- Bitcoin slumps close to $90K after the Fed’s price minimize triggers one other traditional “promote the information” drop as a substitute of a reduction rally.

- Liquidity throughout crypto has thinned dramatically, with spot quantity down 66% since January and ETFs seeing billions in outflows.

- BTC now assessments key assist at $90K, with draw back threat towards $83K–$86K, although long-term patterns nonetheless level to late-cycle exhaustion fairly than a full breakdown.

The crypto market slid into the pink as we speak, with Bitcoin drifting round $90K, down roughly 2.8% in 24 hours. Lots of people anticipated a reduction rally after the Fed minimize charges yesterday… however nope, not even shut. As an alternative we received a traditional “promote the information” dump. It’s a kind of days the place the whole lot ought to be bullish, but value motion says in any other case — and that disconnect is precisely what’s throwing merchants off.

The Federal Reserve minimize by 25 bps, however Jerome Powell’s tone stayed cautious. Inflation nonetheless a priority, future cuts doubtless slower — undoubtedly not the dovish vibe markets have been hoping for. BTC spiked above $94K proper after the announcement, then flipped laborious and slid again down.

And truthfully, this isn’t new. Take a look at how Bitcoin behaved throughout latest FOMC conferences:

- June 18: Pause → -6.36%

- July 30: Pause → -5.62%

- Sept 17: 25 bps minimize → -8.10%

- Oct 29: 25 bps minimize → -12.04%

Each single one triggered short-term draw back. However right here’s the twist: after the September assembly, Bitcoin went on to interrupt its all-time excessive. Quick-term ache, long-term power — the sample retains repeating.

Why Crypto Is Down As we speak… and Why It Might Nonetheless Go Decrease

Crypto is shifting increasingly more like tech shares today, and Nasdaq is barely pink as we speak too. On high of that, AI shares are being questioned for bubble-like valuations, which drags capital out of high-risk belongings — together with crypto.

Then add within the macro overhang:

- Trump’s tariff threats worn out $19B in leveraged positions again in October.

- Yr-end deleveraging is hitting full drive.

- Spot buying and selling quantity has tanked 66% since January (Kaiko).

- Market depth is down 30% — which means barely any liquidity.

- BTC/ETH ETFs have seen $7.2B in internet outflows since October.

- Retail curiosity by Google Developments = principally on life assist.

When liquidity dries up like this, even small sell-offs snowball into ugly candles. That’s precisely what’s taking place.

MicroStrategy even minimize its 2025 BTC goal all the way down to $85K–$110K, which rattled some holders. Sure, the largest company Bitcoiner simply received slightly nervous too.

Bitcoin Chart: Nasty, Uneven, and Testing Assist

Over the past week, BTC has been caught in a sloppy downtrend, now testing the $90K assist — proper across the 20-day EMA. The construction nearly seems like a bear flag, which isn’t nice in case you’re hoping for a clear bounce.

BTC and ETH choices expire as we speak, which often results in uneven, gradual, directionless value motion till after U.S. markets shut.

If $90K breaks convincingly, the following assist sits round $83K–$86K.

So Is Crypto Completed? Is This the Finish?

Quick reply: no. Longer reply: completely not — however the market is exhausted.

December has been brutal, marking Bitcoin’s worst month since 2021, dropping roughly $18K in November alone. However traditionally, December truly averages +9.7% beneficial properties for BTC. And analysts nonetheless anticipate stabilization heading into a possible 2026 bull section.

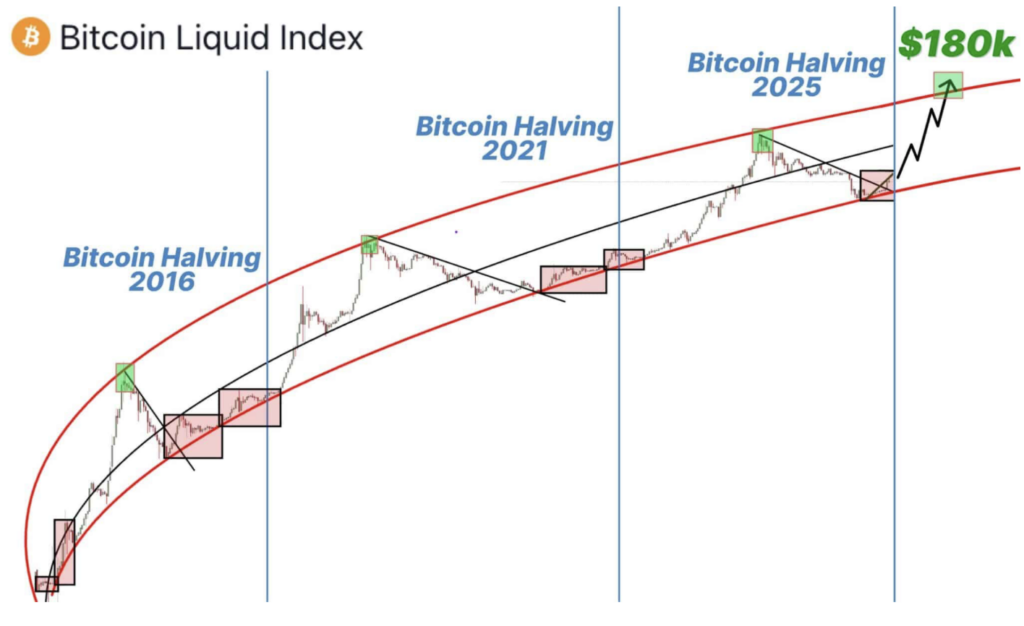

This seems much less like a structural crash and extra like late-cycle fatigue — a drained market shaking out anyone overleveraged or overconfident.

Altcoins? Additionally wrecked. The Altcoin Season Index is sitting at 17, which principally screams “oversold.”

In case you’re holding long-term, give attention to the larger cycle fairly than the short-term noise. However as all the time, DYOR — markets flip quick, and often when individuals cease anticipating it.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.