Be a part of Our Telegram channel to remain updated on breaking information protection

The Terra Luna worth plunged 23% as co-founder Do Kwon was sentenced to fifteen years in jail after its ecosystem collapsed in 2022, revealing a $40 billion fraud.

US District Decide Paul A. Engelmayer, who handed down the sentence, rebuked Kwon for repeatedly mendacity to buyers who trusted him with their life financial savings.

“This was a fraud on an epic, generational scale,” he mentioned throughout a listening to in Manhattan federal court docket. ”Within the historical past of federal prosecutions, there are few frauds which have induced as a lot hurt as you may have, Mr. Kwon.”

JUST IN: Do Kwon will get 15 years in jail for $40 billion Terraform fraud. pic.twitter.com/2Pq1dnsINM

— Whale Insider (@WhaleInsider) December 11, 2025

Kwon pleaded responsible in August to conspiracy and wire fraud expenses whereas on the helm of Terraform Labs.

Federal prosecutors had urged the court docket to impose the complete 12 years permitted underneath Kwon’s plea settlement, whereas Kwon’s legal professionals requested a five-year sentence, asking that he can return to South Korea to face felony expenses there.

However the choose known as the 12-year jail time period advisable by US prosecutors “unreasonably lenient” earlier than imposing an extended 15-year sentence.

Regardless of the current 23% drop, Terra Luna, formally Terra Luna Traditional (LUNC), has gained roughly 40% over the previous week. The place is it headed subsequent?

Terra Luna Value Poised For A Breakout Regardless of The Drop

The Terra Luna worth is buying and selling at $0.00004581 as of 12:27 a.m. EST on buying and selling quantity that plunged 41% up to now 24 hours to $142 million.

