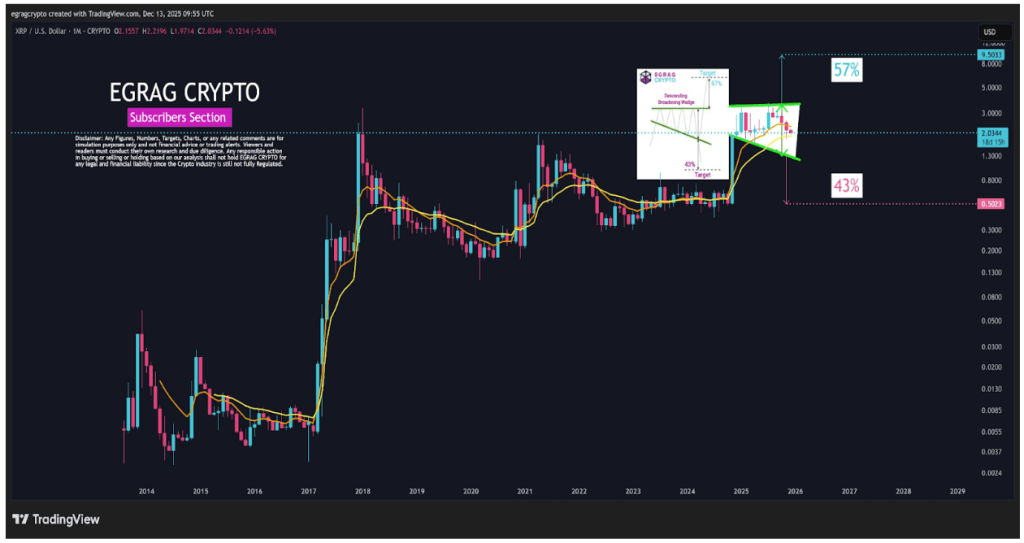

XRP’s latest pullback to $2 has not modified the broader technical image, in response to a brand new evaluation shared on X by crypto analyst Egrag Crypto. Regardless of the dearth of bullish worth motion in latest weeks, the technical evaluation proposes that the market construction continues to favor an upside continuation slightly than the pattern ending.

This outlook locations the following three to 6 months in a constructive zone for XRP’s worth motion, the place the likelihood of additional upside is increased than the chance of a downward transfer.

Associated Studying

XRP Presently In Consolidation, Not Distribution

The evaluation of Egrag’s technical evaluation relies on XRP’s worth motion presently ticking an inventory of containers that factors to the following transfer being up. The primary of those containers is what the analyst known as a regime shift, which occurred after the XRP worth made a decisive breakout from a multi-year base round $0.5 final 12 months.

This decisive breakout shifted the market from accumulation to growth. Pullbacks on this part are often corrective, not trend-ending. In that context, the present worth motion may be considered as half of a pure pause slightly than a sign that the bigger bullish transfer has failed.

One other central argument within the evaluation is that the present worth conduct represents consolidation slightly than distribution. Egrag Crypto describes the market as being in a compression part following an impulse, and this can be a pause, not a prime. Though XRP has spent about 13 months ranging inside this construction, the analyst interpreted this as prolonged consolidation as an alternative of a distribution course of.

Chart Picture From X. Supply: @egragcrypto On X

EMA Construction Retains Bullish Bias Intact

One more reason as to why the pattern is extra seemingly bullish is as a result of XRP remains to be buying and selling in alignment with its long-term exponential shifting common, which stays above the 21 EMA. That relationship preserves the bullish bias, although worth presently sits under the quicker 9 EMA, however this solely displays short-term weak point slightly than a structural breakdown.

Past pure chart construction, basic developments have added weight to the case for longer-term appreciation. XRP is presently holding $2 as an necessary help zone, and up to date developments have emerged that might improve bullish sentiment.

An instance is Ripple’s conditional approval alongside different crypto companies for a nationwide belief financial institution constitution from the US Workplace of the Comptroller of the Foreign money.

Associated Studying

Though the outlook is rather more bullish, there may be at all times the opportunity of turning bearish throughout the subsequent six months. In keeping with Egrag, this outlook can solely flip bearish if XRP information a sustained month-to-month shut under the $1.80 to $1.60 area.

Taken collectively, the evaluation concludes that XRP is extra more likely to resolve increased than decrease over the following three to 6 months, even when there may be worth volatility alongside the best way.

Featured picture from Unsplash, chart from TradingView