Itaú, Brazil’s largest personal financial institution, recommends traders Bitcoin allocation 1%–3% of their portfolio in 2026. That is suggested as a approach to diversify threat and hedge in opposition to forex fluctuations.

Itaú, the funding arm of Brazil’s largest personal financial institution, Itaú Unibanco, has launched an in depth analysis report. The evaluation advises traders to have an allocation of between 1 and three p.c of their portfolios in Bitcoin subsequent 12 months. That is seen as a means of spreading the chance and hedging in opposition to forex fluctuations.

Itaú’s Devoted Digital Asset Technique

The report argues that Bitcoin has already constructed a spot as a related element in funding portfolios. That is notably true for many who are uncovered to financial uncertainties and geopolitical tensions.

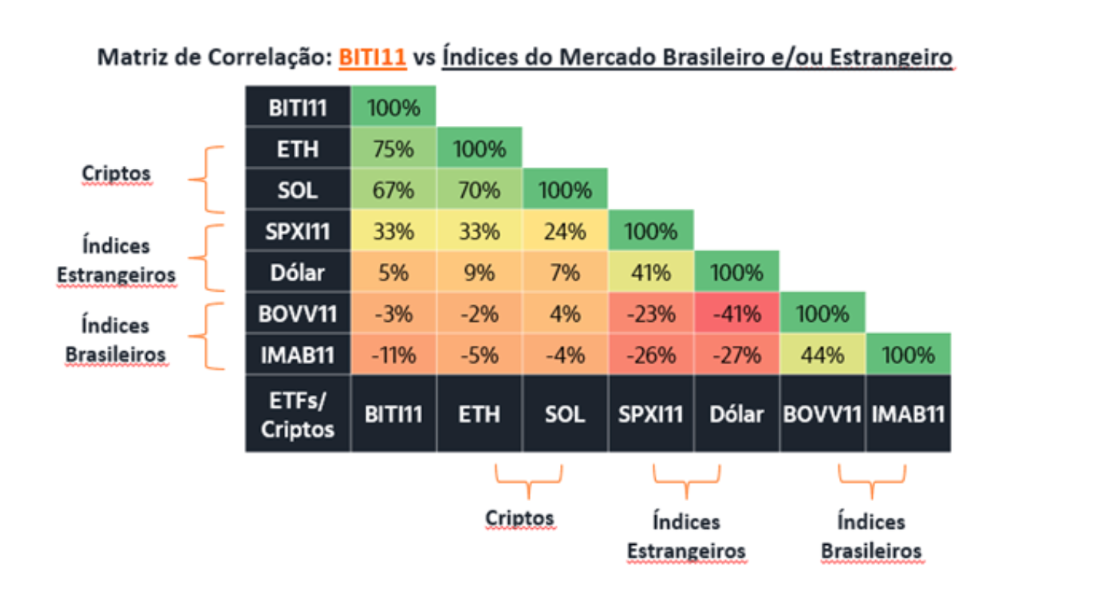

The doc, which was signed by analyst Renato Eid, describes the perform of the asset. Bitcoin isn’t like conventional shares, mounted earnings, or native markets. Its international and decentralized construction offers distinctive alternatives. Traders on the lookout for the stability of threat and return in unfavorable conditions can profit. Even with excessive volatility, the financial institution reinforces the truth that Bitcoin has potential for long-term appreciation.

Associated Studying: Bitcoin ETFs Information: BlackRock Sees Surging Demand for Bitcoin ETFs in Brazil | Dwell Bitcoin Information

Itaau Asset is working with property of roughly $185 billion. This suggestion comes as a part of an institution-wide shift in direction of the digital asset house. The allocation is taken into account to be a method of managing threat. As well as, it helps to hedge in opposition to forex fluctuations. This additionally helps traders get by means of international financial uncertainty.

Itau already offers many managed merchandise based mostly on cryptocurrency to its shoppers. These encompass a bitcoin exchange-traded fund (ETF). It additionally offers the index fund in addition to the pension fund with BTC publicity. These merchandise have a complete of about R$850 million ($156 million) in property.

Moreover, Itau Asset arrange a particular workforce to work on digital property in September 2025. Due to this fact, the workforce got here collectively to construct extra modern crypto funding options for shoppers. Furthermore, they prioritize security whereas making certain easy accessibility.

Brazilian Regulation Paves Method for Institutional Adoption

This institutional adoption of Bitcoin is going down in an atmosphere of quickly altering laws in Brazil. The Central Financial institution of Brazil (BNM) has a brand new complete regulatory framework for digital property.

These new guidelines will apply in February 2026. They may want the licensing of all crypto firms. Current banking laws will apply to the crypto business as properly. These embody AML/CFT measures and insurance policies for the safety of shoppers.

In the meantime, a big invoice is transferring by means of the Brazilian parliament. This invoice requires the creation of a Sovereign Strategic Bitcoin Reserve (RESBit). It could put as much as 5% of the nation’s worldwide reserves into Bitcoin. If accepted, this may make Brazil the primary G20 nation so as to add Bitcoin to its official reserves. This might be a big shift on this planet.

Brazil is already an enormous marketplace for crypto in Latin America. It has a excessive price of adoption and utilization, particularly when it comes to stablecoins. In the end, the motion of main personal banks and the central authorities collectively is a decisive step in direction of the built-in adoption of crypto.