- Cardano whales are quietly accumulating ADA whereas retail wallets proceed to promote into weak spot.

- ADA worth stays below strain close to $0.40, with momentum weak however sellers exhibiting indicators of fatigue.

- This divergence has traditionally appeared close to late-stage downtrends, usually earlier than broader pattern reversals.

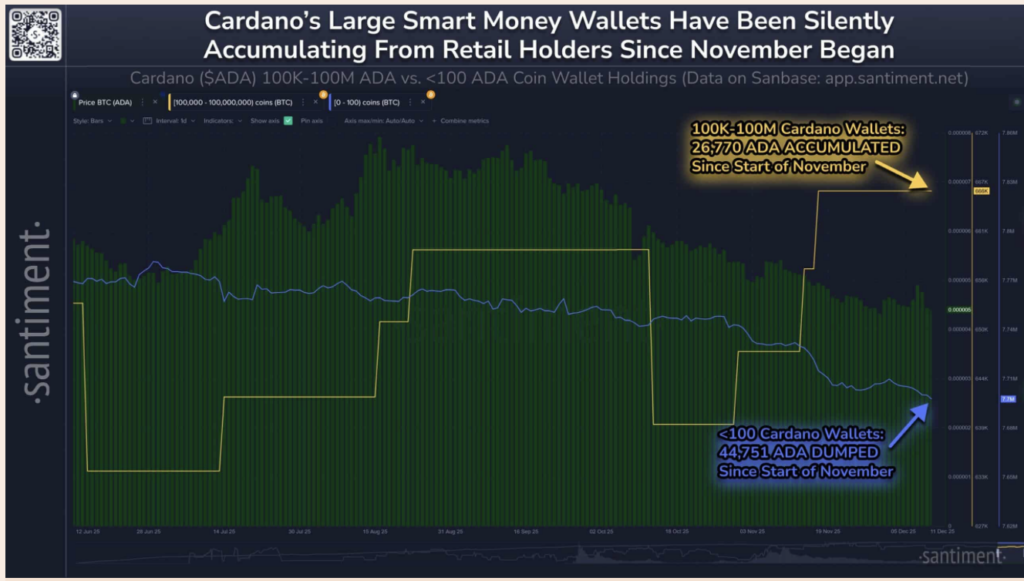

Contemporary on-chain knowledge is hinting that Cardano’s current worth weak spot could be hiding one thing greater beneath the floor. On the chart, ADA doesn’t look nice — it’s been sliding decrease for almost two months now. However below that quiet downtrend, conduct is beginning to break up in an attention-grabbing manner.

Whereas retail merchants look like shedding persistence, Cardano’s largest holders are doing the other. They’re shopping for. Slowly, quietly, and with out a lot noise.

Whales Accumulate as Retail Offers Up

Based on Santiment, the divide between massive holders and smaller wallets has change into fairly clear. Wallets holding between 100,000 and 100 million ADA have added roughly 26,770 ADA since November 1. On the identical time, retail wallets holding lower than 100 ADA have dumped about 44,751 ADA.

That sample reveals up many times close to the later levels of bearish cycles. Huge gamers step in when concern peaks, whereas smaller merchants exit after months of frustration. It’s not flashy, however traditionally, one of these absorption has mattered for ADA over longer timeframes.

Worth Nonetheless Struggles, At the same time as Accumulation Builds

Regardless of that accumulation, ADA’s worth hasn’t reacted but. The token trades close to $0.40, nonetheless caught in a construction of decrease highs and decrease lows. Momentum stays weak, and consumers haven’t reclaimed management.

The RSI sits round 40, which displays bearish strain — but additionally hints that sellers could also be operating out of steam. Importantly, ADA hasn’t misplaced its key mid-term help zones. It’s simply… stalled. For now, worth motion and on-chain fundamentals are transferring in reverse instructions, which might really feel uncomfortable when you’re watching solely the chart.

Why This Divergence Issues

Traditionally, Cardano has tended to rally when three issues line up:

Sensible cash will increase publicity,

Retail sentiment turns fearful, and

Bitcoin stabilizes after volatility.

Santiment notes that whale accumulation in ADA often turns into extra significant as soon as Bitcoin calms down. Proper now, BTC remains to be reacting to macro uncertainty and post-FOMC noise, which can be holding altcoins like ADA in a holding sample.

Massive holders shopping for into weak spot suggests confidence in ADA’s longer-term outlook — whether or not that’s pushed by staking rewards, future upgrades, or easy valuation resets after a protracted decline. Retail promoting, then again, usually displays late-stage capitulation quite than knowledgeable positioning.

What Comes Subsequent for ADA?

If Bitcoin finds stability and liquidity improves throughout the market, ADA’s quiet accumulation section may develop into the groundwork for a pattern shift. Till then, worth could proceed to float, at the same time as sensible cash retains constructing below the floor.

Nothing explosive but. Only a sluggish divergence — and people are sometimes the setups individuals solely acknowledge after the transfer is already underway.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.