Bitcoin is heading right into a vital window because the Financial institution of Japan prepares what might be its most consequential coverage transfer in many years. The central financial institution is extensively anticipated to lift rates of interest by 25 foundation factors to 0.75% at its December 18-19 assembly, a stage not seen since 1995 and a transparent sign that Japan is continuous its exit from ultra-loose financial coverage.

This upcoming occasion is inflicting a number of conversations amongst crypto merchants as a result of comparable coverage strikes from Japan have repeatedly coincided with the beginning of Bitcoin value crashes.

Japan’s Fee Hikes And The Repeating Bitcoin Promote-Off Sample

Crypto market observers have been fast to spotlight an uncomfortable sample referring to Bitcoin and the BOJ. Every time the financial institution has raised charges since 2024, Bitcoin’s value motion has skilled a deep and comparatively quick correction.

For instance, March 2024 noticed Bitcoin fall by about 23% following Japan’s first charge hike since 2007. An identical charge spike transfer in July was adopted by a drop of round 26%, whereas the January 2025 hike preceded a steeper decline of greater than 30%.

Crypto analyst 0xNobler expressed concern, noting that if this historic pattern repeats itself, Bitcoin might be headed beneath the $70,000 stage shortly after the upcoming December resolution. The chart he shared illustrates how every charge hike has aligned with a neighborhood market prime, adopted by a pronounced leg decrease. The consistency of those strikes has turned what would possibly in any other case be dismissed as coincidence into an information level many merchants are actually taking severely.

Japan’s rate of interest

The strain extends past reactions by the crypto trade alone. Japan is the most important overseas holder of US authorities debt, and any tightening from the Financial institution of Japan reverberates throughout international liquidity markets. Greater Japanese charges strengthen the yen, and this, in flip, reduces extra capital which may in any other case stream into danger property.

Echoing this view, one other crypto commentator generally known as AndrewBTC pointed to Bitcoin’s repeated 20% to 31% declines following every BOJ hike since 2024. He warned that one other charge enhance in December may produce the same final result and likewise recognized $70,000 because the doable draw back goal if the sample repeats itself.

Bitcoin/US Greenback. Supply: @cryptoctlt On X

Bitcoin Above Lengthy-Time period Help: Not Everybody Is Bearish

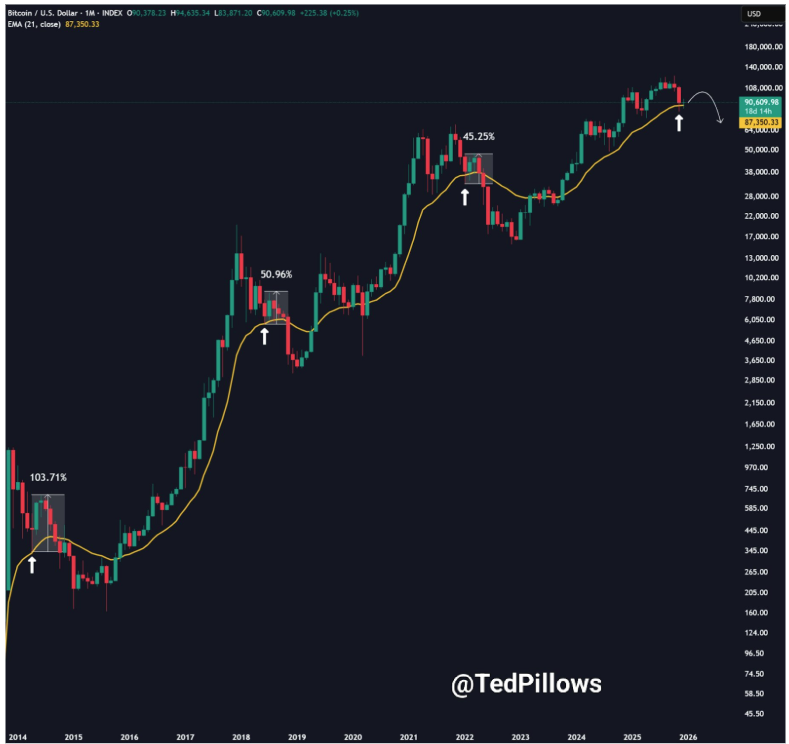

Regardless of the rising nervousness in the direction of the Financial institution of Japan’s charge enhance, the outlook for Bitcoin will not be universally destructive. As an example, analyst Ted Pillows identified that Bitcoin is presently interacting with its month-to-month EMA-21, a stage that has at all times acted as a launchpad in prior cycles.

Primarily based on this construction, Pillows predicted that Bitcoin may nonetheless surge to between the $100,000 and $105,000 vary within the close to time period earlier than there’s one other value dump.

Because the December assembly approaches, Bitcoin finds itself caught between a troubling sample and a resilient technical help. Whether or not Japan’s subsequent charge hike results in one other instant sell-off or permits for a brief upside push might outline how Bitcoin and the remainder of the crypto market shut out the yr.

Bitcoin / U.S. Greenback. Supply: @TedPillows on X

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.