Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth tumbled 2% up to now 24 hours to commerce at $90,323 as of 11:17 a.m. EST on buying and selling quantity that rose 12% to $54 billion.

This comes as John Ameriks, Vanguard’s international head of quantitative fairness, dismissed Bitcoin as primarily speculative.

In a current assertion at Bloomberg’s ETFs in Depth convention in New York, Ameriks described BTC as a “digital Labubu,” referencing in style collectible plush toys that lack intrinsic financial worth.

JUST IN: Vanguard says Bitcoin remains to be a speculative digital “toy.”

Humorous take from an organization that opened Bitcoin ETF entry after two years of screaming about it. 😂 pic.twitter.com/1eFKtMXif4

— Merely Bitcoin (@SimplyBitcoin) December 12, 2025

Supporting Ameriks’ standpoint is that the value of Bitcoin has traditionally been pushed by shortage narratives and market hypothesis quite than constant money flows or real-world utility.

Ameriks emphasised Bitcoin’s brief historical past, which supplies inadequate knowledge to ascertain a strong funding thesis. Whereas the know-how behind the primary cryptocurrency underpins it, specialists like Ameriks argue that it has but to show sturdy financial advantages in on a regular basis purposes.

The feedback by Ameriks come days after the world’s second-largest fund supervisor, behind BlackRock, allowed shoppers to commerce crypto ETFs and mutual funds that maintain digital belongings.

Vanguard is now providing solely ETFs that meet regulatory requirements, together with these monitoring Bitcoin, Ethereum, XRP, and Solana, whereas excluding speculative meme-coin merchandise.

Bitcoin Value Holds Key Assist In The Consolidation Section

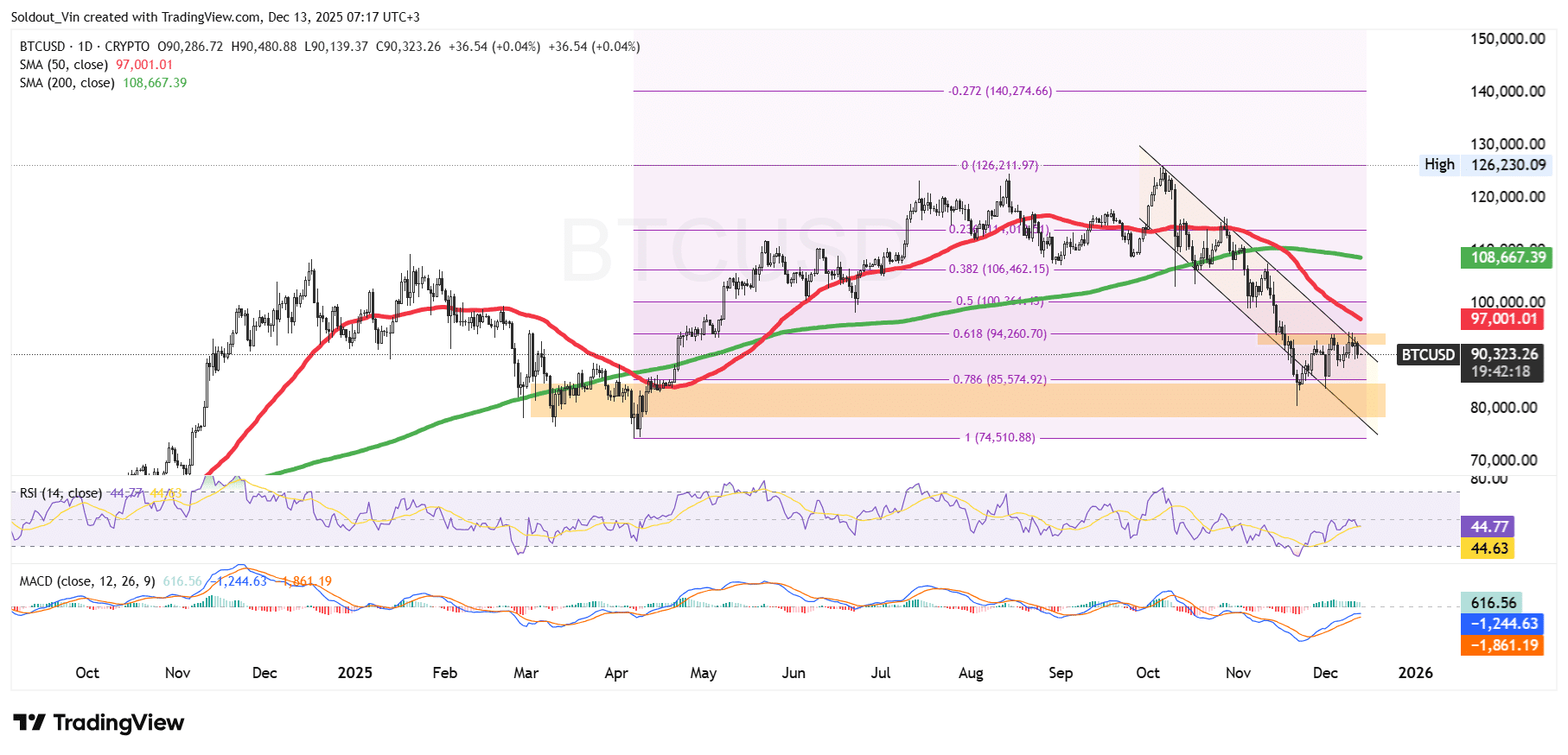

After printing a cycle excessive close to $126,230, the BTC worth entered a sustained downtrend inside the confines of a falling channel sample.

The selloff accelerated after Bitcoin misplaced the $108,000–$110,000 area, the place the 200-day Easy Transferring Common (SMA) beforehand offered dynamic assist. The SMAs additionally fashioned a demise cross round $110,577, which additional pushed the value of BTC even greater.

BTC finally discovered demand close to the $85,000–$90,000 zone, an space that aligns with the 0.618–0.786 Fibonacci retracement ranges.

Following that transfer, Bitcoin staged a modest rebound, pushing again towards the $94,000 stage, although upside momentum stays capped inside the falling channel.

The newest candles recommend vendor exhaustion, as draw back momentum slows and BTC begins to stabilize above the current swing low.

Nevertheless, with the present retracement, the value of Bitcoin stays beneath the 50-day SMA at $97,000, reinforcing the broader bearish bias within the brief time period. The 200-day SMA, at present close to $108,600, continues to behave as a serious overhead resistance.

In the meantime, the Relative Energy Index (RSI) is displaying indicators of a restoration, at present at 44, which reveals that the value of BTC is at present in equilibrium, therefore a consolidation section. .

The Transferring Common Convergence Divergence (MACD) stays beneath the zero line. Nonetheless, the histogram has turned optimistic because the blue MACD line has crossed above the orange sign line, an indication that bearish momentum might be choosing up.

BTC Value Prediction

Based on the BTC/USD chart evaluation, the BTC worth seems to be consolidating after a deep corrective transfer, with technical indicators hinting on the potential for a short-term aid rally.

If BTC manages to interrupt above the falling channel resistance and reclaim the $100,000 zone, the subsequent upside goal might be the $106,000–$109,000 area, the place the 0.382 Fibonacci stage and the 200-day SMA converge.

On the draw back, if the present bounce fails and sellers regain management, Bitcoin might revisit the $85,000 assist zone, which now acts as a crucial cushion towards a deeper retracement towards the $74,000 stage.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection