Bitcoin will increase post-FOMC assembly slide, and Congress urges SEC Chair Paul Atkins to open 401(ok) retirement accounts to crypto investments now.

The Federal Reserve made its fee announcement in December, and Bitcoin felt the stress immediately. The digital asset has since stabilised. The commentators observe completely different habits out there as in comparison with earlier conferences of the Federal Open Market Committee.

Bitcoin fell instantly after the FOMC announcement, based on CryptoRover on X. The asset has since stabilized. Downward motion continued within the earlier conferences. It takes merchants days to find out the actual path.

Supply: CryptoRover

You may also like:Bitcoin Dip Deepens: Fed Charge Lower Indicators Extra Ache Forward

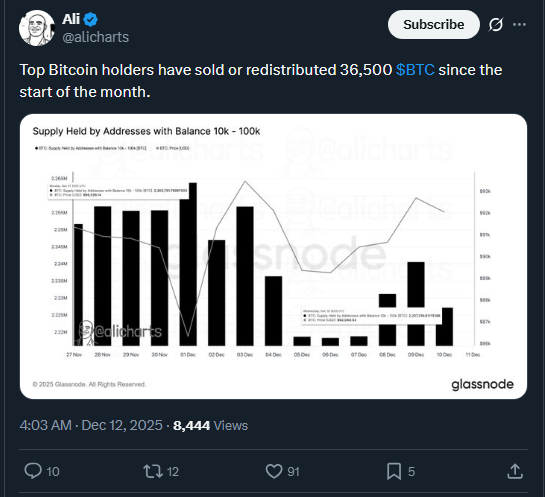

Whales Dump Whereas Worth Stabilizes

The large holders of Bitcoin offered their stakes this month by massive margins. AliCharts reported on X that high holders offered or redistributed 36,500 BTC. This pattern began at the start of December. The gross sales had been made in a interval of elevated uncertainty out there.

Supply: AliCharts

The Federal Reserve decreased charges by twenty-five foundation factors. This was the third reduce in 2025. Bitcoin was at first down however recovered to commerce at roughly 92,000. Many gamers within the markets had been taken unexpectedly by the stabilization.

You may also like:Bitcoin Treasuries Stall in This autumn as Giant Traders Preserve Accumulating

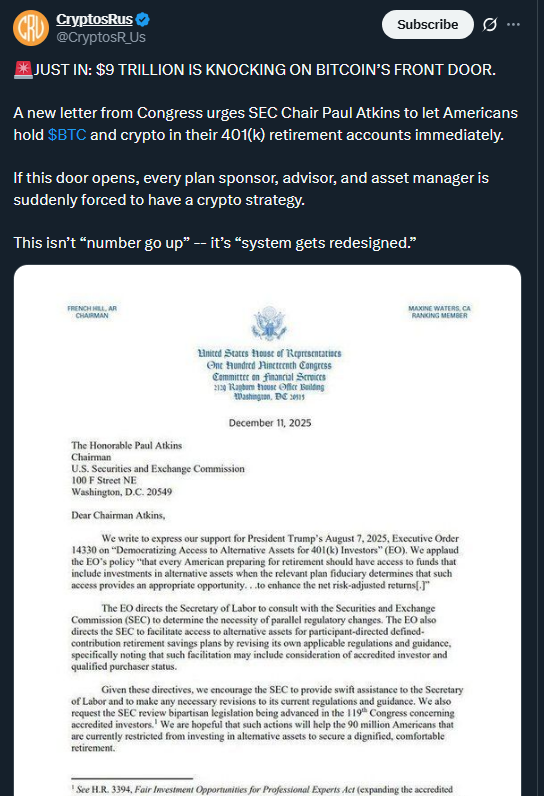

Congress Targets $9 Trillion Retirement Market

A brand new congressional letter requests quick SEC Chair Paul Atkins’ motion. Congressmen want Individuals to maintain Bitcoin and crypto in 401(ok)s. The relocation would doubtlessly open up the door to 9 trillion retirement {dollars}.

This can be a gigantic potential as CryptosR_Us tweeted on X. All of the plan sponsors are all of a sudden in want of a crypto technique. Asset managers must adapt to new market realities. The transformation shouldn’t be restricted to mere worth appreciation.

Supply: CryptosR_Us

The letter was despatched by the Home Monetary Providers Committee on December 11. Members referred to as for the revision of the foundations of digital property in retirement plans. The prevailing legal guidelines restrict tens of millions of individuals to the brand new lessons of property. Legislators state that these rules are old school.

This coverage change is guided by the August govt order of President Trump. The order focuses on democratizing entry to different property. It refers to cryptocurrencies and actual property, and personal fairness. The federal companies want to extend the funding choices to retirement savers.

You may also like:Bitcoin Builds Basis: $100K Bounce Eyes $80K Retest

System Redesign on the Horizon

The congressional drive is on the SEC modifications in rules within the palms of SEC Chair Atkins. He initiated a undertaking referred to as Challenge Crypto to clarify the foundations of digital property. In line with latest speeches, nearly all of crypto tokens usually are not securities. Such differentiation facilitates retirement fund inclusion.

There may be additionally a want amongst lawmakers to broaden definitions of accredited traders. The prevailing rules favor prosperous individuals. The proposal comprises staff who’re well-educated and skilled. New funding entry could possibly be developed by lecturers, nurses, and engineers.

After the Fed announcement, Bitcoin was above the mark of 92,000. The market capitalization was at 1.85 trillion. The amount of buying and selling per day was over 52 billion. The restoration adopted the primary stress on the post-FOMC promoting.

Critics warning in opposition to cryptocurrency instability in retirement portfolios. Throughout market crashes, the value of Bitcoin has the potential to plummet. Proponents reply that youthful workers require digital asset choices. Cryptocurrency inclusion is rising in reputation amongst retirement suppliers.

The SEC has to liaise with the Division of Labor. The 2 companies regulate retirement plans. The presence of congressional stress is an indicator of attainable coverage change.

You may also like:SpaceX Strikes $94M in Bitcoin Amid IPO Rumors and Future Plans