- BONK stays caught in a bearish construction, with decrease highs and weak restoration makes an attempt.

- Key resistance close to $0.000001025 continues to cap upside and favor quick setups.

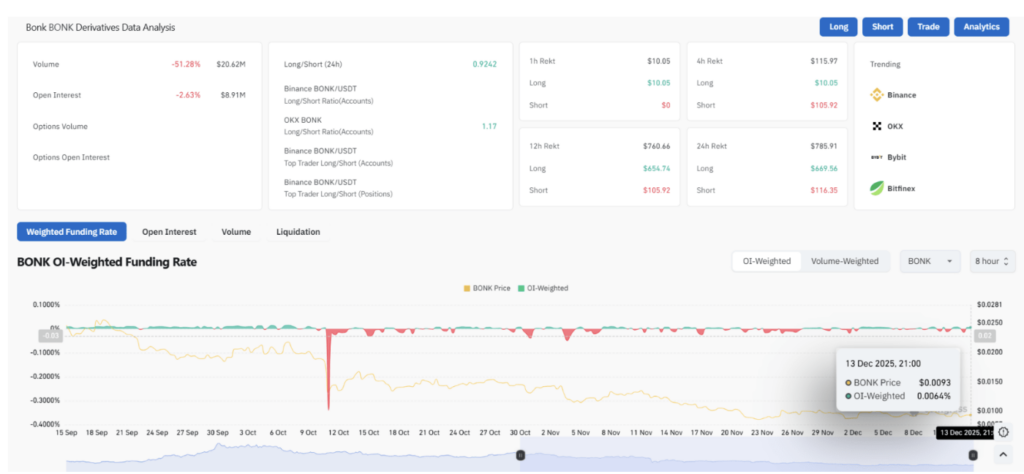

- Falling quantity and open curiosity counsel merchants are decreasing threat, not constructing conviction.

BONK continues to commerce below strain, and thus far, sellers aren’t letting go. After the current decline, worth motion hasn’t proven the sort of follow-through that may sign an actual restoration. As an alternative, BONK is caught drifting sideways, with sentiment nonetheless cautious and merchants ready for readability earlier than committing both manner.

Bearish Construction Stays Intact on Greater Timeframes

Crypto analyst CryptoPulse highlighted that the higher-timeframe development stays firmly bearish. On the day by day chart, BONK retains printing decrease highs and decrease lows, with a noticeable string of huge pink candles reflecting persistent promote strain. Value is now consolidating inside what seems like a bearish flag, a sample that usually favors continuation moderately than reversal, even when issues look quiet on the floor.

Key Resistance Ranges Restrict Upside Makes an attempt

One degree drawing consideration is the $0.000001025 zone, which analysts see as a serious resistance space. A transfer again into that vary may entice sellers searching for quick setups moderately than recent longs. There’s additionally the chance of a pointy breakdown beneath present assist, which might affirm the bearish flag and probably speed up draw back strain.

Technical Indicators Proceed to Sign Weak point

From a technical standpoint, BONK stays properly beneath its main exponential transferring averages. The 20-day EMA sits simply overhead as quick resistance, whereas the 50-day, 100-day, and 200-day EMAs are stacked a lot increased, reinforcing the bearish construction. The MACD continues to be beneath the zero line, and though the histogram has turned barely optimistic, there’s no bullish crossover but. Momentum could also be slowing, nevertheless it hasn’t flipped.

Quantity and Open Curiosity Level to Dealer Warning

Derivatives knowledge provides one other layer of warning. Buying and selling quantity has dropped sharply, and open curiosity has additionally declined, signaling place unwinding moderately than new accumulation. Funding charges stay barely optimistic, however leverage on the lengthy facet is restricted. For now, merchants seem like stepping again as an alternative of leaning aggressively into both path.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.