Sunday’s shut exhibits that Bitcoin stays passive and directionless. In the meantime, large-cap altcoins fall into three classes: these with stay catalysts, these buying and selling on rumors and people bleeding capital however not making headlines. XRP falls into the second class, Cardano into the primary, and Shiba Inu into the third.

Liquidity stays selective. There is no such thing as a vital risk-taking or coordinated motion throughout completely different markets, neither is there a way of urgency from patrons. Costs solely react when the construction, sign or narrative forces them to.

TL;DR

- XRP pulled consideration from the person with the best IQ, however liquidity went lacking.

- Cardano lined up a 40% worth rise sign and a community catalyst on the identical time.

- SHIB misplaced over $100 million as patrons stepped apart.

XRP receives surprising prediction from world’s highest IQ holder

XRP is buying and selling round $2.018 on Binance on the finish of the week, down a bit on the day, however nonetheless in the identical vary it has been in since early November. If you happen to have a look at the day by day chart, you will notice that there was a steady sequence of decrease highs for the reason that October rejection close to $3. There has additionally been some ongoing draw back stress.

The one factor that modified this weekend was the main target as YoungHoon Kim, who is named the world’s highest IQ holder, wrote a brief remark saying that XRP “may need some motion this weekend.” There is no such thing as a timeframe outlined, actually just a few obscure language in regards to the token.

Beforehand Kim was tweeting about Bitcoin, however now his consideration appears to have shifted to XRP and another tokens.

Merchants had been confused about what “short-term” meant. Was he speaking about seconds, hours or days? Some had been brazenly questioning if the publish was truly serving any function. Others agreed they had been in search of longs anyway regardless of the chart not confirming it. The engagement itself was extra in style than the knowledge content material.

The assertion didn’t add any helpful information from a market perspective. XRP didn’t break by way of the resistance. The quantity didn’t enhance. Open curiosity didn’t spike. There wasn’t any seen follow-through candle on the day by day chart.

As Sunday involves an in depth, XRP remains to be caught between a gentle flooring close to $1.98-$2 and overhead stress beginning at $2.28-$2.34. The market has seen this zone reject costs a bunch throughout November. If it drops under that vary, the historic assist on the $1.82 space goes to vanish fairly rapidly.

