On-chain knowledge reveals the Unrealized Loss within the crypto market lately ballooned to $350 billion, with Bitcoin accounting for a big a part of it.

Unrealized Loss Has Spiked In The Crypto Sector After Bearish Value Motion

In a brand new publish on X, on-chain analytics agency Glassnode has shared the information associated to the Unrealized Loss within the crypto sector. This indicator measures, as its identify suggests, the whole quantity of loss that buyers are holding on their tokens proper now.

The metric works by going by way of the transaction historical past of every token on a given community to search out what worth it was final moved at. If this final promoting worth of a token was lower than the present spot worth of the asset, then that specific coin is assumed to be underwater.

The precise quantity of the loss concerned with the token is the same as the distinction between the 2 costs. The Unrealized Loss sums up this worth for all cash being held at a loss.

Just like the Unrealized Loss, there additionally exists the Unrealized Revenue, maintaining monitor of the provision of the other sort. That’s, it accounts for the cash with a price foundation decrease than the newest spot worth.

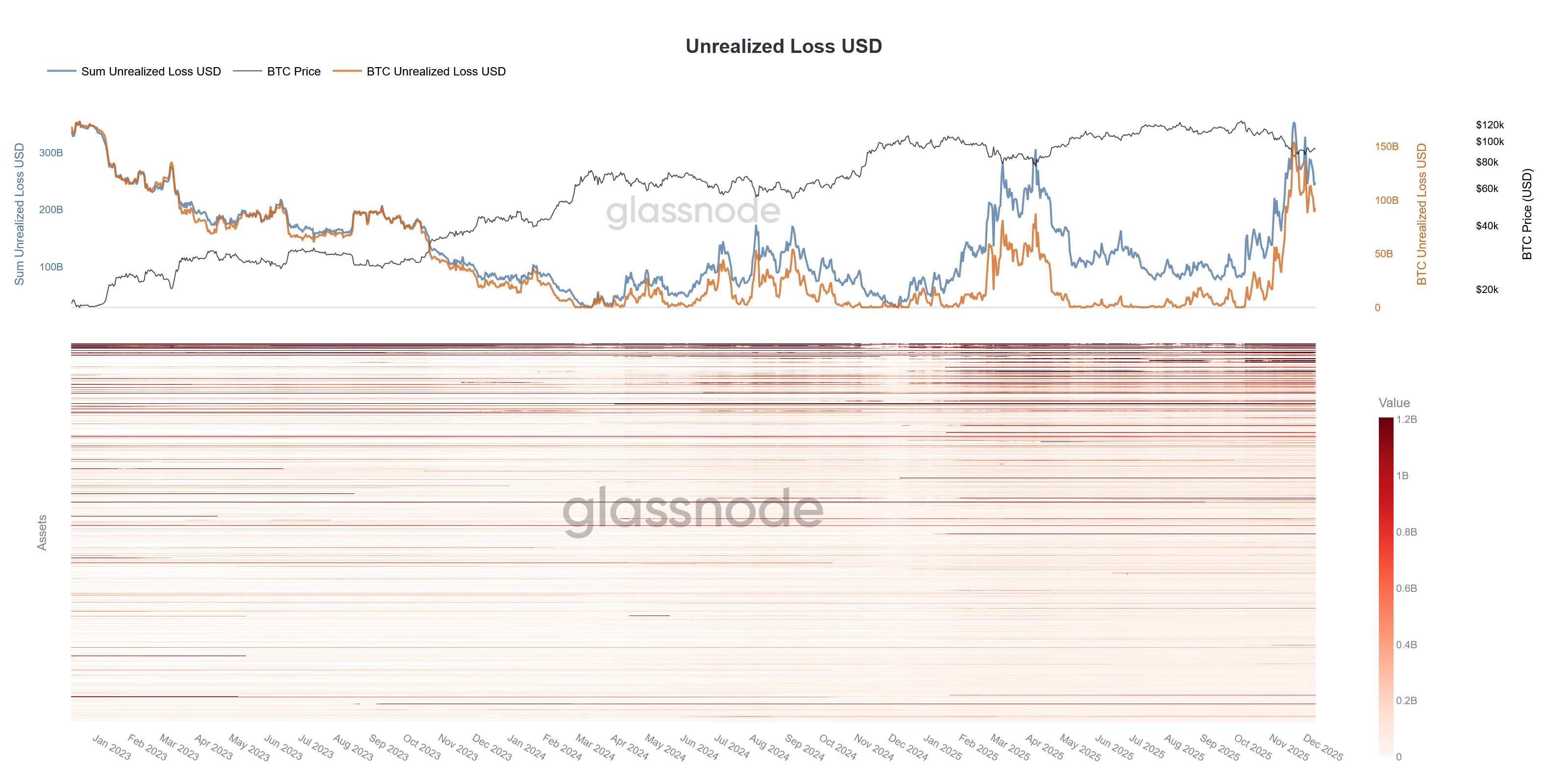

Now, here’s a chart that reveals the development within the Unrealized Loss for the mixed crypto market and Bitcoin over the previous few years:

The worth of the metric seems to have shot up for each all the market and Bitcoin in latest months | Supply: Glassnode on X

As displayed within the above graph, the Unrealized Loss throughout the crypto market has surged following the downturn that the sector has gone by way of since October.