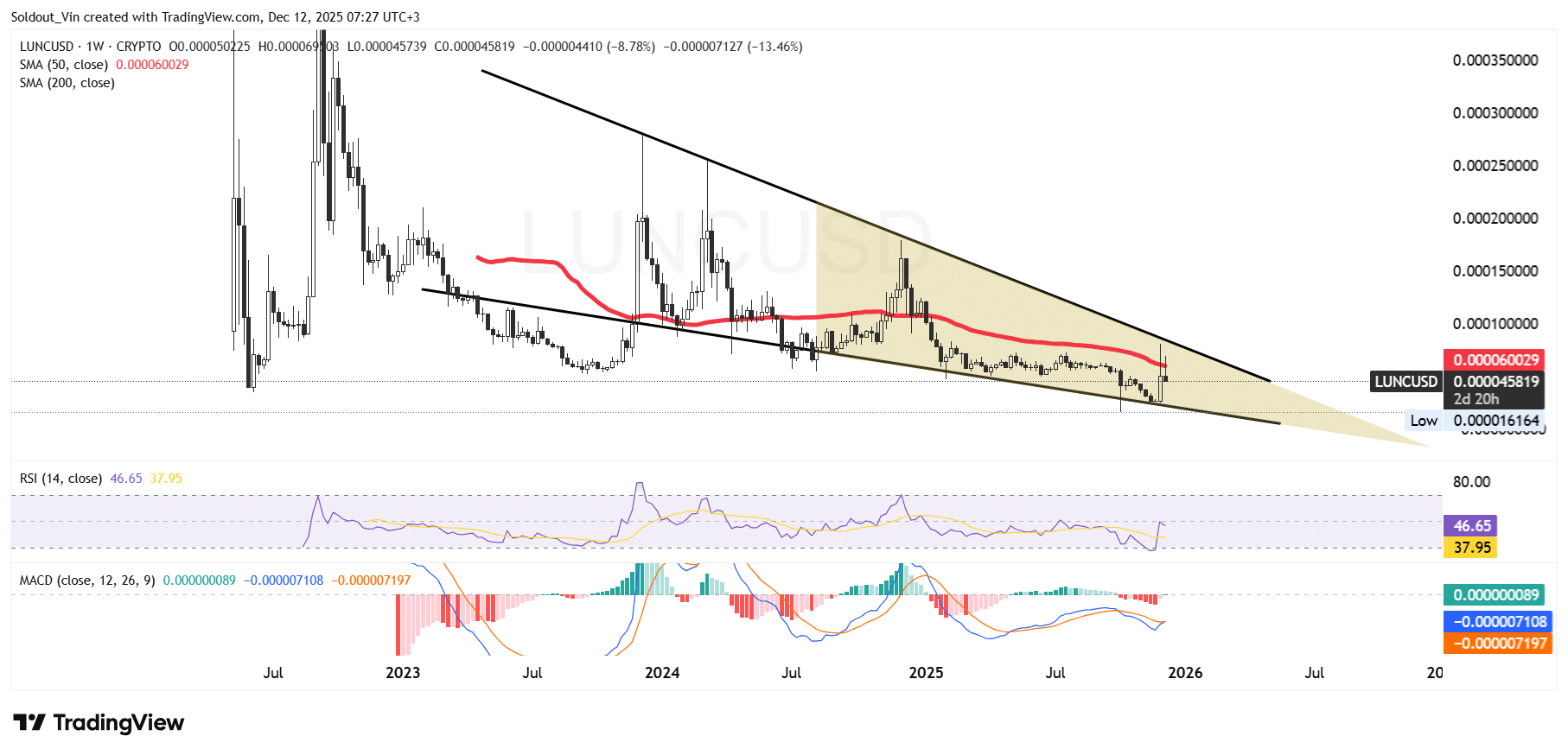

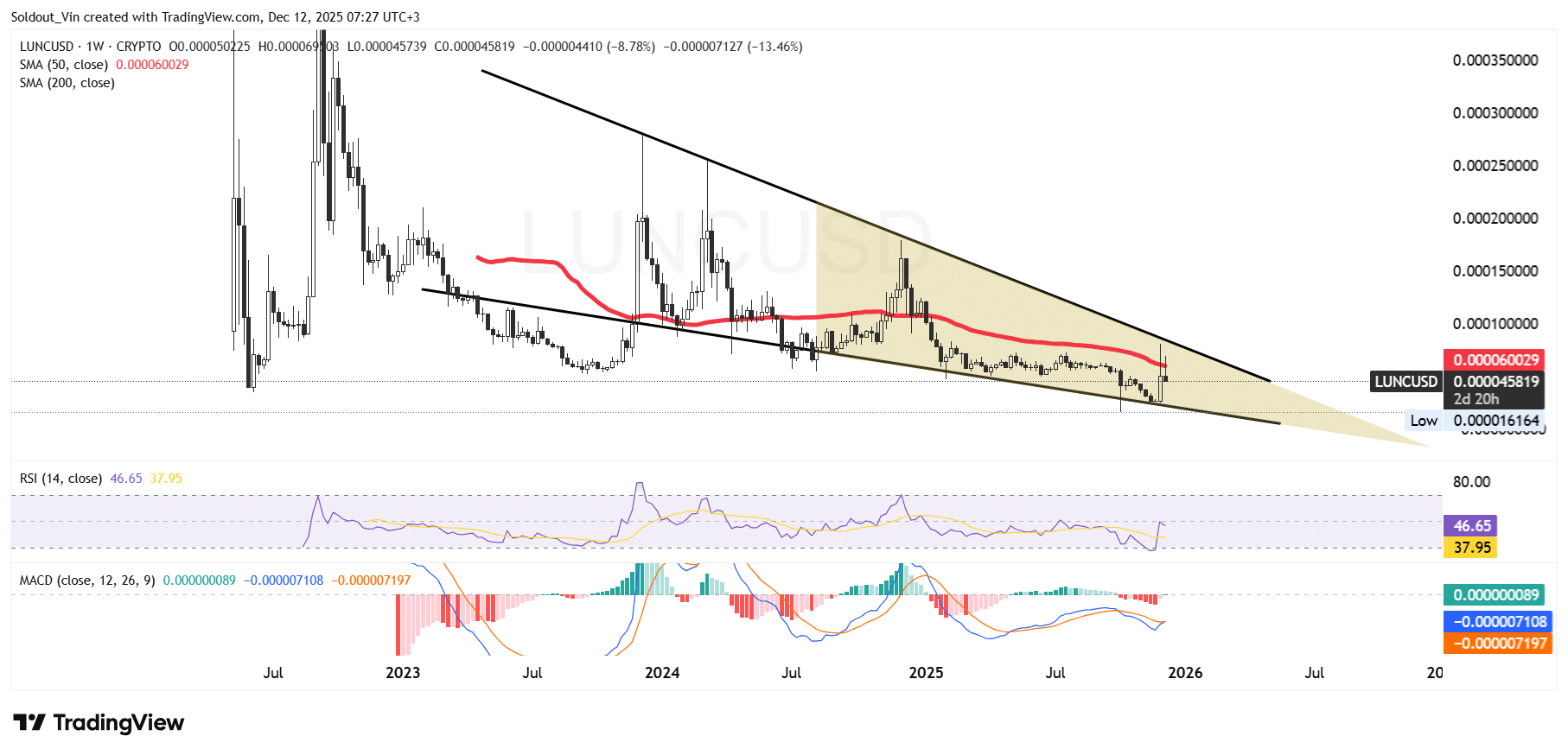

After attempting to get better to the $0.000170 resistance in 2024, the LUNC worth has continued to pattern downwards inside a falling wedge sample, with the asset capped between the 2 boundaries.

After hitting the decrease boundary round $0.000022, the Terra Luna then used this help to stage a rebound, climbing to round $0.000070 within the final candle on the weekly timeframe.

The weekly surge was fueled by hypothesis over sentencing, as technical indicators recommended a breakout from a 3-year downtrend.

Nevertheless, the final candle exhibits that LUNC is correcting from that resistance, presumably on account of sellers reserving earnings.

With the present retracement, the value of Terra Luna then dropped underneath the 50-day Easy Transferring Common (SMA), cementing the general bearish stance.

In the meantime, the Relative Power Index (RSI) has recovered to under the 30-oversold area, at the moment hovering across the impartial zone at 46, suggesting that patrons and sellers are in a tug-of-war.

The Transferring Common Convergence Divergence (MACD), though under the zero line, has turned optimistic because the blue MACD line has crossed above the orange sign line.

LUNC Value Prediction

Based on the LUNC/USD chart evaluation, the Terra Luna worth is gearing up in direction of a sustained restoration and a breakout above the falling wedge sample.

The optimistic technical indicators additionally help the optimistic sentiment. If the value of LUNC breaks out of the wedge, the subsequent attainable resistance is on the $0.0001220 zone.

Conversely, if the present candle continues to drop in direction of the decrease boundary of the wedge, the subsequent help zone might be at $0.000024, which now acts as a cushion towards additional downward strain.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection