XRP is in a light undervalued zone based on the 30-day MVRV Ratio. Right here’s how different cryptocurrencies like Bitcoin and Ethereum examine.

XRP 30-Day MVRV Ratio Reveals Unfavourable Returns

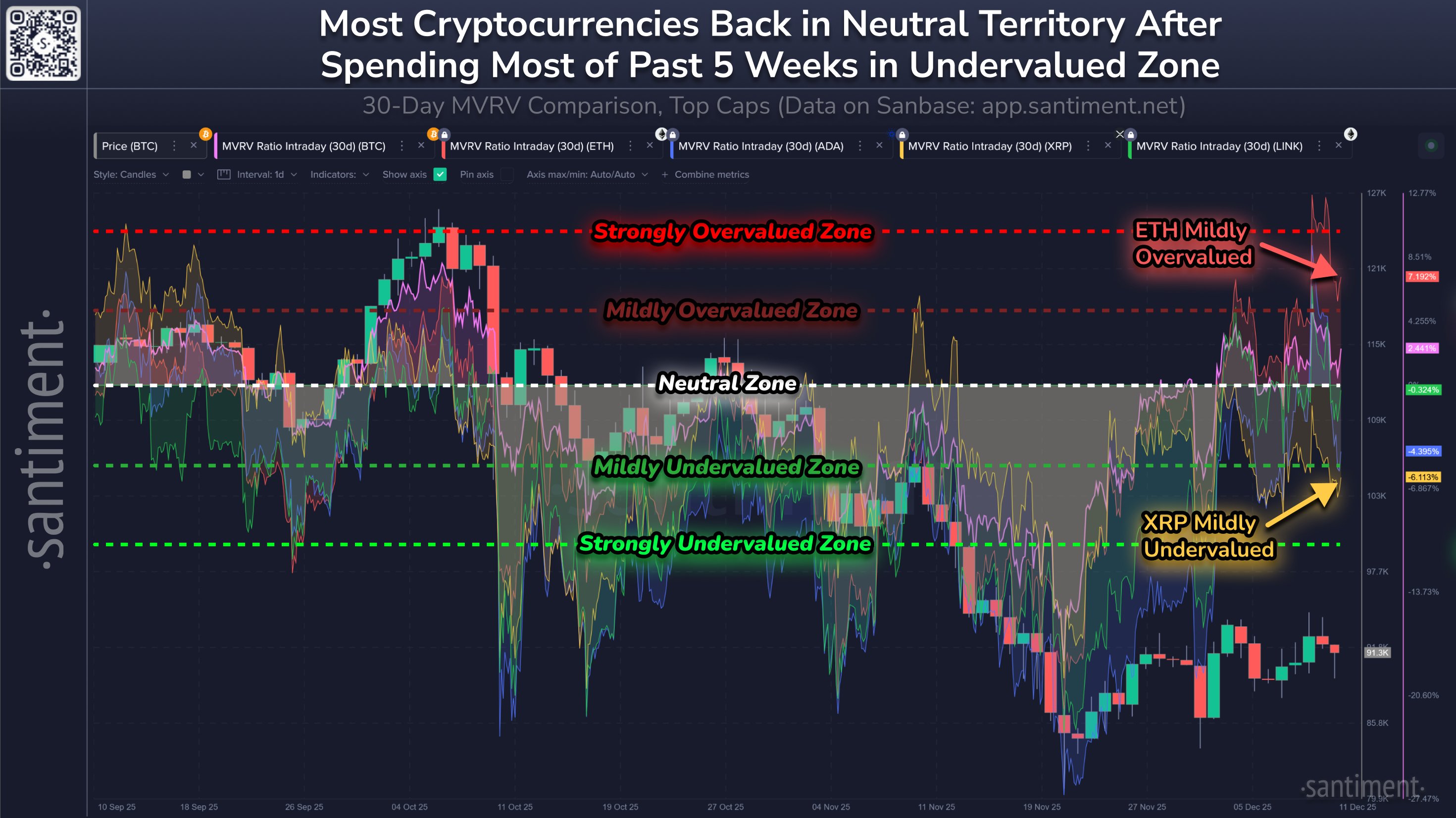

In a brand new put up on X, on-chain analytics agency Santiment has talked about how the 30-day Market Worth to Realized Worth (MVRV) Ratio is at the moment on the lookout for the completely different prime cash within the cryptocurrency sector like Bitcoin and XRP.

Associated Studying

The “MVRV Ratio” is a well-liked indicator that retains monitor of the ratio between an asset’s market cap and its Realized Cap. The latter capitalization mannequin calculates the cryptocurrency’s complete worth by assuming the worth of every particular person token is the same as the spot value at which it was final transacted on the blockchain.

The Realized Cap will be considered an estimate of the capital that the traders as an entire used to buy their tokens. In distinction, the market cap is the worth that they’re carrying within the current. Because the MVRV Ratio takes the ratio between the 2, it basically incorporates details about the profit-loss stability of the traders.

Within the context of the present subject, a really particular type of the MVRV Ratio is of curiosity: the 30-day model. This metric solely tracks the profit-loss stability for the merchants who obtained into the market in the course of the previous month.

Now, right here is the chart shared by Santiment that reveals the pattern within the 30-day MVRV Ratio for six property: Bitcoin, Ethereum, Cardano, XRP, and Chainlink.

As is seen within the above graph, the 30-day MVRV Ratio hasn’t displayed a uniform habits throughout the highest cryptocurrencies, indicating that the scenario of the 30-day patrons is completely different for the varied property.

Ethereum at the moment has the metric at a constructive worth of seven.2%. Which means that market entrants from the previous month are sitting on a achieve of seven.2% on the community. Bitcoin additionally has a constructive worth, however at only a degree of two.4%, the 30-day merchants are more-or-less breaking even.

Chainlink additionally has a really impartial pattern with the 30-day MVRV Ratio at a worth of -0.3%. Cardano 30-day merchants are additionally within the purple, however in its case, the losses are extra notable at -4.4%.

Lastly, new XRP traders are down 6.1%, implying that the community at the moment hosts the worst dealer profitability. This truth, nevertheless, could not truly be unfavorable for the cryptocurrency.

Usually, the upper investor features get, the extra seemingly they grow to be to take part in a selloff with the intention of revenue realization. This will make a prime extra possible for the asset when its MVRV Ratio is at a excessive degree. Equally, a deep unfavorable worth will be bullish as a substitute, because it suggests profit-takers have in all probability grow to be depleted.

Associated Studying

Within the chart, the analytics agency has outlined overvalued and undervalued zones primarily based on the 30-day MVRV Ratio. XRP is at the moment the one one in an undervalued zone, whereas Ethereum is inside a light overbought area.

XRP Value

On the time of writing, XRP is floating round $2.04, up 1.5% during the last 24 hours.

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com