Bitcoin has didn’t reclaim increased costs, reinforcing the rising perception that the market could also be getting into a deeper bearish part. After a number of makes an attempt to push above key resistance ranges, BTC continues to commerce sideways with declining momentum, reflecting a transparent shift in investor sentiment. Concern is rising throughout the market, and worth motion has but to point out any convincing indicators of restoration.

In response to new knowledge shared by Axel Adler, a number of structural on-chain and market indicators now assist a continuation of bearish circumstances within the months forward. Adler’s evaluation factors to weakening demand, persistent promote strain, and deteriorating liquidity—elements that traditionally precede extended corrective durations.

Whereas Bitcoin has held above crucial assist zones, its incapacity to determine increased highs or maintain rebounds means that patrons stay cautious and largely defensive.

Furthermore, broader market circumstances present related fragility, with derivatives positioning, stablecoin flows, and long-term holder habits all signaling diminished conviction. This confluence of things strengthens the bearish thesis and implies that volatility might intensify earlier than the market finds a significant backside.

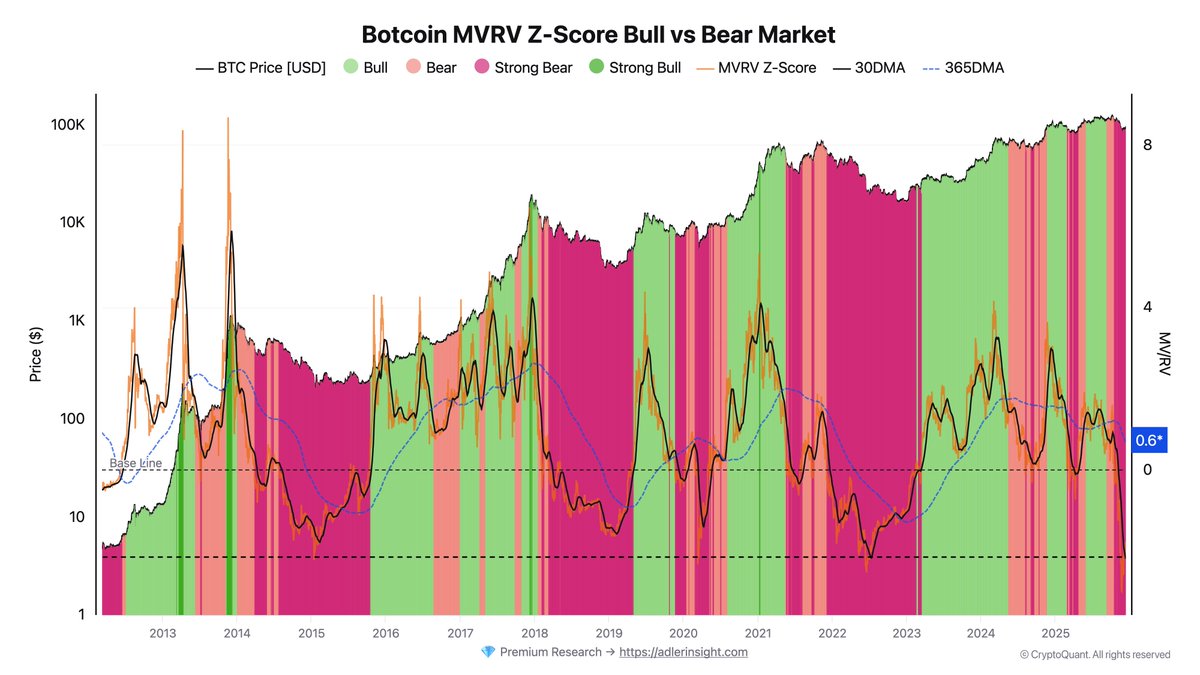

Bitcoin MVRV Unfold Indicators a Deep Bear Part

Adler’s evaluation highlights one of many clearest structural indicators pointing towards sustained bearish circumstances: the Bitcoin MVRV Z-Rating Bull vs. Bear Market mannequin. Particularly, he notes that the 30-day to 365-day MVRV unfold is deeply unfavorable and continues to deteriorate.

This unfold measures the distinction in profitability between short-term and long-term holders, and when the short-term cohort is underperforming considerably, it historically indicators danger aversion, exhaustion, and weakening demand.

A crossover—when the 30-day MVRV rises above the 365-day metric—has traditionally marked the transition from bear markets into new bullish phases. Nonetheless, Adler stresses that such a crossover doesn’t seem imminent underneath present circumstances. The unfold stays far under the brink required for a structural reversal, reinforcing the view that Bitcoin continues to be entrenched in a deep bear part inside this mannequin’s framework.

Cycle analogs additional assist this interpretation. Reviewing previous market cycles, Adler estimates that the subsequent probably window for a significant crossover sits within the second half of 2026. This means that even when short-term rallies happen, they’re extra more likely to be counter-trend bounces fairly than the early levels of a sustainable bull market. Till the MVRV construction improves, broader sentiment might stay decisively bearish.

Value Struggles to Recuperate Momentum

Bitcoin continues to maneuver sideways, reflecting a market that continues to be indecisive and structurally weak. The chart exhibits BTC buying and selling close to $92,000 after its sharp decline from the $120,000 area, with current candles forming a decent consolidation vary. This habits usually indicators a brief stabilization part fairly than a confirmed reversal, particularly given the broader bearish context highlighted by on-chain and macro indicators.

The 50-day shifting common sits nicely above the present worth, performing as dynamic resistance and indicating that short-term momentum stays firmly bearish. Likewise, the 100-day and 200-day shifting averages pattern downward, making a compression zone that BTC has but to problem. Till Bitcoin can reclaim these ranges with conviction, rallies might proceed to be light by sellers.

Regardless of the small rebound from sub-$90,000 ranges, shopping for exercise stays muted in comparison with the heavy promote quantity that drove the preliminary breakdown. This implies that demand is inadequate to soak up higher-timeframe promoting strain.

Structurally, Bitcoin is forming decrease highs and decrease lows throughout the day by day timeframe, reinforcing a downtrend. A decisive break under $90,000 would expose deeper liquidity zones close to $86,000–$84,000. Conversely, reclaiming $96,000 can be the primary signal of power—however present worth motion exhibits no such momentum but.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.