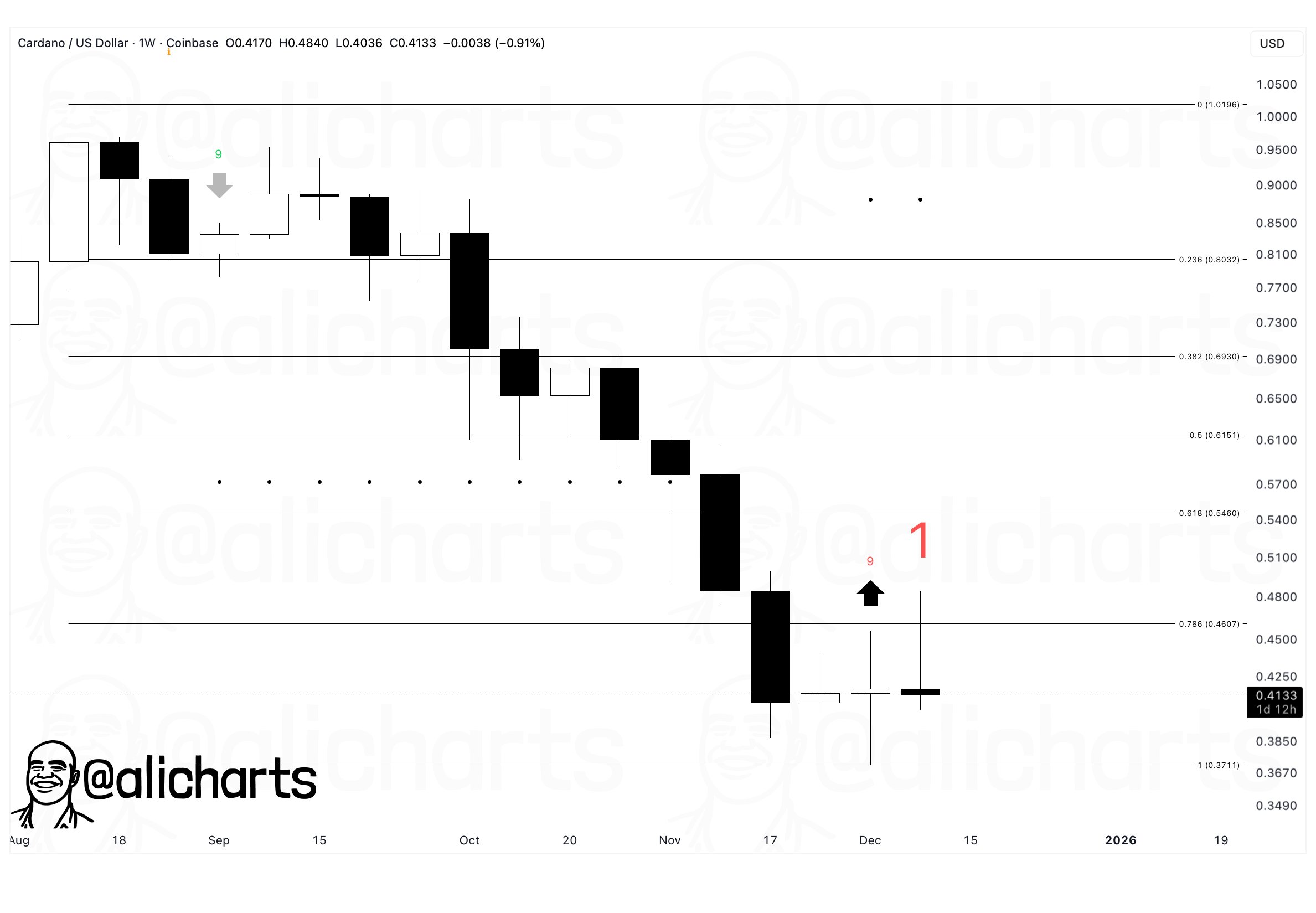

Cardano to rocket 40% if this sign validates

Cardano finishes the week in a really completely different place. On the weekly chart, a TD Sequential purchase sign from Ali Martinez has proven up, and this often occurs when costs are close to their lowest level, not when the development is constant. The sign itself doesn’t do something, however the place it is positioned is vital.

For ADA, all the pieces is now at $0.37. That degree is simply above the latest lows, and it’s just like the pivot level the place stabilization meets continuation decrease. If it holds above that, it’ll open a path towards the $0.46 area first, then $0.54, representing an upside of about 40% from present ranges. If ADA loses it, the sign fails cleanly.

This technical sign comes at a time when the Cardano ecosystem is experiencing its most energetic week in months. That is as a result of launch of NIGHT, the native token of the Midnight Community. NIGHT began buying and selling stay instantly with assist from some massive names like Binance, Bybit, Kraken, OKX, KuCoin and Gate.

In simply sooner or later, NIGHT had racked up greater than $1 billion in buying and selling quantity and pushed its market capitalization above $1 billion, making it one of the crucial actively traded belongings on main exchanges.

That degree of participation is vital. It confirms actual demand, not skinny liquidity spikes. It additionally places Cardano again on the map as an energetic deployment layer as a substitute of a series that’s simply losing a top-10 spot.

ADA has not damaged out but, however it has stopped falling. If you happen to have a look at the weekly candles, you will notice that they’re exhibiting compression somewhat than acceleration decrease. Consumers should not actually aggressive, however sellers should not within the driver’s seat anymore.

That is the type of setup merchants pay shut consideration to: an outlined invalidation degree, a transparent upside goal and a elementary occasion that was not even on the radar every week earlier. If $0.37 holds, the chart does the remainder of the speaking.

Shiba Inu (SHIB) down $110 million in 24 hours: What is going on on?

The Shiba Inu coin ends the week on a quiet word, with none main headlines or panic, however with some noticeable injury.

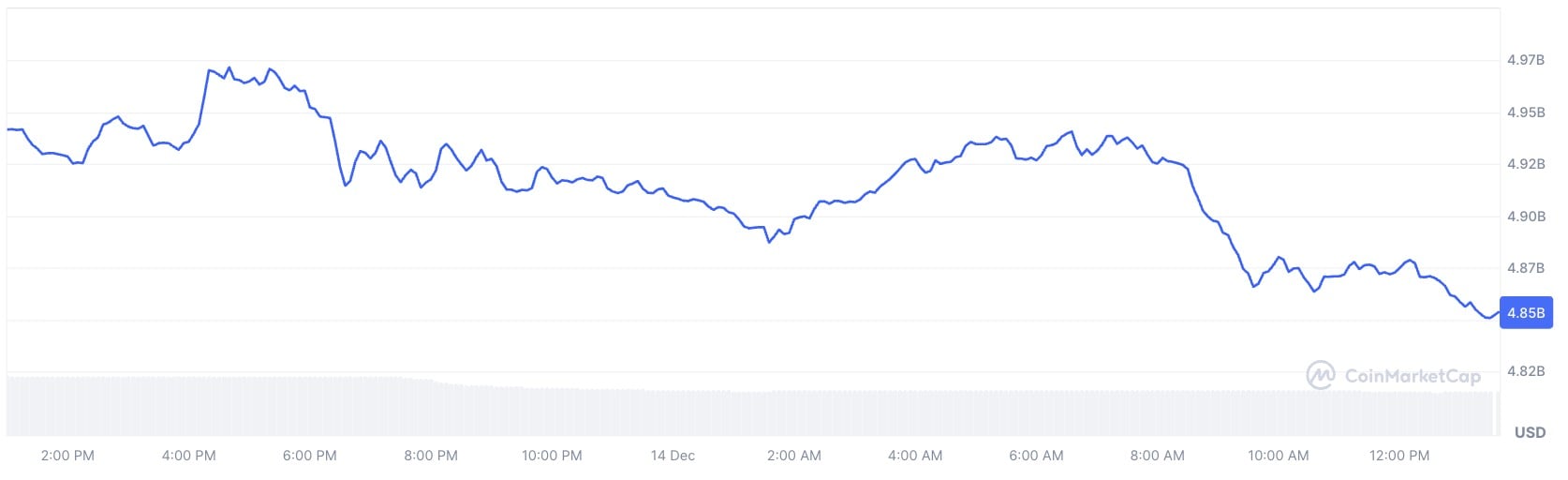

In accordance with CoinMarketCap, SHIB’s market capitalization dropped from $4.97 billion to $4.86 billion in simply sooner or later, wiping out round $110 million in worth. The transfer was extra of a managed exit than a compelled liquidation, which is why it didn’t unfold all of a sudden.

The quantity confirms that bias. SHIB’s buying and selling quantity for the day dropped to $77.86 million, which is a 27% decline. This pushed the volume-to-market-cap ratio to simply 1.59%. That is not how accumulation works.

The market cap chart exhibits a gradual decline in the course of the day, then stabilizes at round $4.86 billion. This often occurs when patrons cease defending ranges as a substitute of when sellers rush to exit.

SHIB’s drawback is fairly easy. There is no such thing as a energetic driver. Whereas Cardano is getting some consideration with its new token launch and XRP is within the highlight, SHIB doesn’t have any clear course or affect. In that type of surroundings, costs will drift decrease till demand returns.

As Sunday involves an in depth, SHIB is simply weak. If issues don’t enhance in the marketplace, it might lose much more worth.

Crypto market outlook

The week for crypto closes with out fireworks, however not with out data. Capital is selecting rigorously, ignoring noise and rewarding solely setups that mix construction with substance.

- Bitcoin (BTC): passive and range-bound — so, no management sign into the weekly shut.

- XRP: locked close to $2.02, however must reclaim above $2.28-$2.34 to alter construction.

- Cardano (ADA): $0.37 is decisive, maintain opens $0.46 then $0.54.

- Shiba Inu (SHIB): Capital leakage continues with quantity confirming that patrons are absent.