At its peak, the indicator hit a price of $350 billion for all the market, with Bitcoin alone contributing about $85 billion. These are each elevated ranges and showcase the diploma of ache among the many buyers.

Glassnode defined:

With a number of on-chain indicators signalling shrinking liquidity throughout the board, the market is probably going coming into a high-volatility regime within the weeks forward.

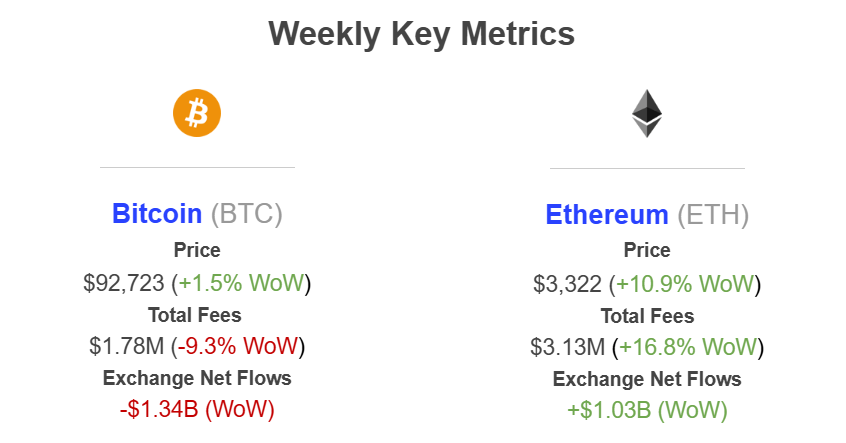

In another information, Bitcoin and Ethereum have proven sturdy divergence within the Change Netflow development this week, as institutional DeFi options supplier Sentora has identified in an X publish.

How key metrics have in contrast between Bitcoin and Ethereum this week | Supply: Sentora on X

As is seen above, the Bitcoin Change Netflow registered a big worth of -$1.34 billion over the previous week. The worth being unfavorable implies centralized exchanges confronted web withdrawals.

In distinction, the identical indicator has witnessed a pointy constructive worth of $1.03 billion for Ethereum as a substitute. Normally, buyers deposit to exchanges once they wish to take part in one of many providers that they supply, which might embrace promoting. As such, giant change web inflows might be bearish for the asset’s worth.

BTC Value

Bitcoin has once more failed to take care of its restoration above $92,000 as its worth is again to $90,000.

The development within the BTC worth over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Sentora.com, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.