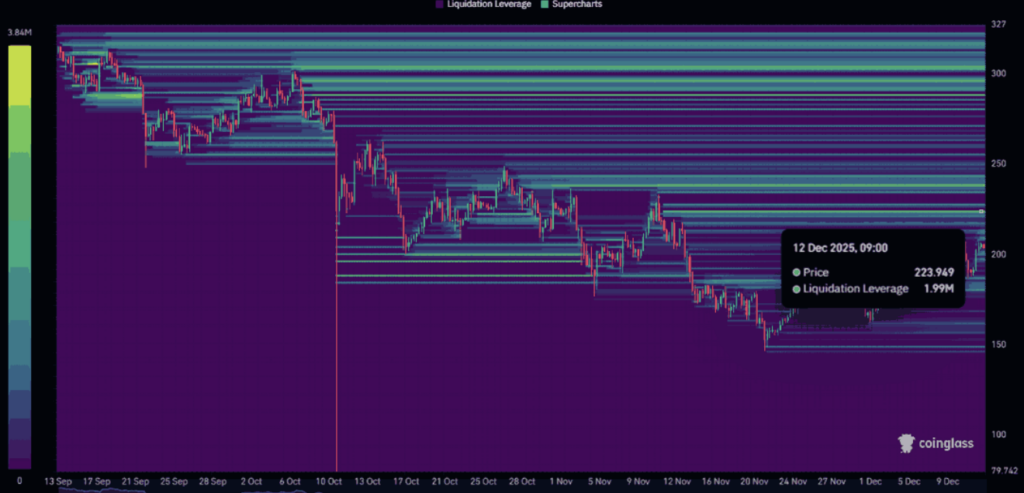

Even with the sturdy bounce, derivatives information exhibits a transparent space of curiosity above present worth. CoinGlass’ liquidation heatmap highlights a $1.99 million liquidity cluster round $223. If bullish momentum continues and broader market circumstances cooperate, that zone might act like a short-term magnet.

However there’s a flip facet. With leverage constructing once more, any failure to carry key ranges might result in sharper pullbacks. The identical derivatives positioning that fuels upside can unwind rapidly if confidence wavers.

For now, AAVE seems energized. Fee cuts helped, the V4 improve added a story merchants might latch onto, and on-chain information confirms rising exercise. Whether or not this transfer extends additional will depend upon how properly the protocol — and the market — deal with the additional leverage now again in play.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.